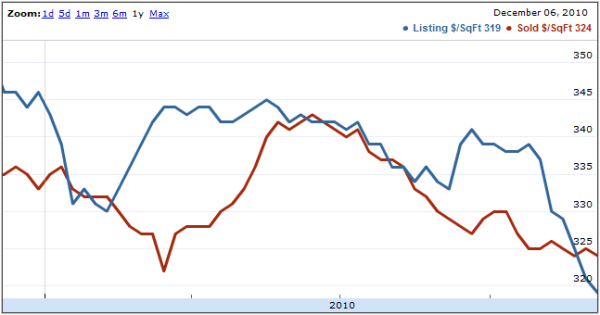

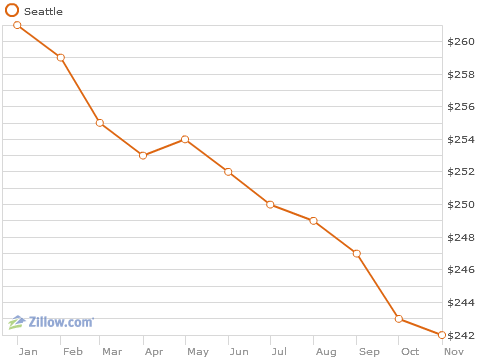

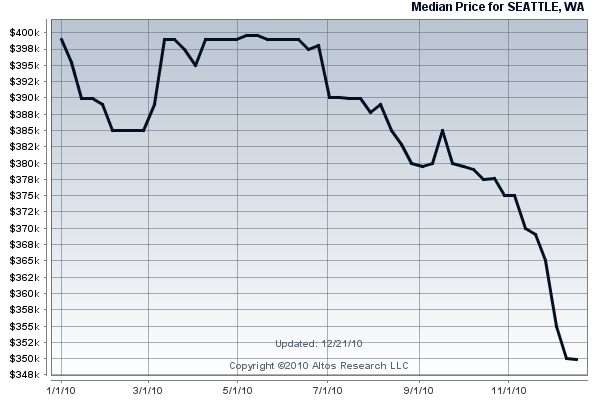

Here are a few charts of price per square foot for Seattle single-family homes…

Zillow (list price):

Altos Research (list price):

Draw your own conclusion about whether or not prices have hit bottom yet.

Full disclosure: The Tim is employed by Redfin.