With September in the books, let’s have a look at our monthly stats preview. Most of the charts below are based on broad county-wide data that is available through a simple search of King County and Snohomish County public records. If you have additional stats you’d like to see in the preview, drop a line in the comments and I’ll see what I can do.

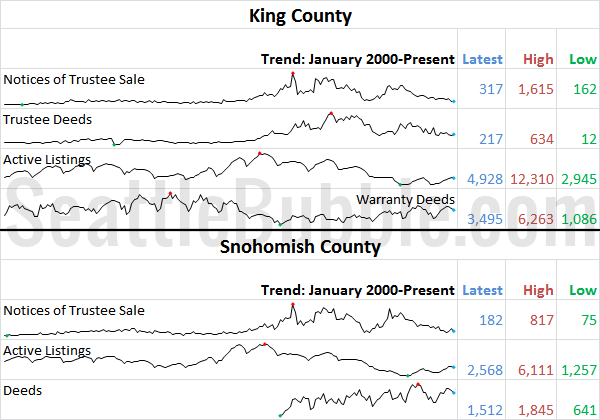

First up, here’s the snapshot of all the data as far back as my historical information goes, with the latest, high, and low values highlighted for each series:

Listings dipped slightly from August in both counties. Snohomish is still up year-over-year, but King slipped slightly. Sales inched down a bit from a year ago in King and Snohomish. Foreclosure starts and completions both continued to fall from last year’s levels.

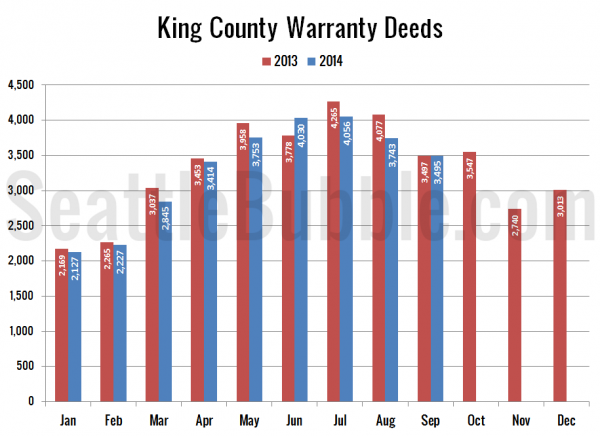

Next, let’s look at total home sales as measured by the number of “Warranty Deeds” filed with King County:

Sales in King County fell 7 percent between August and September (in 2013 they fell 14 percent over the same period), and were down 0.1 percent year-over-year.

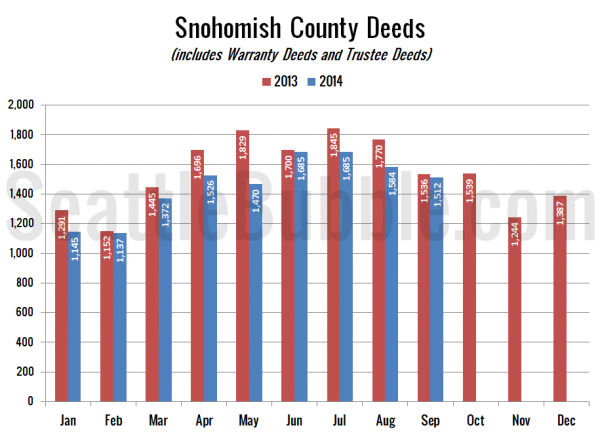

Here’s a look at Snohomish County Deeds, but keep in mind that Snohomish County files Warranty Deeds (regular sales) and Trustee Deeds (bank foreclosure repossessions) together under the category of “Deeds (except QCDS),” so this chart is not as good a measure of plain vanilla sales as the Warranty Deed only data we have in King County.

Deeds in Snohomish fell 5 percent month-over-month (compared to a drop of 13 percent over the same period last year) and were down 2 percent from September 2013.

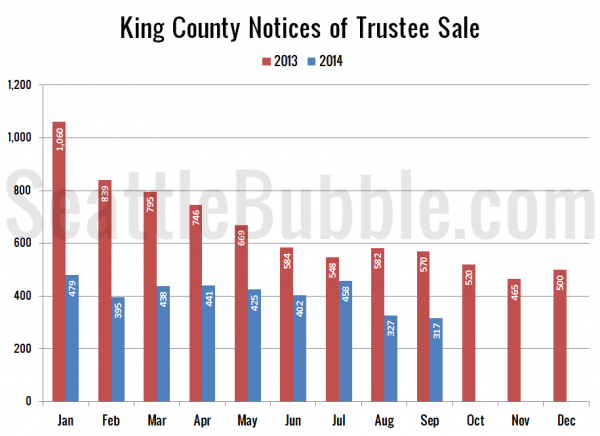

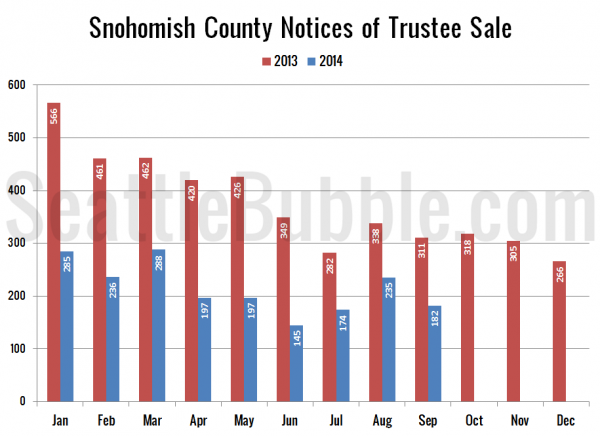

Next, here’s Notices of Trustee Sale, which are an indication of the number of homes currently in the foreclosure process:

Foreclosures in both counties were once again down considerably from a year ago. King was down 44 percent from last year, and Snohomish fell 41 percent.

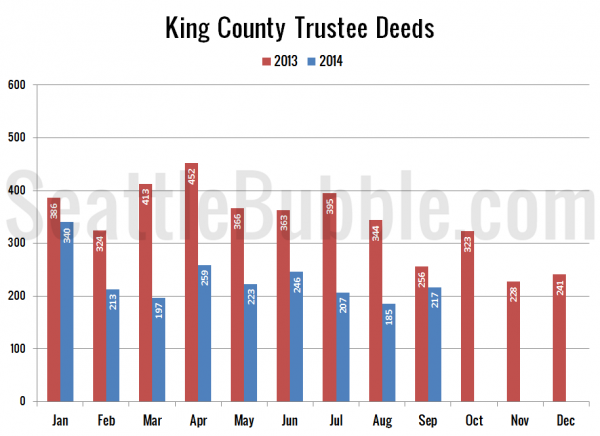

Here’s another measure of foreclosures for King County, looking at Trustee Deeds, which is the type of document filed with the county when the bank actually repossesses a house through the trustee auction process. Note that there are other ways for the bank to repossess a house that result in different documents being filed, such as when a borrower “turns in the keys” and files a “Deed in Lieu of Foreclosure.”

Trustee Deeds were down 15 percent from a year ago but rose a bit month-over-month.

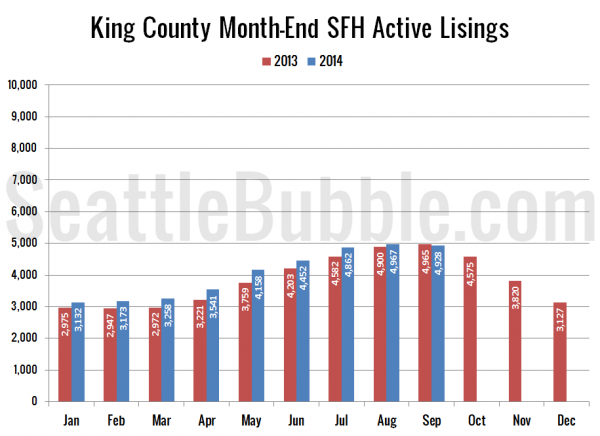

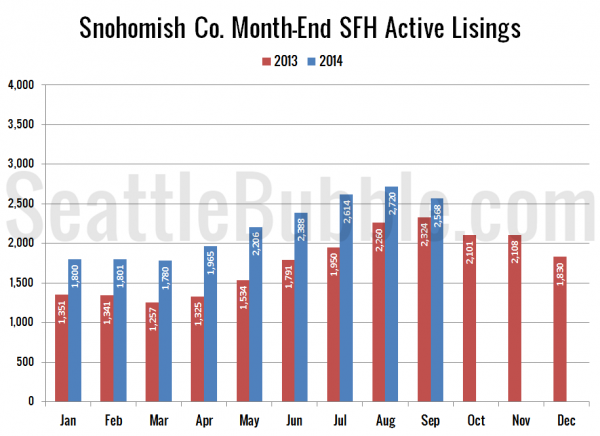

Lastly, here’s an update of the inventory charts, updated with the inventory data from the NWMLS.

Month-over-month inventory flipped from increases to decreases, as it usually does this time of year. King is currently down 1 percent from last year, while Snohomish is up 10 percent.

Stay tuned later this month a for more detailed look at each of these metrics as the “official” data is released from various sources.