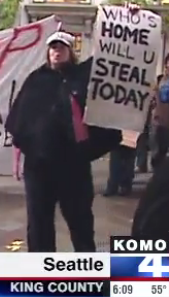

Spotted the sign pictured at right in a KOMO News story about Occupy Seattle protesters disrupting the weekly courthouse steps foreclosure auction on Saturday at the King County Courthouse.

Spotted the sign pictured at right in a KOMO News story about Occupy Seattle protesters disrupting the weekly courthouse steps foreclosure auction on Saturday at the King County Courthouse.

I’ll let the sign speak for itself, but I will say that I really don’t understand the connection these protesters appear to be making. Other signs at the protest:

- “STOP ROBBIN’ OUR HOODS!”

- “STOP ILLEGAL FORECLOSURES”

- “NO MORE Foreclosures in OUR WA!”

- “BANKERS LIED, ECONOMY DIED”

- “Fund the needy, Not the greedy”

- “BANKS TERRORISTS WORSE THAN AL QAEDA”

- “HOMELAND SECURITY NEEDS TO DEFEND MY HOME”

How are foreclosures equivalent to corporate greed, theft, and terrorism?