Much has been made of Seattle’s continued resilience in the face of the national downturn in housing prices. However, the bear comeback to this type of cheerleading is the argument that Seattle is simply late to the party and will eventually see declines of its own as well.

In order to test how well the “late to the party” hypothesis holds up, let’s do a little comparison shopping using the latest data from the S&P/Case-Shiller Home Price Index (March 2007).

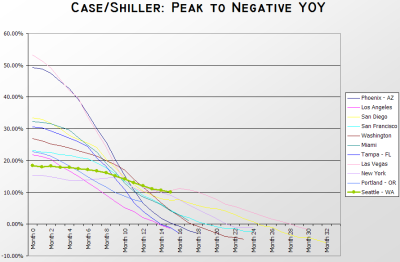

Following is a graph of YOY appreciation for each of the cities tracked by the Case-Shiller index in which YOY appreciation reached at least 15%, with the peak appreciation for each city lined up at “Month 0”:

I have highlighted Seattle’s data with the thick green line. As you can see from this graph, Seattle is actually following right along the middle of the road since its peak YOY appreciation, when compared to other cities that experienced a similar real estate boom. Here’s a summary of how long each city took to go from maximum YOY to YOY negative:

City – months from cliff to negative YOY

Cities in italic have not gone YOY negative yet.

Portland, OR – 12 (6.98%)

Tampa, FL – 14

Los Angeles, CA – 14

Seattle, WA – 15 (10.02%)

Phoenix, AZ – 16

Miami, FL – 17 (1.05%)

Washington, DC – 18

San Francisco, CA – 19

New York, NY – 22

San Diego, CA – 25

Las Vegas, NV – 29

Average – 19.6

To review, Seattle:

- Peaked at 18.5% YOY appreciation in December 2005.

- Has since been consistently declining.

- Is approximately 6-12 months away from where the Case-Shiller data suggests it will enter negative YOY territory.

FYI, “all real estate is local,” is not a valid retort to data that suggests a conclusion that makes you uncomfortable. If “all real estate is local” then why is it that since March of last year, every single city tracked by the Case-Shiller index has had steadily decreasing YOY appreciation?

In my opinion, the writing is on the wall.

For even more brainy number-crunching of the Case-Shiller data, check out Deejayoh’s analysis in the forum. Great work!

(MacroMarkets, S&P/Case-Shiller HPI, 05.2007)