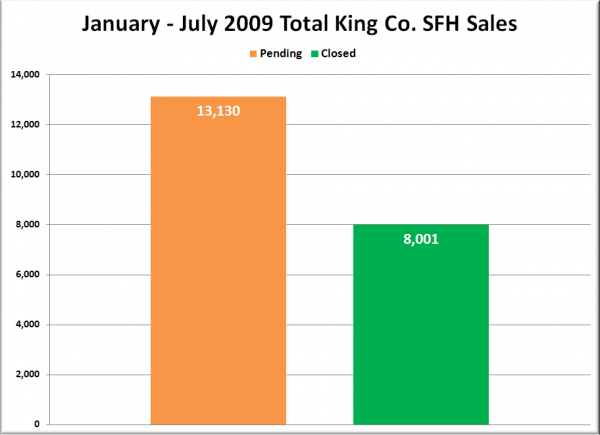

In the comment thread on yesterday’s post there was some discussion about the ever-growing gap between pending sales and closed sales. Here’s a simple look at how they stack up through July (since August stats aren’t out just yet):

The massive difference between pending and closed sales brings up the question: Is there really a backlog of over 5,000 homes waiting to close?

Most likely no, there is no such tsunami of closings about to crash on the shores of the Puget Sound. This growing discrepancy is probably due to a couple of factors.

First, the redefinition of what is counted as a “pending sale” last year to include homes that have merely reached the inspection point naturally means that a larger number of these pendings will not close simply due to failed inspections.

However, the larger factor is probably short sales. Hundreds if not thousands of these pendings in limbo are probably due to a buyer making an offer on a short sale, the seller “accepting” the offer (at which point the “sale” is counted as pending) and sending it to the bank, and the bank simply never replying.

It is also worth mentioning that each of these 5,000+ seemingly dead pending sales represents two parties (the buyer and the seller) that have wasted their time submitting and reviewing offers. The situation is definitely not pretty. One of my coworkers recently purchased a short sale, and he went for months without hearing anything from the seller’s agent regarding the status of their offer. It took him threatening over the phone to drive his truck through the (vacant) house to finally spur some action by the seller’s agent and the bank (not a recommended course of action)!

One suggestion that was floated in yesterday’s conversation was that the NWMLS ban short sales in their system all together unless the seller has gotten a pre-approval from the bank on the list price. This would certainly save a lot of people a lot of headaches, and would probably overall help the market to be more efficient.

Have you had an experience with a short sale that completely died? What, if anything, do you think should be done about this growing problem?