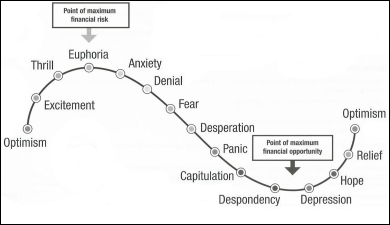

It’s been quite a while since we had a look at the “Cycle of Market Emotions.”

Last time, in late 2007 as prices just began to decline here in the Seattle area, I pegged our location on the curve at somewhere between anxiety and denial. Today I’d guess that we’re holding fairly steady between fear and desperation.

Here’s a quick highlight of where the market is at today:

- foreclosures still increasing

- prices declining slowly

- sales boosted through the spring

- Post-tax credit, mortgage purchase applications have dropped to a 13-year low

- interest rates still at record lows

- banks failing at an increasing rate

While there may be signs of a bounce-back off the bottom for the economy as a whole, I have a hard time believing that the Seattle-area housing market has really “hit bottom” yet, either in terms of home prices or with respect to the cycle of market emotions.

What do you think? Have we hit capitulation or despondency yet, or are we still treading water somewhere between fear and desperation?