The latest issue of Sound Housing Quarterly has been published. Sound Housing Quarterly is a subscription-based sister project to Seattle Bubble. Here are a couple of highlights from the third quarter issue.

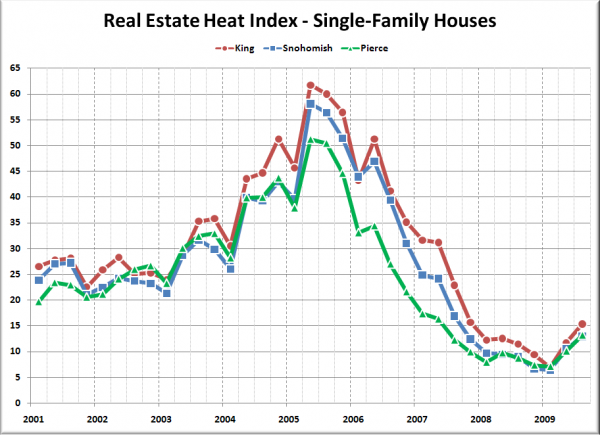

The Real Estate Heat Index (a proprietary index I created that uses supply, demand, and home prices to calculate the general “heat” of the housing market) rose in all seven Puget Sound Counties in the third quarter, but still remains below pre-bubble levels.

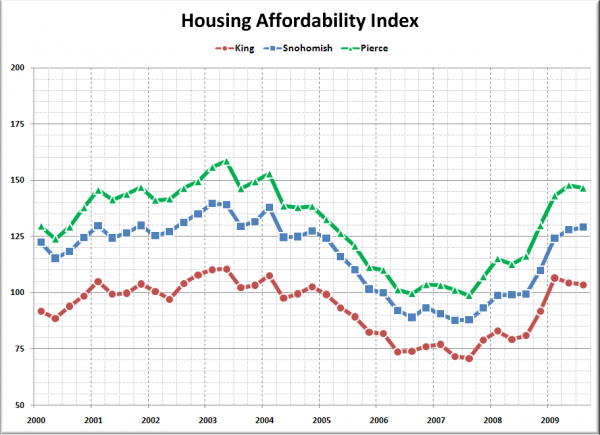

Meanwhile, affordability dropped in every county but Snohomish, despite interest rates in the 5s.

The full version of Sound Housing Quarterly includes detailed data and analysis for King, Snohomish, Pierce, Kitsap, Thurston, Island, and Skagit counties.

Head over to HousingQuarterly.com to subscribe to Sound Housing Quarterly. You can also download a free single-page summary of this quarter’s report, or head over to the free archive to check out last year’s Q3 report in full.