Reminder: Subscribers have access to the members-only spreadsheets folder, which is updated with the charts in this post.

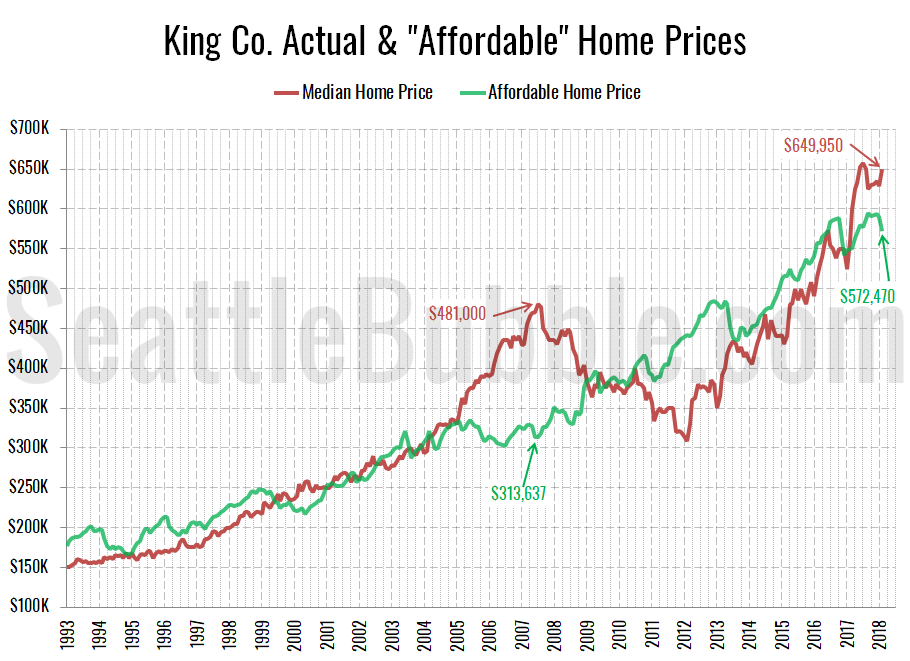

As promised in Monday’s affordability post, here’s an updated look at the “affordable home” price chart.

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could “afford” to buy at today’s mortgage rates, if they spent 30% of their monthly gross income on their home payment. Don’t forget that this math includes the (giant) assumption that the home buyers putting 20% down, which would be $129,990 at today’s median price.

The “affordable” home price has been declining in recent months as interest rates have climbed. The “affordable” home price of $572,470 in King County would have a monthly payment of $2,274.

The current gap of $77,480 between the affordable price and the median price is on-par with the difference seen in early 2006. We were in the same range early last year as well before declining mortgage rates bumped the affordable home price up, even as the median price declined a bit.

If interest rates were at a more reasonable level of 6 percent (which is still quite low by historical standards), the “affordable” home price would be just $474,203—about $98,000 lower than it is today, and $176,000 below the current median price.

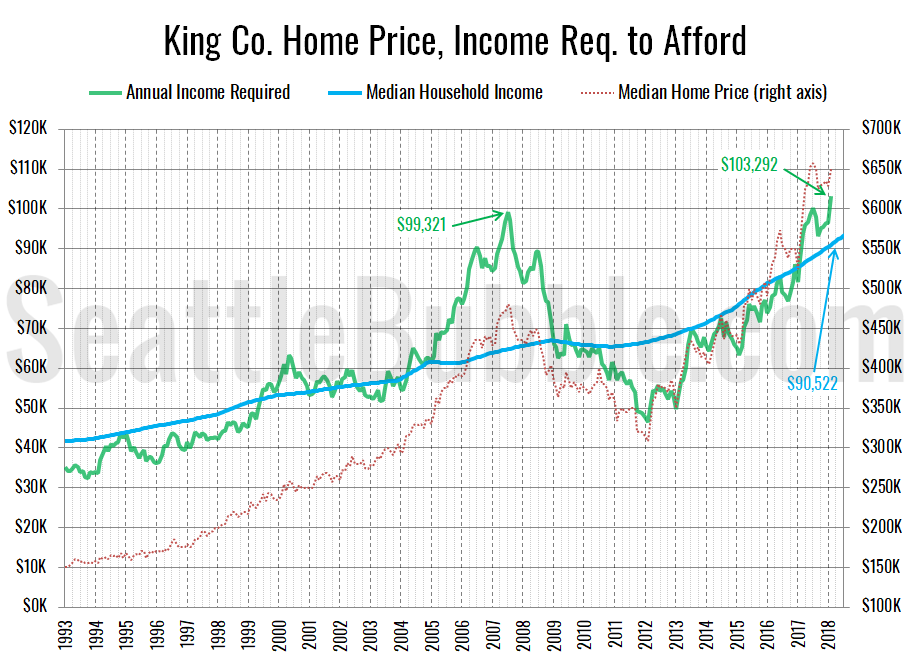

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of February, a household would need to earn $103,292 a year to be able to “afford” the median-priced $649,950 home in King County. This is up from the low of $46,450 in February 2012, and the hignest point ever recorded, even surpassing the previous July 2007 high. Meanwhile, the actual median household income in King County is estimated to be about $91,000.

If interest rates were 6% (around the pre-bust level), the income necessary to buy a median-priced home would be $124,697—37 percent above the current median income.