It is a little late for this but it’s been a few months so I wanted to make sure we posted the update on Case-Shiller’s three price tiers.

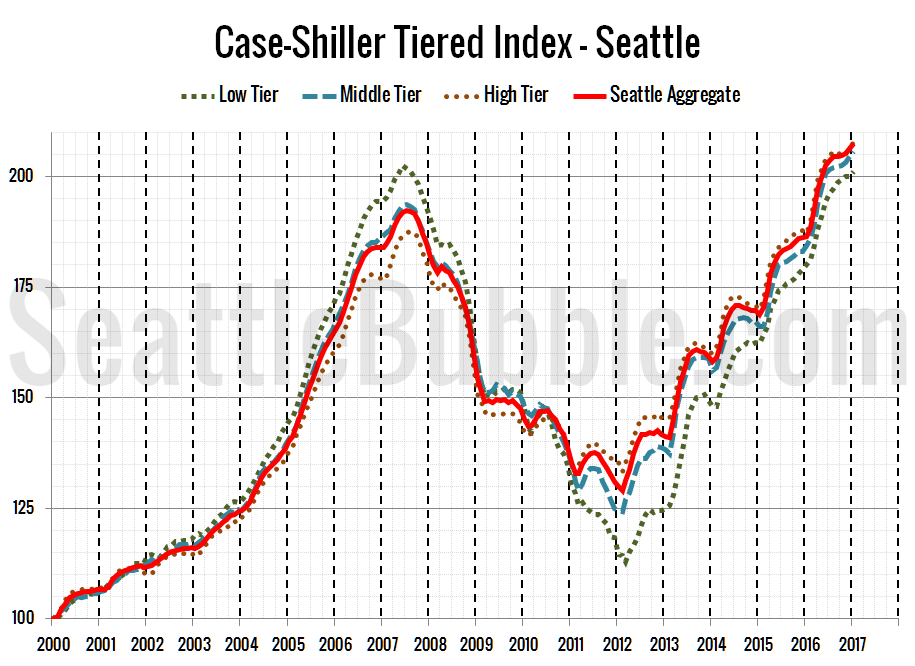

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $334,320 (down 0.2%)

- Mid Tier: $334,320 – $532,269

- Hi Tier: > $532,269 (down 0.1%)

First up is the straight graph of the index from January 2000 through January 2017.

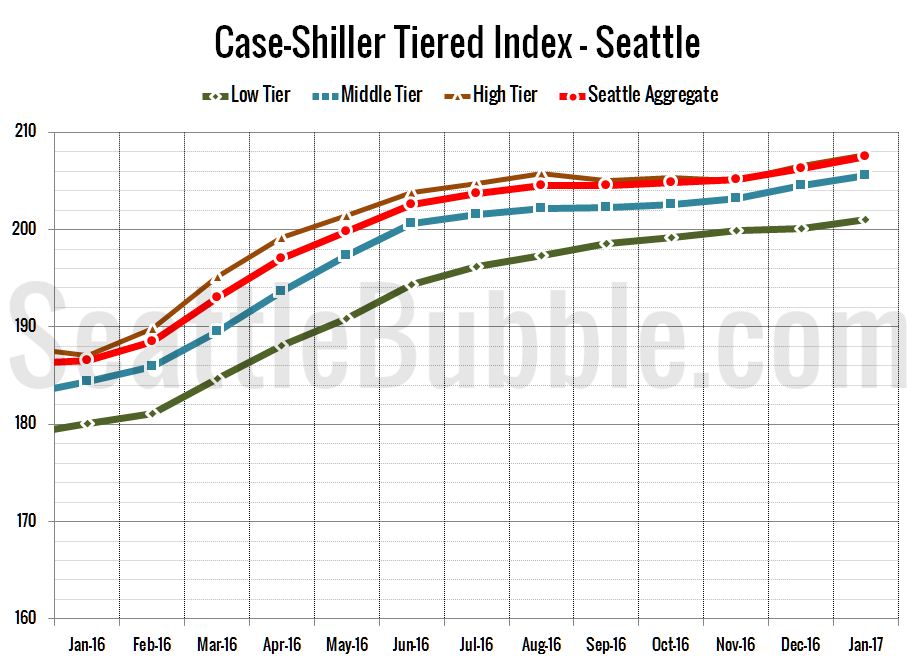

Here’s a zoom-in, showing just the last year:

All three tiers are increasing month-over-month, and look to be setting up another year of big price increases.

Between December and January, the low tier increased 0.5 percent, the middle tier rose 0.5 percent, and the high tier was up 0.5 percent. Somehow this translates to an overall increase of 0.6 percent.

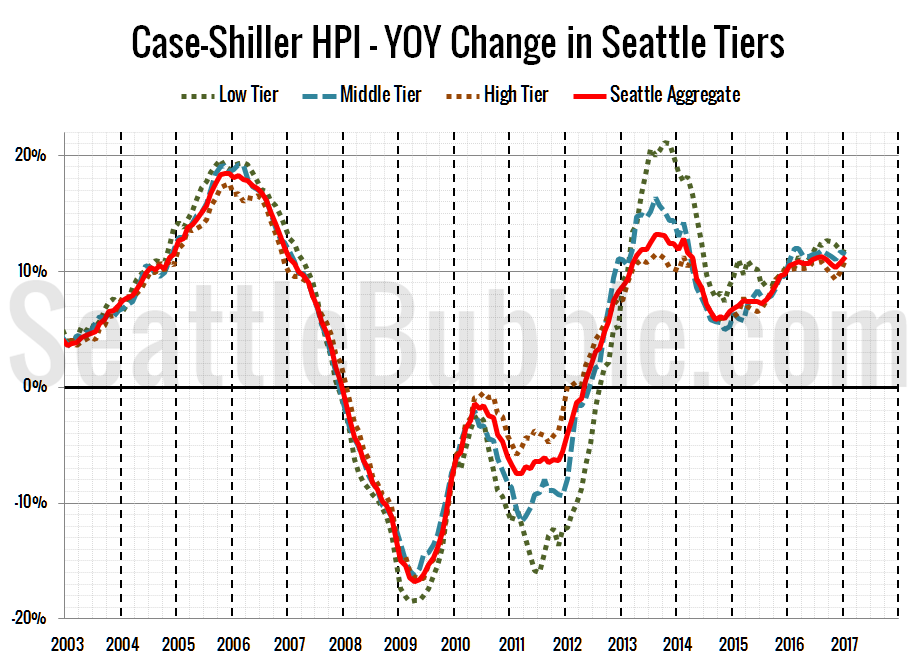

Here’s a chart of the year-over-year change in the index from January 2003 through January 2017.

Year-over-year price growth in January was strong in all three tiers, but lower in the low and middle tier than mid-year. The high tier hit its highest year-over-year price growth level since April 2014. Here’s where the tiers sit YOY as of January – Low: +11.6 percent, Med: +11.5 percent, Hi: +11.0 percent.

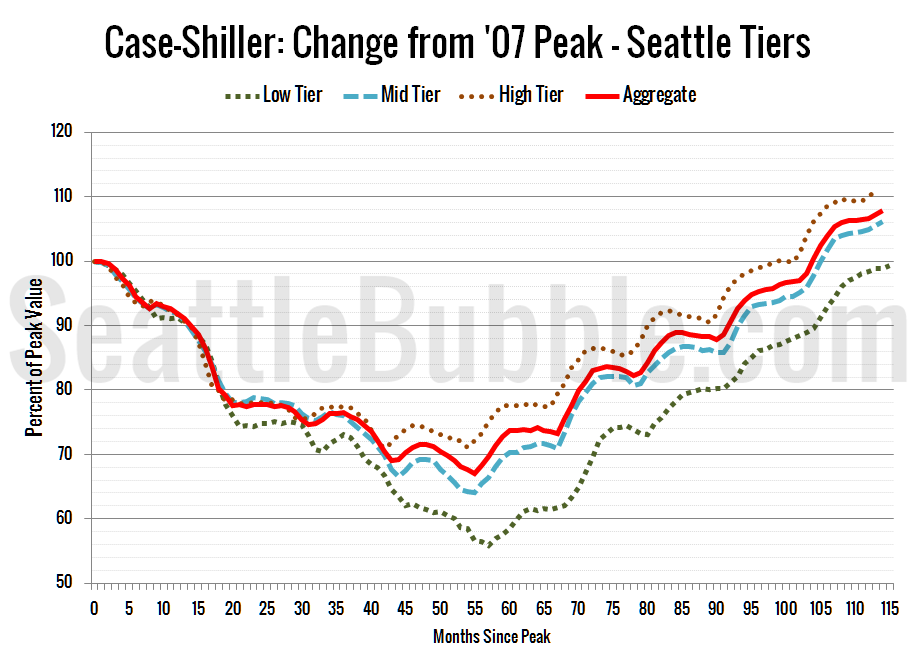

Lastly, here’s a decline-from-peak graph like the one posted earlier for the various Case-Shiller markets, but looking only at the Seattle tiers.

Current standing is 0.7 percent below peak for the low tier, 6.1 percent above the 2007 peak for the middle tier, and 10.7 percent above the 2007 peak for the high tier.

(Home Price Indices, Standard & Poor’s, 2017-03-28)