They have not yet published the press release to their website, but September market stats are now available from the NWMLS. Once they post a press release I’ll update this post with a brief snippet. Until then, let’s just go straight to the stats.

NWMLS monthly reports include an undisclosed and varying number of

sales from previous months in their pending and closed sales statistics.

Here’s your King County SFH summary, with the arrows to show whether the year-over-year direction of each indicator is favorable or unfavorable news for buyers and sellers (green = favorable, red = unfavorable):

| September 2013 | Number | MOM | YOY | Buyers | Sellers |

|---|---|---|---|---|---|

| Active Listings | 4,965 | +1.3% | -0.8% |  |

|

| Closed Sales | 2,200 | -14.1% | +22.4% |  |

|

| SAAS (?) | 1.19 | -9.1% | -8.5% |  |

|

| Pending Sales | 2,508 | -11.8% | +3.4% |  |

|

| Months of Supply | 1.98 | +14.9% | -4.1% |  |

|

| Median Price* | $420,000 | -2.3% | +12.0% |  |

|

Feel free to download the updated Seattle Bubble Spreadsheet (Excel 2003 format), but keep in mind the caution above.

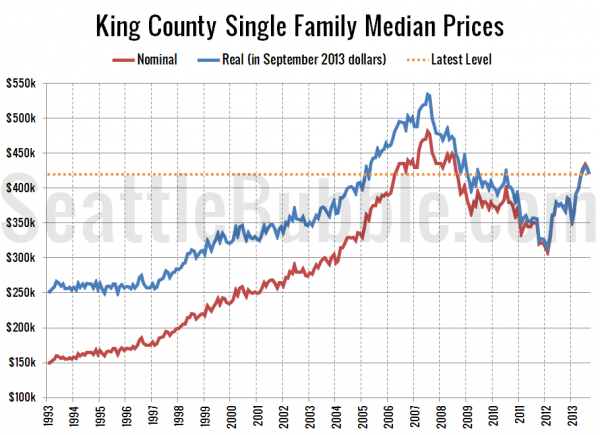

Just like we said earlier this week in the stats preview, inventory ticked up one more time this year, but didn’t quite beat 2012’s number yet. Pending sales fell for the fourth month in a row, while closed sales fell for the second month. The median price dipped slightly, putting home prices on par with where they were in February 2005 after adjusting for inflation.

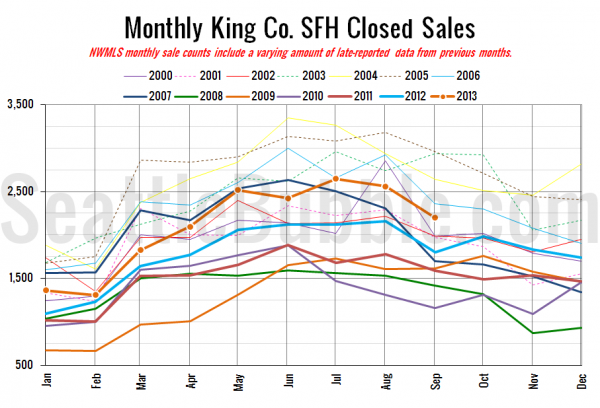

Here’s your closed sales yearly comparison chart:

Closed sales fall between August and September most years, and 2013 was no exception. The decline was somewhat on the large side though, as the 6th largest drop in the last 21 years.

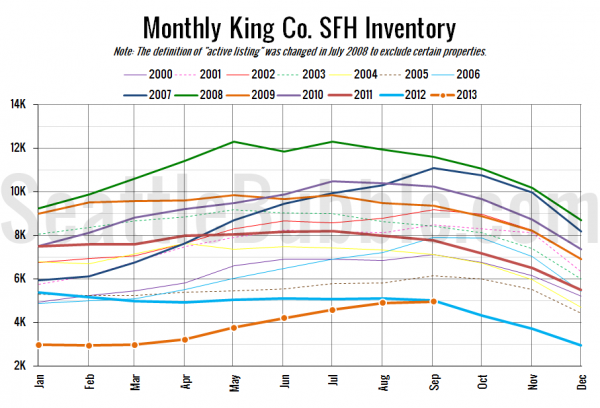

Here’s the graph of inventory with each year overlaid on the same chart.

Still didn’t quite hit year-over-year positive inventory in September, even though we saw a month-over-month increase while last year the same period saw a decrease. Inventory was down less than one percent from a year ago—a lot better for buyers than the 44.7% year-over-year decrease we saw in January.

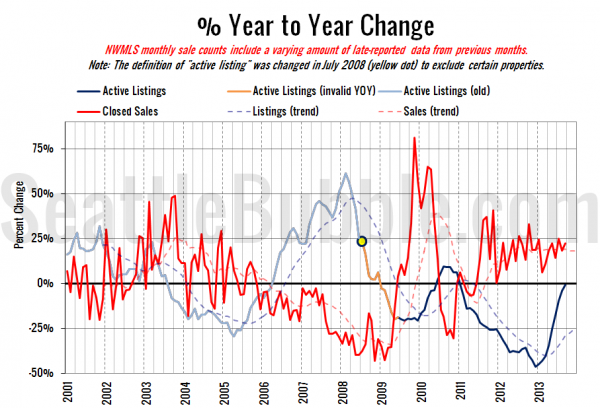

Here’s the supply/demand YOY graph. “Demand” in this chart is represented by closed sales, which have had a consistent definition throughout the decade (unlike pending sales from NWMLS).

The supply trend almost hit zero, while the demand trend moved back up a bit. We’re still quite a ways from a good market for buyers.

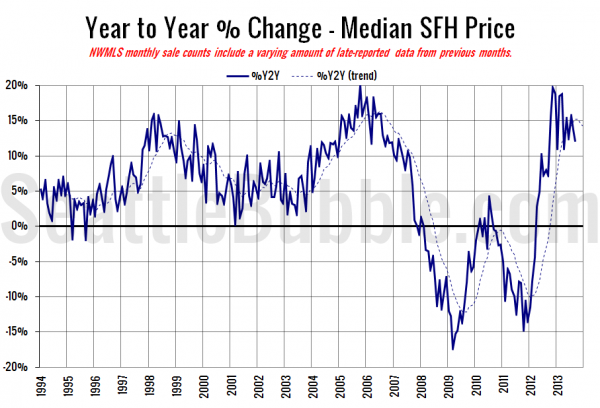

Here’s the median home price YOY change graph:

The median sale price fell for the second month in a row in September, but year-over-year the median price is still up double digits.

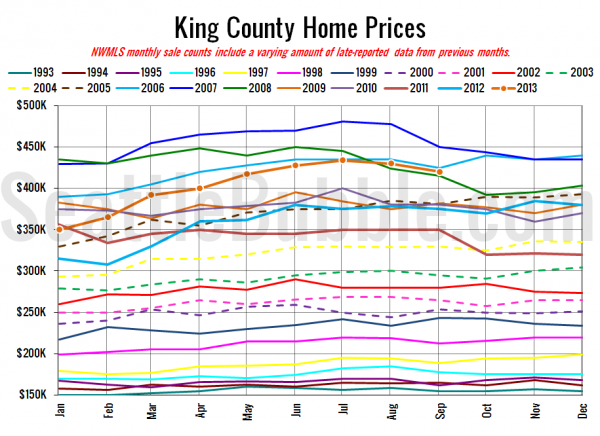

And lastly, here is the chart comparing King County SFH prices each month for every year back to 1994 (not adjusted for inflation).

September 2013: $420,000

April 2006: $419,000

Here are today’s articles from the Times and P-I:

Seattle Times: King County home prices fell 2.3 percent last month

Seattle P-I: Home selection the best since February

Check back Monday for the full reporting roundup.