Yesterday a reader asked:

I was wondering if you could write a post sometime on the relationship between interest rates and home prices (or direct me to a previous post if you’ve already done this). My husband is feeling pressured to buy a home within the next couple of months b/c he thinks interest rates will go up soon and we will have to spend more money for a house. I feel that an increase in interest rates will cause home prices to drop further. What is the historical relationship between interest rates and home prices? Have home prices ever declined before when interest rates go up? What data exist to inform your opinions on this? Also, does an increase in interest rates usually lead to an increase in inflation?

First, here’s a post I wrote back in June on the subject of interest rates and home prices: The Consequences of a Market Full of Monthly Payment Buyers. [Update: Here’s another relevant one that I had forgotten: Interest Rates vs. Home Prices] I’d also like to point out another more recent post that argues that It’s a Great Time to Rent.

Also, please be aware that feeling “pressure” is never a good reason to buy a home. Never.

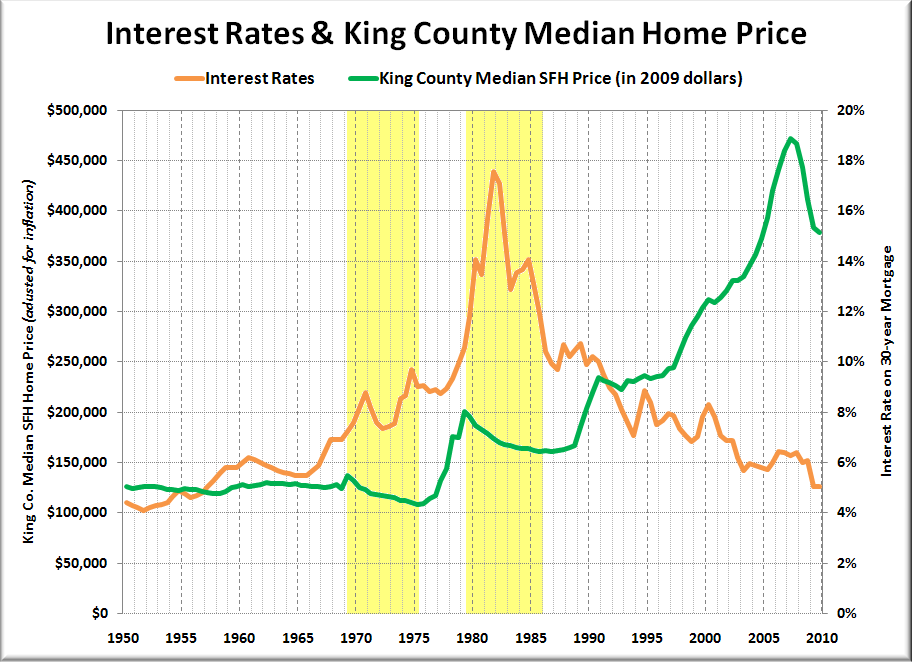

Okay, let’s tackle the specific questions quoted above. In order to attempt to explore this issue, we’ll look at King County home prices (inflation-adjusted using the CPI) and mortgage interest rates over the last 60 years.

Prior to 2007, there were two extended periods of time during which inflation-adjusted King County home prices fell: 1969-1975 and 1979-1985 (each highlighted above in yellow). Interestingly, mortgage interest rates were indeed rising going into both of those periods.

From 1965 to 1974, interest rates rose over five points. Meanwhile, home prices dropped over 20% from their peak. During a period of relatively stable (though definitely still high) interest rates between 1975 and 1979, home prices shot up. Then, as interest rates began their steepest climb, shooting up nine points in four years, home prices fell again, dropping 20% off the peak.

It is interesting to note that the dramatic price declines that we are currently seeing is the first time that home prices have fallen for an extended period of time without a corresponding period of rising interest rates.

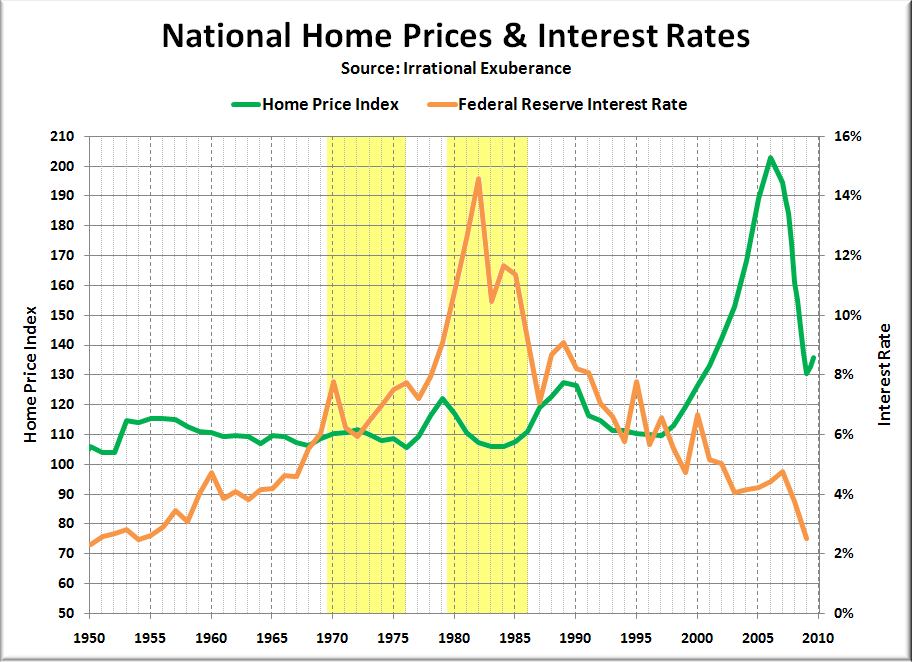

The national picture looks similar, although the 1969-1975 decline is much less pronounced, and there is an additional period of declining prices between 1990 and 1996, during which interest rates were declining.

(Note that the interest rate on the above chart does not exactly match the first chart, as the above chart is taken directly from the data provided by Robert Shiller on his Irrational Exuberance website.)

It was also asked “does an increase in interest rates usually lead to an increase in inflation?” I believe that high interest rates and high inflation usually happen around the same time, but I don’t think it’s necessarily accurate to say that the increased interest rates lead to increased inflation. More likely they’re both symptoms of larger economic forces at play.

All that being said, it is important to be aware of a couple of things. One, people have been expecting interest rates to rise for about a year, and yet they continue to hover around 5%. Buying based on where you think interest rates are going to go is probably not a good plan.

Two, if you do end up buying in a high interest rate situation, keep in mind that you can always refinance if rates go down later. However, if you end up buying in a high purchase price situation, then home prices go down later, you won’t have the luxury of refinancing into a lower principal balance.

Lastly, I’ll take this opportunity to repeat the advice I have given since launching this site about when it is best to buy a home. If you find a house that you believe is priced fairly, that you can afford using a conventional fixed-rate mortgage, that you will be happy living in for at least ten years, and you won’t be distraught if the value goes down, then go for it.

Frankly, who cares about interest rate or home price trends if it is important to you to buy a home and you can afford to buy a home you love? Just don’t allow yourself to be fooled into believing that buying a home is a great investment, or that you have to buy now or risk being priced out forever.