January market stats have been published by the NWMLS. Here’s the NWMLS press release: Northwest MLS members report 28 percent increase in pending sales from year ago. Still focusing on the useless pending sales number. Tsk.

Here’s your King County SFH summary, with the arrows to show whether the year-over-year direction of each indicator is favorable or unfavorable news for buyers and sellers (green = favorable, red = unfavorable):

| January 2010 | Number | MOM | YOY | Buyers | Sellers |

|---|---|---|---|---|---|

| Active Listings | 7,523 | +8.7% | -16.5% |  |

|

| Closed Sales | 956 | -34.6% | +41.8% |  |

|

| SAAS (?) | 2.33 | +17.1% | -30.9% |  |

|

| Pending Sales | 1,765 | +24.9% | +52.3% |  |

|

| Months of Supply | 4.3 | -12.9% | -45.1% |  |

|

| Median Price* | $375,000 | -1.3% | -2.0% |  |

|

Closed sales usually tumble from December to January, but last month’s -34.6% drop was quite a bit higher than the -19.9% average December to January fall from 2001 through 2009. Only in January 2005 did closed sales fall more month-to-month, dropping from 2,813 in December ’04 to 1,677 in January ’05 (-40.4%).

Feel free to download the updated Seattle Bubble Spreadsheet, and here’s a copy in Excel 2003 format.

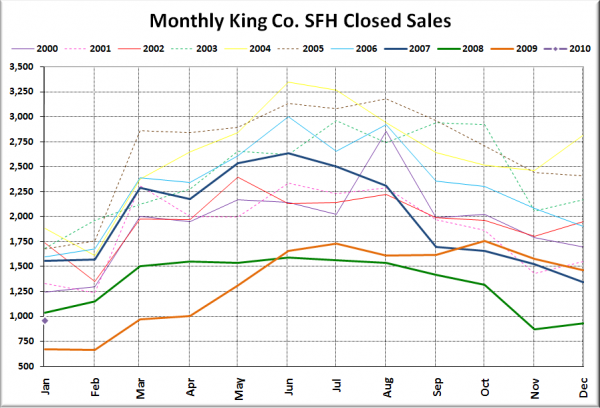

Here’s your closed sales yearly comparison chart:

More closed sales in January 2010 than 2009, but less than every other year on record.

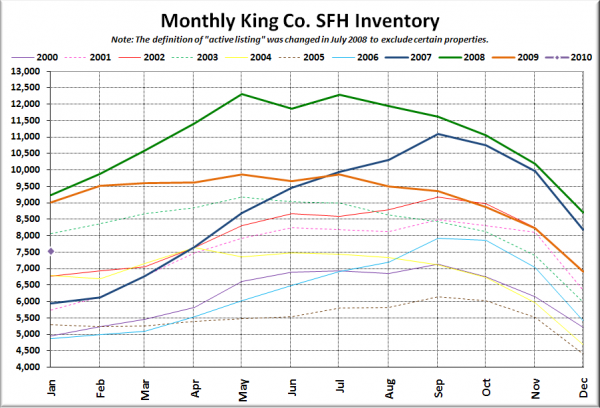

Here’s the graph of inventory with each year overlaid on the same chart.

Lower than 2008, 2009, and 2003. Higher than any other year.

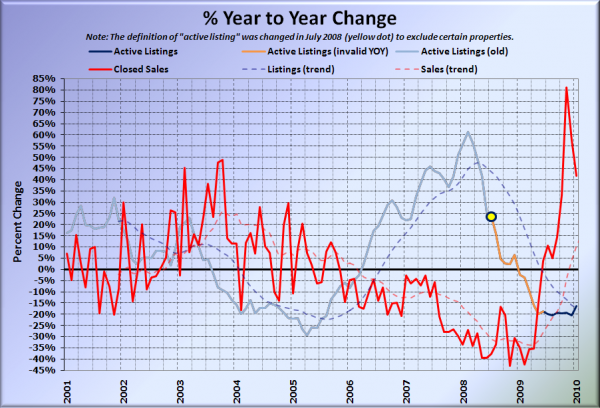

Here’s the supply/demand YOY graph. In place of the now-unreliable measure of pending sales, the “demand” in the following two charts is now represented by closed sales, which have had a consistent definition throughout the decade.

The sales spike is falling off almost as fast as it spiked up.

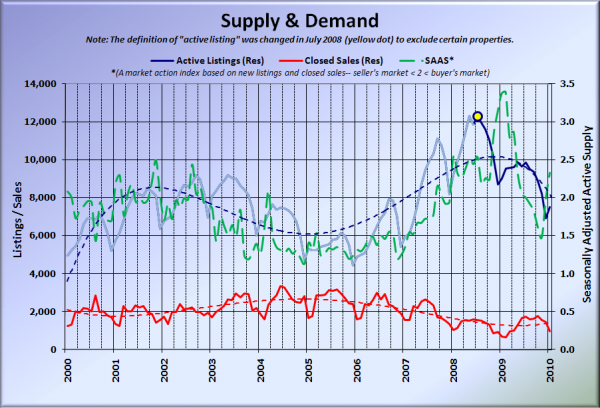

Here’s the chart of supply and demand raw numbers:

Starting off 2010 slightly better than 2009, but lower than every other year…

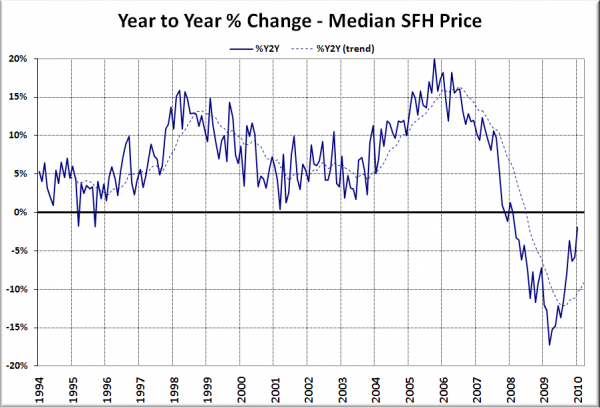

Here’s the median home price YOY change graph:

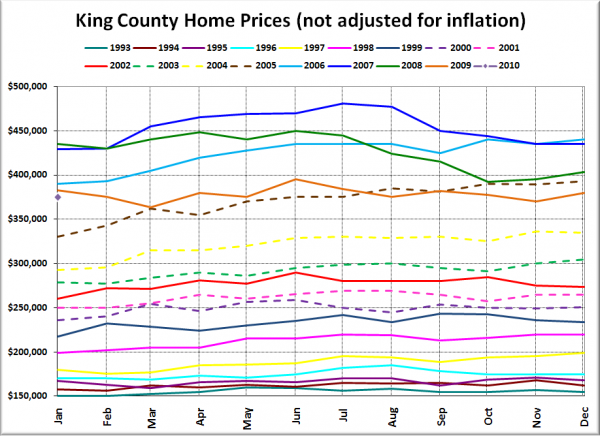

And lastly, here is the chart comparing King County SFH prices each month for every year back to 1994.

Still bobbing along somewhat of a floor there.

Here’s a few news blurbs to hold you over until tomorrow’s reporting roundup.

Seattle Times: Median price of homes in King County drops 2 percent from a year ago January

Seattle P-I: Seattle home prices up for first time since March 2008