Let’s make our regularly scheduled monthly check on the Case-Shiller Home Price Index. According to February data,

Down 1.5% January to February.

Down 15.4% YOY.

Down 20.9% from the July 2007 peak

Last year prices fell 0.97% from January to February and year-over-year prices were down 2.70%.

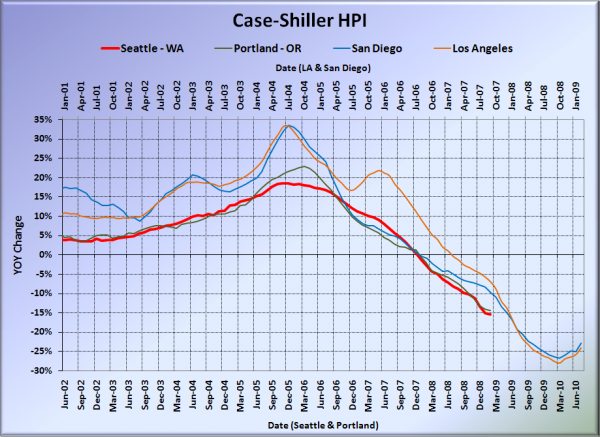

Here’s the usual graph, with L.A. & San Diego offset from Seattle & Portland by 17 months. Portland extended its streak to three months of turning in a smaller YOY loss than Seattle. The YOY declines in Los Angeles and San Diego both continued the upward trends that began with November’s data.

Note: This graph is not intended to be predictive. It is for entertainment purposes only.

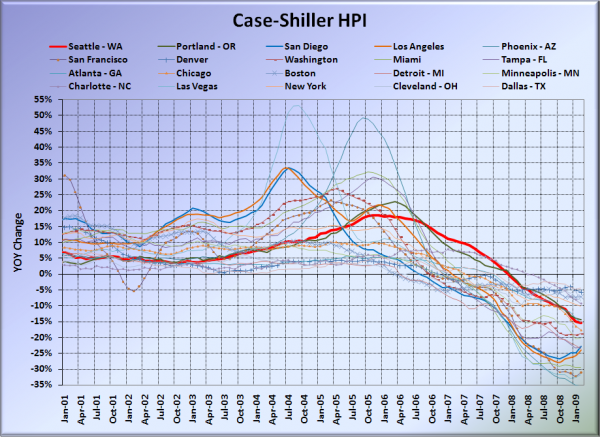

Here’s the graph of all twenty Case-Shiller-tracked cities:

In February, eight of the twenty Case-Shiller-tracked cities experienced smaller year-over-year drops than Seattle (the same number as December and January). Dallas at -4.5%, Denver at -5.7%, Boston at -7.2%, Cleveland at -8.5%, Charlotte at -9.4%, New York at -10.2%, Portland at -14.4%, and Atlanta at -15.2%. As usual, Phoenix had the largest year-over-year drop, with prices falling 35% in a single year again.

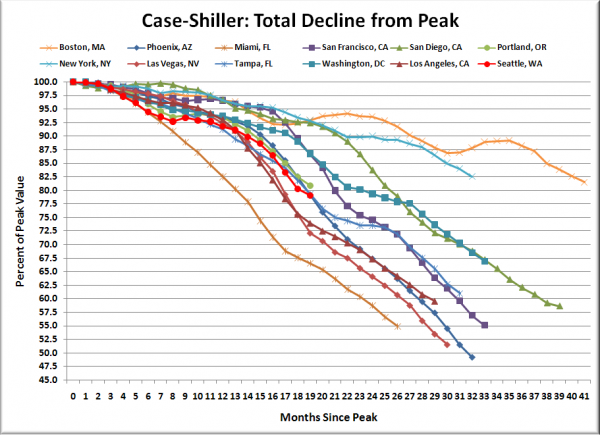

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve cities whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the nineteen months since the price peak in Seattle prices have declined just shy of 21%. Seattle’s price decline this far from the peak was just slightly larger than what was seen in Tampa. Only Miami, Las Vegas, and Los Angeles had declined further this far after their respective peaks.

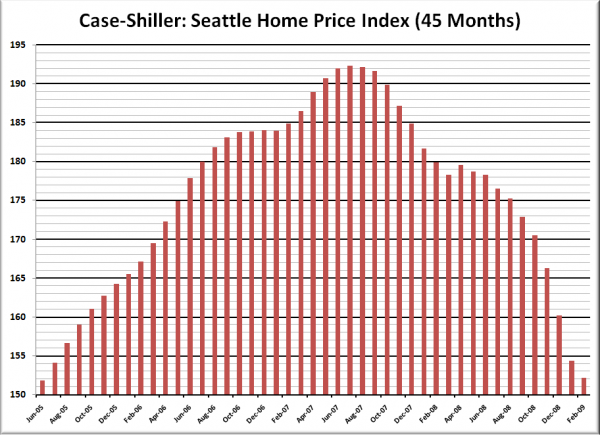

Here’s the “rewind” chart. The horizontal range is selected to go back just far enough to find the last time that Seattle’s HPI was as low as it is now. This gives us a clean visual of just how far back prices have retreated in terms of months.

Seattle’s Case-Shiller value for February 2009 of 152.12 came in just above its June 2005 value of 151.79. Prices have now “rewound” nearly four years.

Check back tomorrow for a post on the Case-Shiller data for Seattle’s price tiers.

(Home Price Indices, Standard & Poor’s, 04.28.2009)