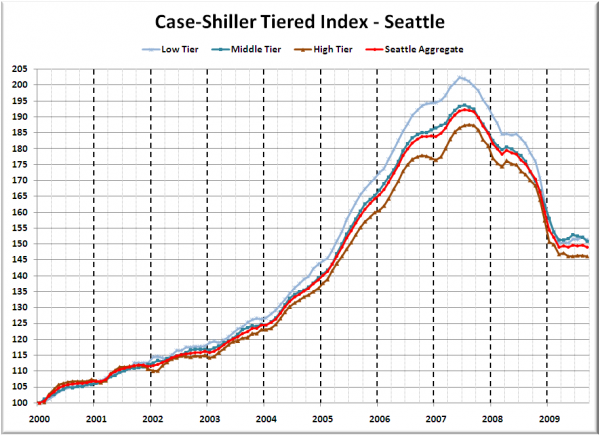

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $273,666

- Mid Tier: $273,666 – $403,681

- Hi Tier: > $403,681

The tier breakpoints broke their recent trend of inching upward over the last few months, as all three tiers saw month-to-month drops.

First up is the straight graph of the index from January 2000 through September 2009.

The low tier fell 0.6% month-to-month, while the middle tier fell 0.9%, and the high tier dropped 0.1%. The “rewind” situation held steady again, with low tier sitting about where it was in April 2005 and the middle and the high tiers at May 2005 levels.

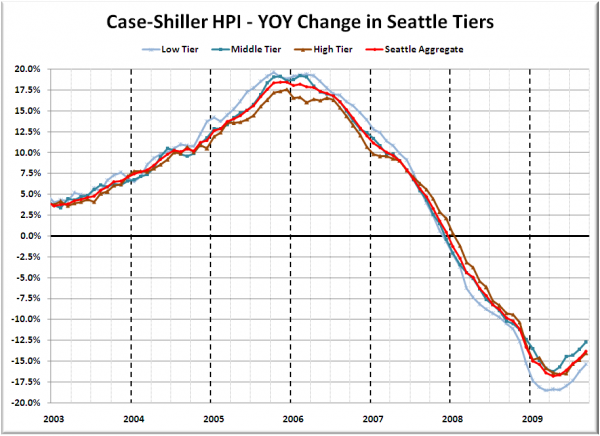

Here’s a chart of the year-over-year change in the index from January 2003 through September 2009.

Despite the month-to-month drop, the year-over-year situation improved slightly in all three tiers, with the high tier seeing the smallest bump. Here’s where the tiers sit YOY as of September – Low: -15.4%, Med: -12.7%, Hi: -14.1%.

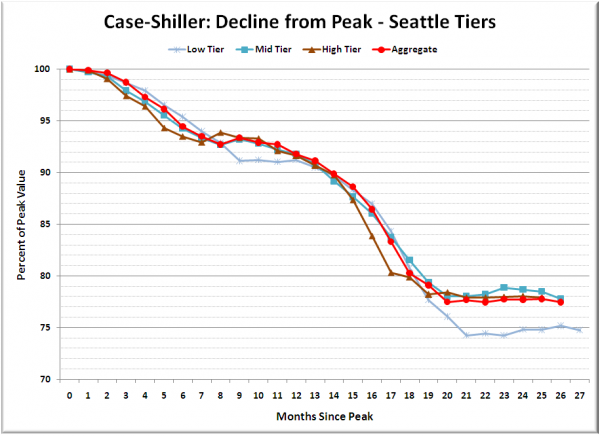

Lastly, here’s a decline-from-peak graph like the one posted yesterday, but looking only at the Seattle tiers.

It’s looking more like my call for “an extended lull on the way to the real bottom” may be an accurate assessment of this summer’s apparent plateau.

(Home Price Indices, Standard & Poor’s, 11.24.2009)