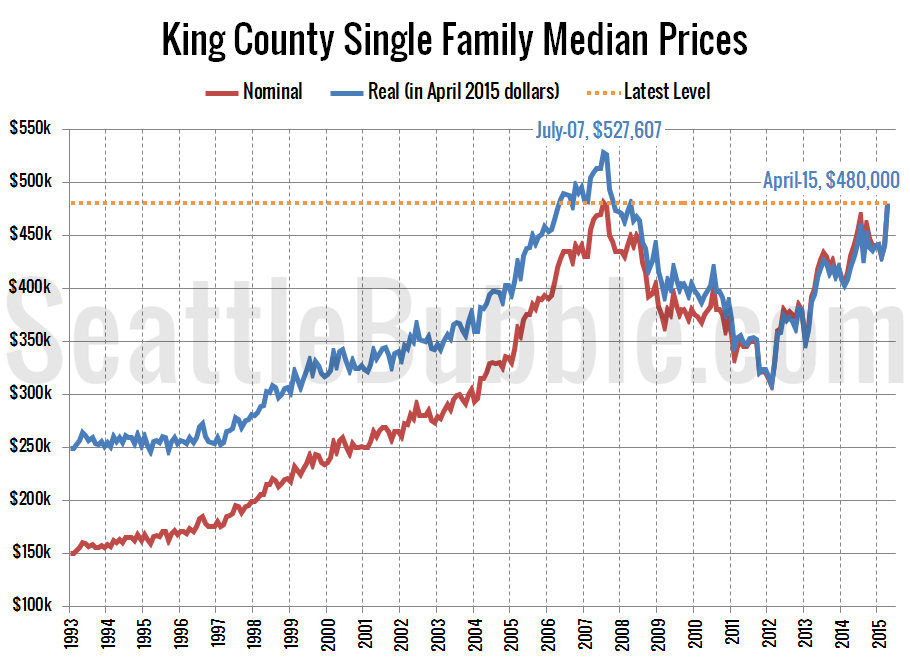

As promised, I’ve updated my chart of nominal and real (inflation-adjusted) King County median single-family home prices with data through April.

When adjusting into 2015 dollars, the median price peaked at $527,607 in July 2007. April 2015’s median price of $480,000 comes in about 9 percent below that level, and is roughly comparable to where prices were in May 2006.

Last year home prices increased 8.7 percent between April and their 2014 high point in July. If we see another similar increase this year we’ll come just shy of the inflation-adjusted price peak in 2015, hitting about $522,000 in July.

In other words, any way you look at it, home prices are really high right now.