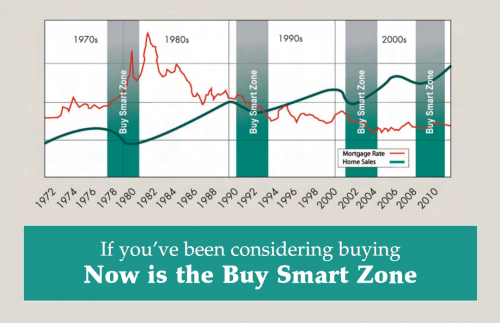

Today’s Friday Flashback comes to us courtesy of John L. Scott (“Your Trusted Real Estate Resource”), who published this delightful “white paper” in early 2008, titled Why Now Is A Smart Time To Buy (pdf).

Here are some selected excerpts:

FACT: The housing market is undergoing a natural cyclical correction.

…unlike what the media would have us believe, a correction in the housing market doesn’t equate to a crash. Unfortunately, the ongoing negative news about the troubled areas in the U.S. has caused a ripple effect, with home buyers and sellers on a national level exercising caution before making a decision.

If only that darn media would have kept their big, stupid mouths shut, we could have kept scamming buyers, and the pyramid scheme could have gone on indefinitely!

FACT: Low mortgage rates give buyers more house for their dollar.

With the 30 year fixed rate hovering between six and seven percent—a 45-year low—qualified buyers continue to have access to incredibly low interest rates.

An excellent example of the “low rates” hype I mentioned yesterday. I doubt we’ll be reading “white papers” from John L. Scott touting the “incredibly low interest rates” when they head back up to 6-7%.

FACT: Heavy speculation and overbuilding result in an increase in foreclosures when prices go down.

The media has been focusing on the hardest hit areas of the country that have seen a dramatic downturn in the market; among them, California, Nevada, Florida and Arizona. …fewer homebuyers in the Pacific Northwest opted for subprime mortgages and because home values have continued to steadily appreciate.FACT: Subprime borrowers get a reality check.

…unlike the media’s portrayal, the reality is that subprime loans comprise only nine percent of total loans nationwide and of those nine percent, less than 11 percent of those subprime ARM and fixed borrowers have defaulted on their loans. The Pacific Northwest stands apart as is its own micro-market, with more homebuyers qualifying for prime loans. Homeowners in the Northwest have been able to successfully sell their homes for a profit or refinance to pay off their subprime loans.FACT: Real Estate is localized and the Northwest is one of the strongest housing markets in the United States.

…many parts of the country, like the Pacific Northwest, do not have the same negative news as California, Nevada, Arizona and Detroit, Michigan, because homes have appreciated at a steady clip in the Pacific Northwest.

The running theme in this paper was that “yeah, things are bad… in other places. But the Pacific Northwest is invincible!”

FACT: Over the long-term, Real Estate has always appreciated in value.

The continuing appreciation of homes in the Northwest is not an anomaly. Real estate has always been one of the most solid investments in the U.S, because, after all, people always need a place to live. Real estate has less volatility than the stock market and over the historical long-term it remains a guaranteed return-on-investment.

Guaranteed!

THE FACTS ADD UP: If you’re in the market to buy, now is the time to “Buy Smart”

I would certainly hope that most of my readers were smart enough to hold off during John L. Scott’s “Buy Smart Zone.” If you took John L. Scott’s advice and purchased a home shortly after reading this “white paper” in early 2008, four years later you would be down nearly 30% on your “solid investment.” Smart!

Here’s what I had to say about this nonsense at the time:

How is it “unfortunate” that people are being more cautious? Oh, right. John L. Scott sells real estate, so they would prefer it if all caution was thrown to the wind. Also, they’re blaming the downturn on “negative news.” That is so laughable it’s not even worth a detailed rebuttal. Here’s a hint though guys: it’s the other way around—the downturn is real, so the news is negative.

…this is definitely not an “objective assessment.” It’s quite clearly a marketing document intended to dupe cautious home buyers into throwing their money into a freshly-declining market. I hope nobody takes this document seriously.

Here’s hoping.