Let’s check in on how Consumer Confidence and mortgage interest rates fared during September.

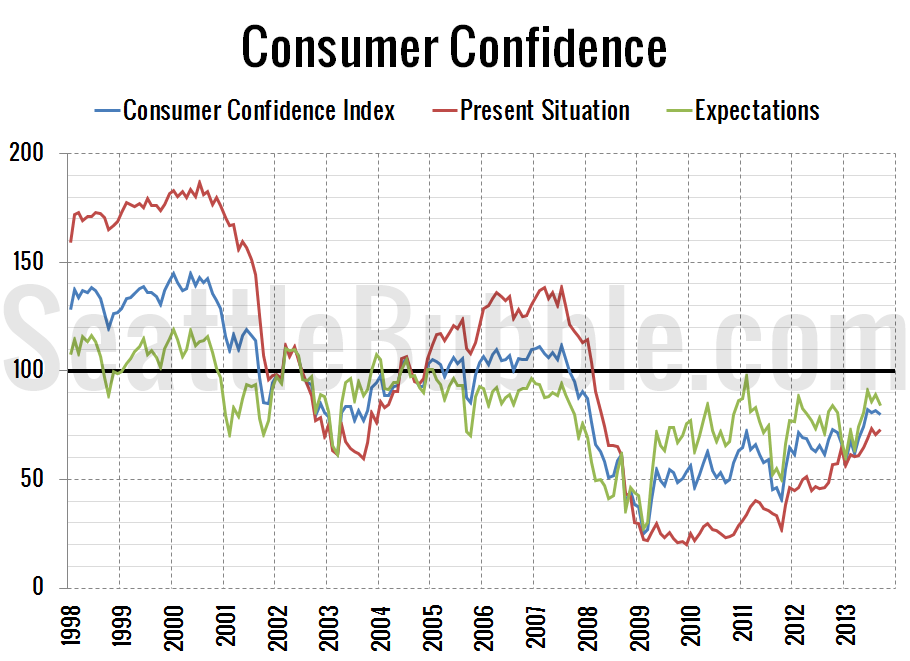

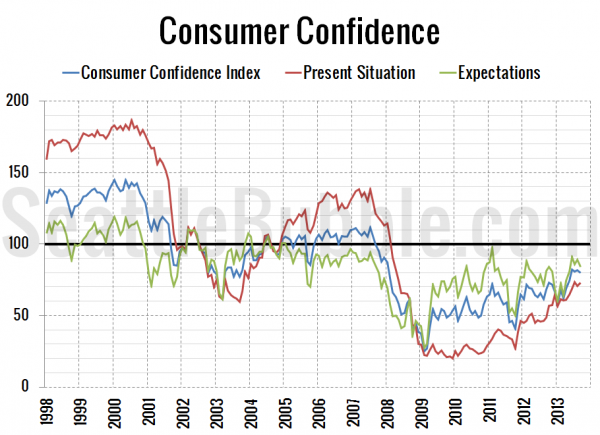

First up, here’s the Consumer Confidence data as of September:

At 73.2, the Present Situation Index increased 3.2% between August and September, and is currently up 262% from its December 2009 low point. The Expectations Index fell slightly in August, losing 5.5% from its August level.

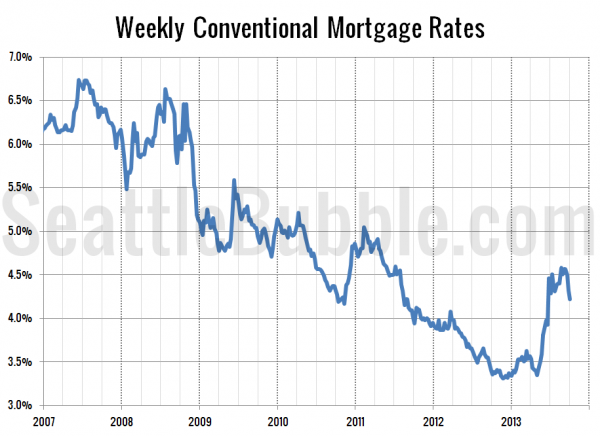

Here’s your chart of home mortgage 30-year interest rates via the Federal Reserve:

As of last week, the 30-year mortgage rate sat at 4.22%, down about a quarter point from where it sat between mid-August and mid-September. Current interest rates are roughly on par with where they were in September 2011, and still over two points below the 6.41% average rate during the height of the housing bubble through 2006.

Click below for the interactive Consumer Confidence chart (only works in Google Chrome).

You can use the sliders under the interactive chart below to zoom in on the data for a specific period.