It’s been a while since we had a look at local job growth data, so let’s update those charts.

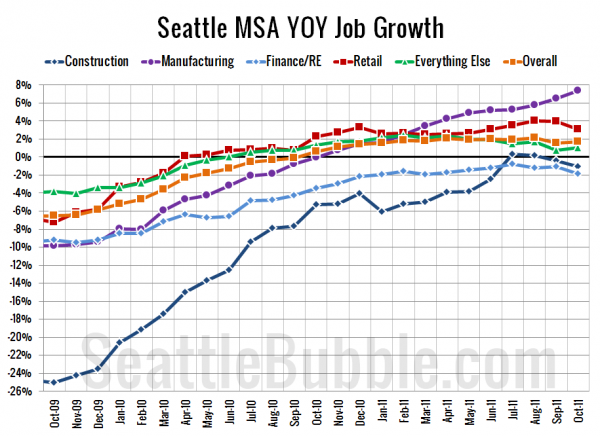

First up, year-over-year job growth, broken down into a few relevant sectors:

Finance, real estate, and construction are all still shedding jobs, despite a slight year-over-year uptick in overall employment data, which seems to be bouyed by an especially strong showing in the manufacturing sector—up 7.4% from October 2010.

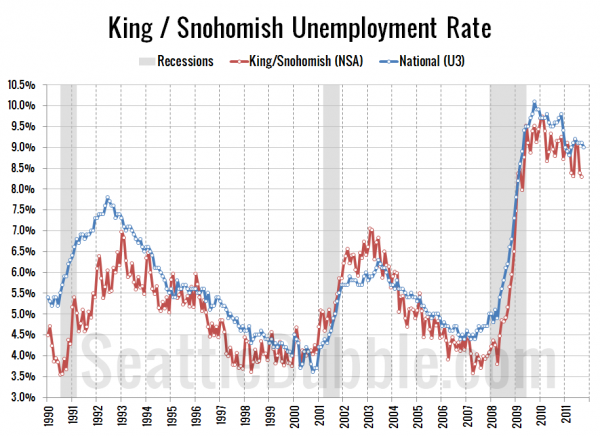

Here’s a look at the overall Seattle area unemployment rate compared to the national rate:

Trending down slowly, along with the national rate. Nationally, the number of jobs is still roughly five percent lower than it was at the start of the recession nearly four years ago.