Reminder: Subscribers have access to the members-only spreadsheets folder, which is updated with the charts in this post.

As promised last week, here’s an updated look at the “affordable home” price chart.

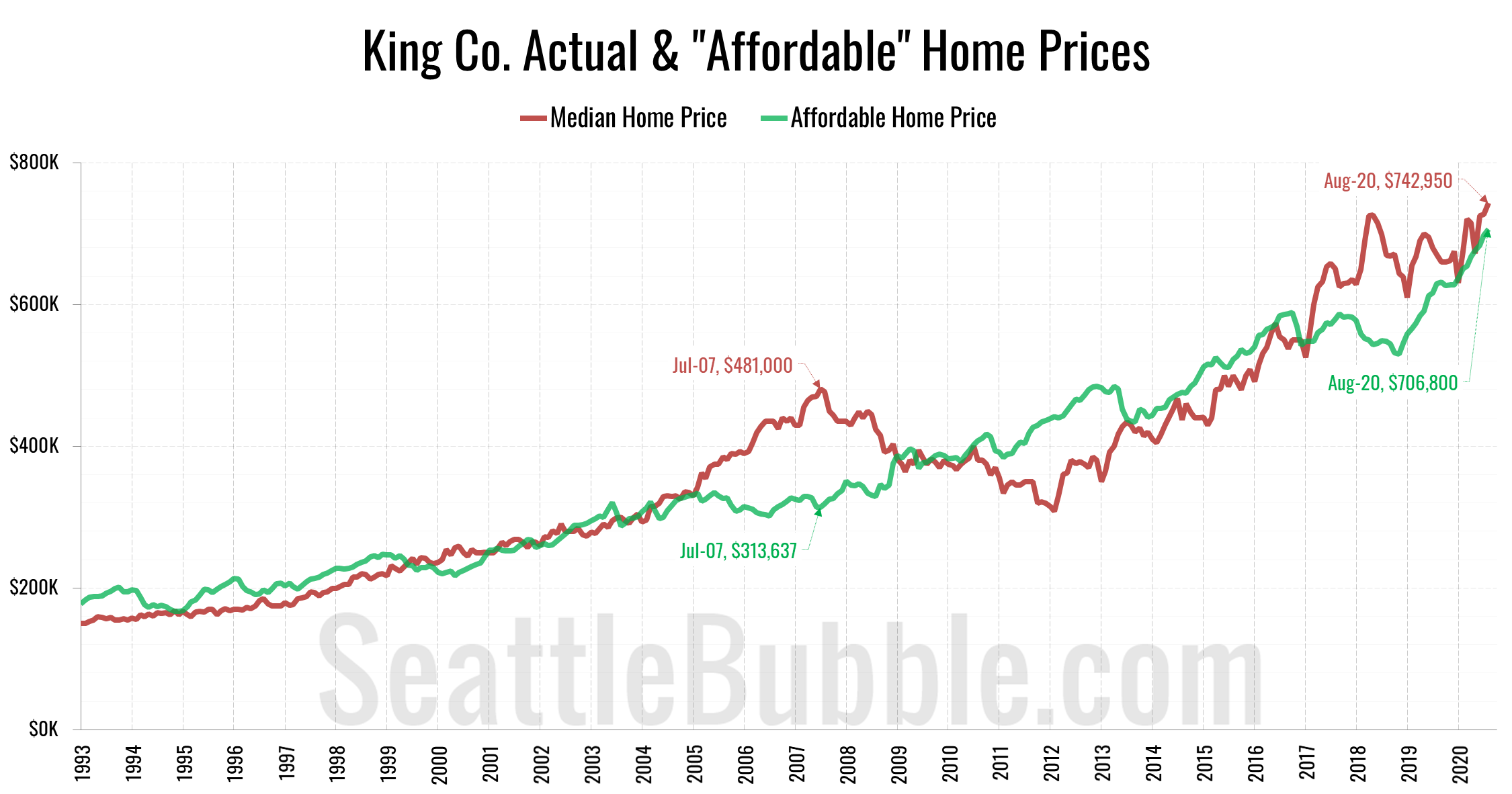

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could “afford” to buy at today’s mortgage rates, if they spent 30% of their monthly gross income on their home payment. Don’t forget that this math includes the (giant) assumption that the home buyers are putting 20% down, which would be $148,590 at today’s median price.

The “affordable” home price has shot up from $530,359 in November 2018 to an all-time high of $706,800 as of August. The current “affordable” home price in King County would have a monthly payment of $2,365.

The current gap of $36,150 between the affordable price and the median price is similar to the difference we saw between the two numbers in mid-2005.

If interest rates were at a more reasonable level of 6 percent (which is still quite low by historical standards), the “affordable” home price would be just $493,215—more than $200,000 below where it is today, and nearly $250,000 below the current median price.

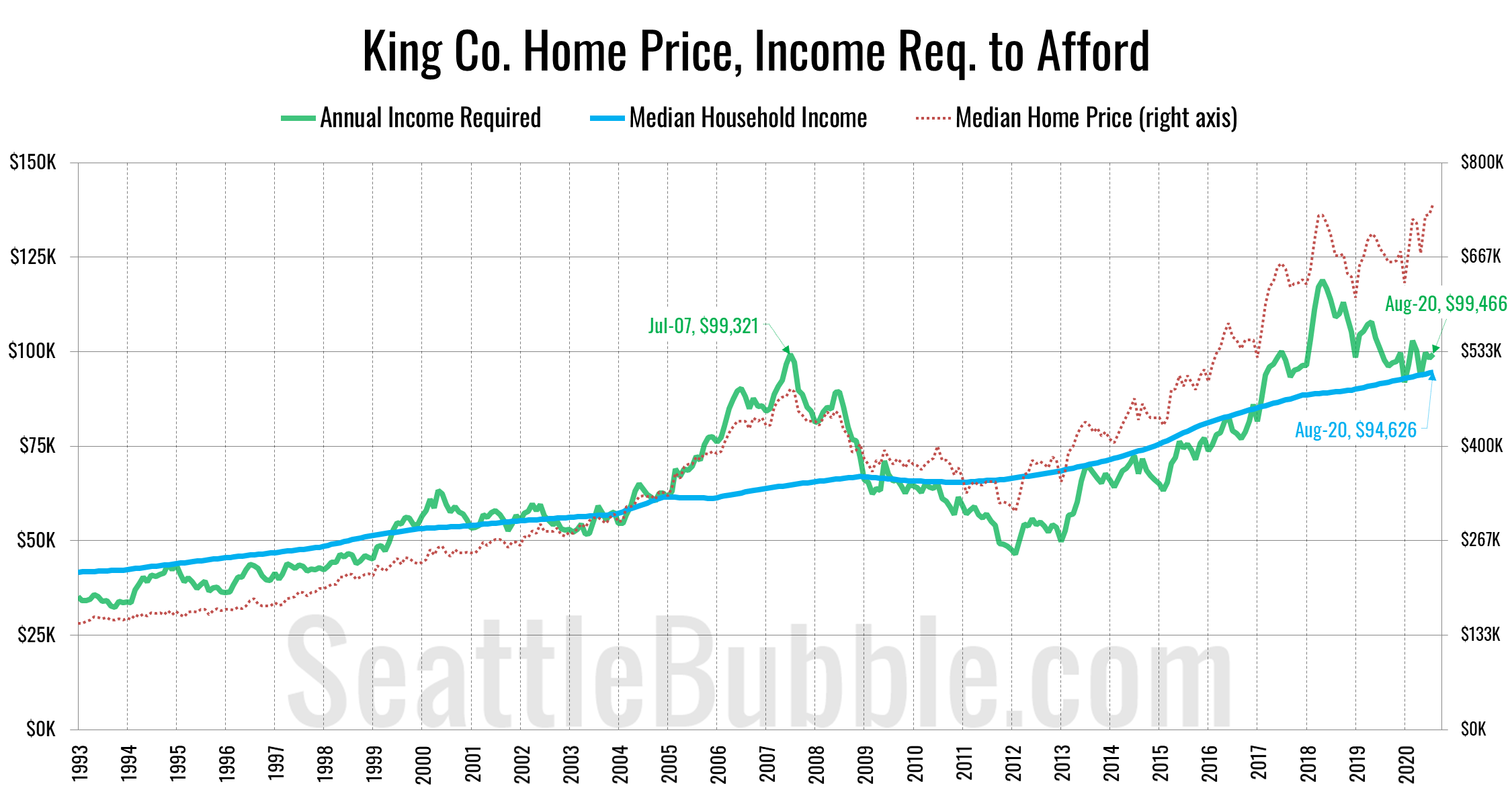

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of August, a household would need to earn $99,466 a year to be able to “afford” the median-priced $742,950 home in King County. This is up from the low of $46,450 in February 2012, but down slightly from the May 2018 high of $119,004. The previous cycle high in July 2007 was $99,321. Meanwhile, the actual median household income in King County is estimated to be about $94,500.

If interest rates were 6% (around the pre-bust level), the income necessary to buy a median-priced home would be $142,540—51 percent above the current median income.