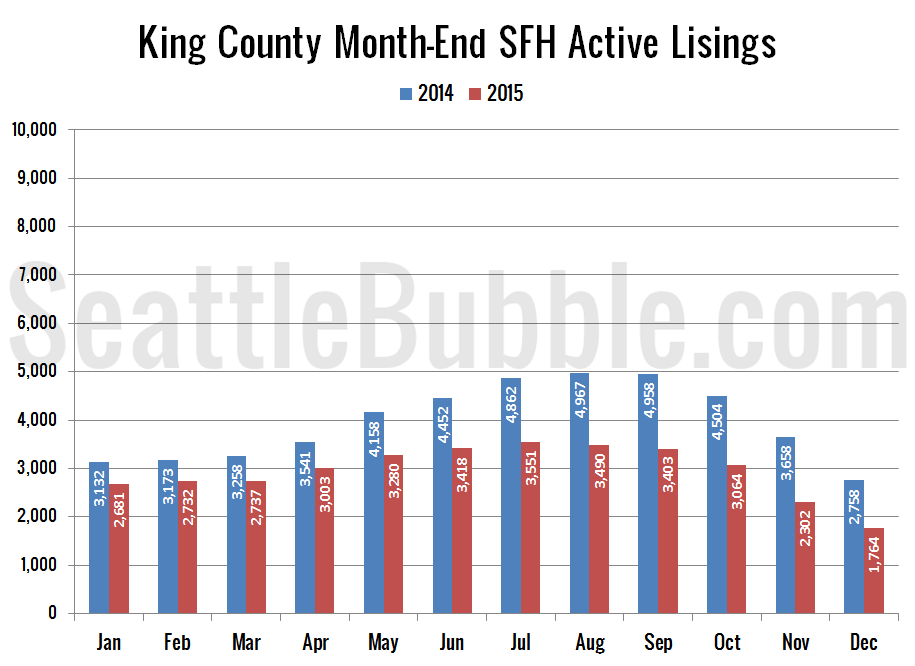

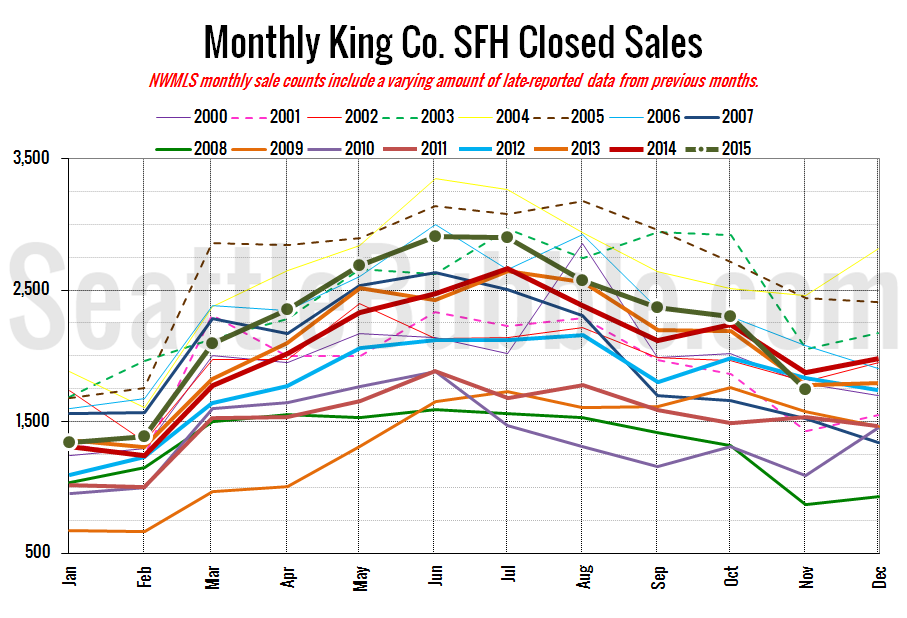

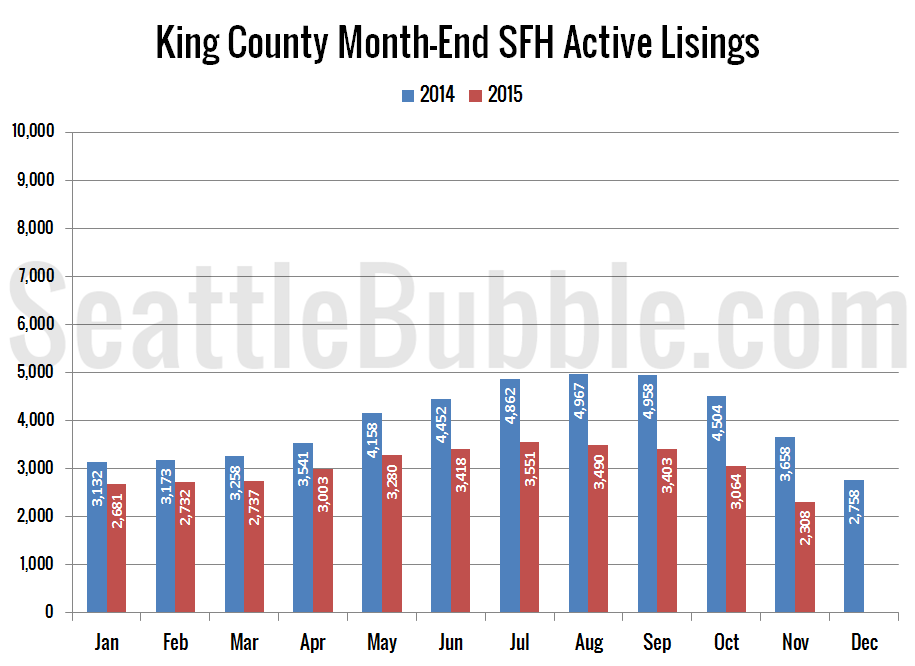

Now that the last month of 2015 is behind us, let’s have a look at our monthly stats preview. Sales actually rose in both counties month-over-month, as inventory fell to new all-time lows. Foreclosure notices are near their low points, and inched up from November in both counties.

Category: Counties

County-wide statistics.

NWMLS: Inventory Hits New All-Time Low

November market stats were published by the NWMLS on Friday. This is the first time in quite a while we’ve seen any green arrows for buyers in the summary table. However, it’s hard to get even a little bit excited, given the all-time low inventory level. At this point there are so few homes for sale that it’s going to be difficult for sales to come in very strong.

November Stats Preview: Where Did the Listings Go?

November has come and gone, so let’s have a look at our monthly stats preview. First up, here’s the snapshot of all the data as far back as my historical information goes, with the latest, high, and low values highlighted for each series:

Sales dropped significantly month-over-month, as is typical for this time of year. Inventory also fell, which is also normal for the season, but the month-over-month drop in homes for sale was the largest on record (since 2000) in both King and Snohomish Counties. Foreclosure notices in both counties were down from a month earlier…

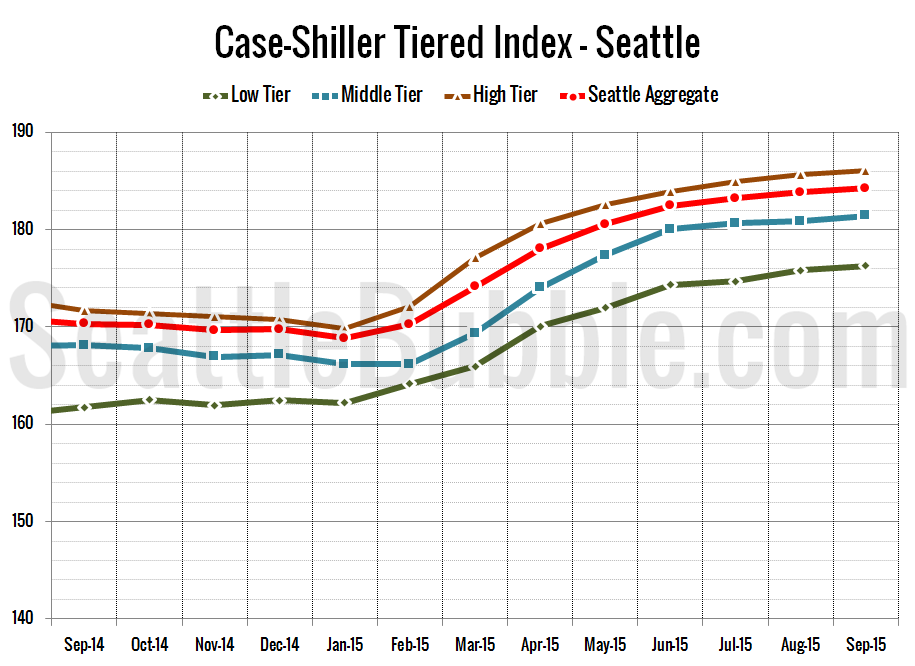

Case-Shiller Tiers: High Tier Nearly Back to Peak Pricing

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

All three tiers were up month-over-month yet again in September, however in the low and high tiers the gains were considerably smaller than a month earlier. The high tier saw the smallest gain of the group…

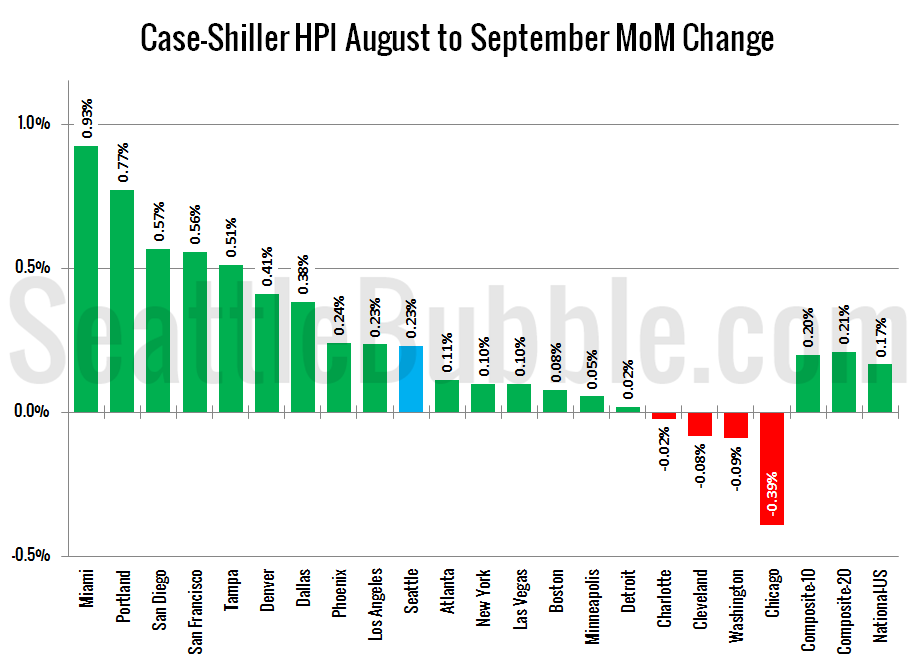

Case-Shiller: Seattle Home Prices Strong in September

Let’s have a look at the latest data from the Case-Shiller Home Price Index. According to August data that was released today, Seattle-area home prices were:

Up 0.2 percent August to September

Up 8.2 percent YOY…