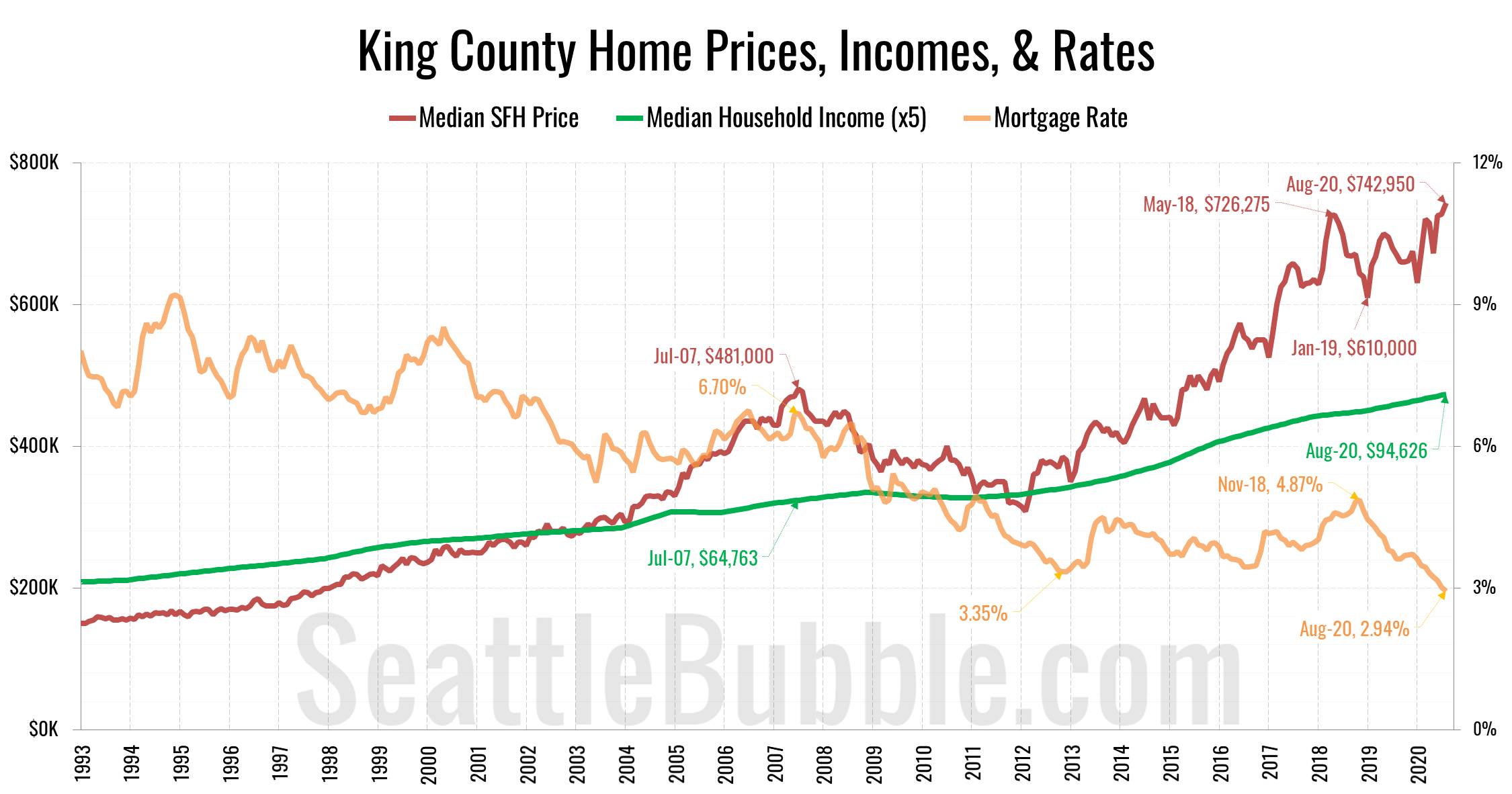

As of February, the monthly payment for the median-price single-family home sold in King County at current mortgage rates was $3,945. The good news: This is down from an eye-watering $4,758 in October. The bad news: It’s up dramatically from just a year prior, and 59% higher than what we saw at the peak of the previous housing bubble…

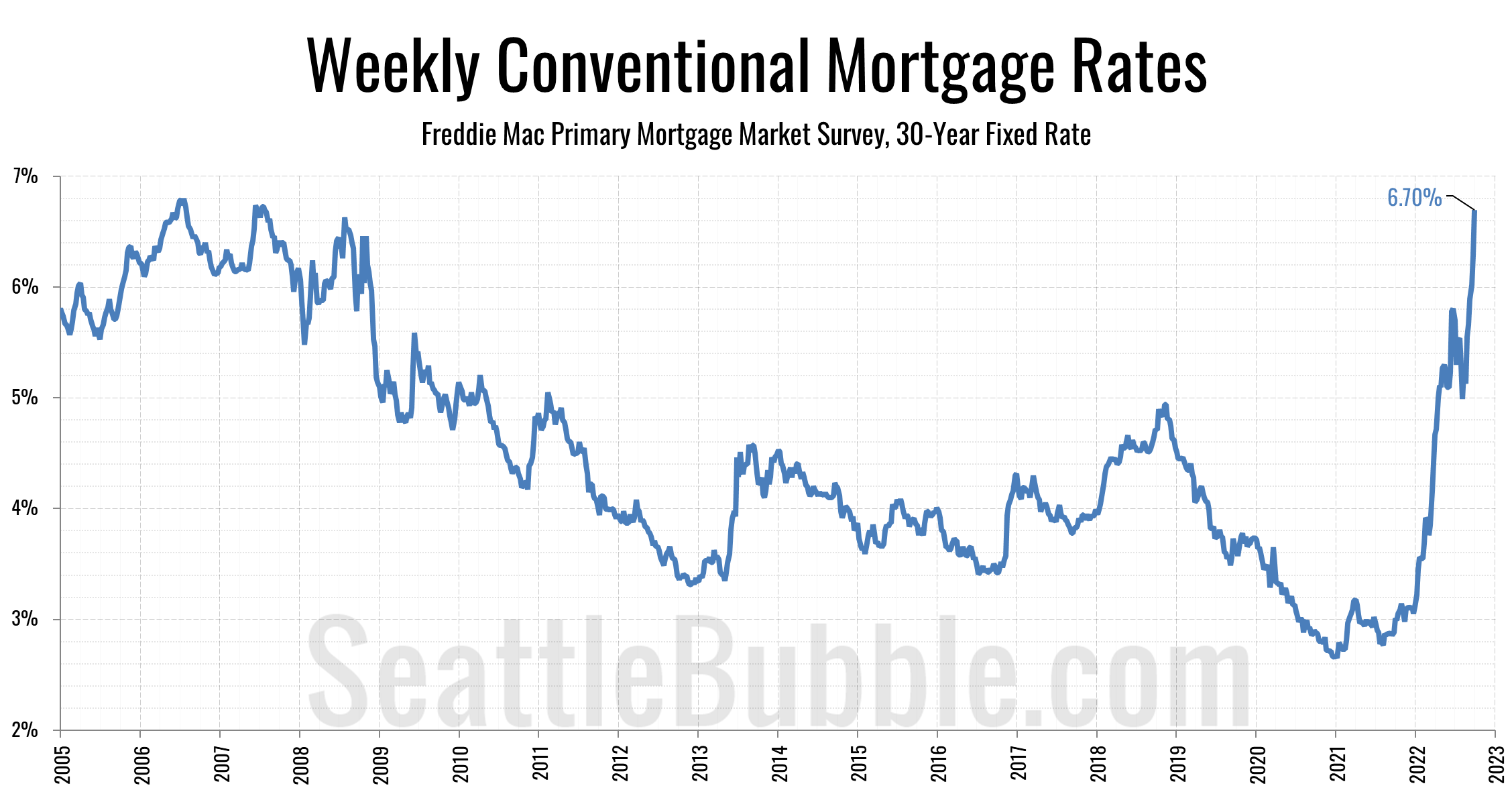

Tag: Interest Rates

Home prices are finally falling around Seattle—more than most places in the nation

Let’s check up on what’s happening with the Seattle-area housing market in early 2023, shall we?

Time for the housing market to detox from low mortgage rates

After more than a decade of rates under 5%, we’re finally going to see how a more “normal” mortgage rate will impact the housing market.

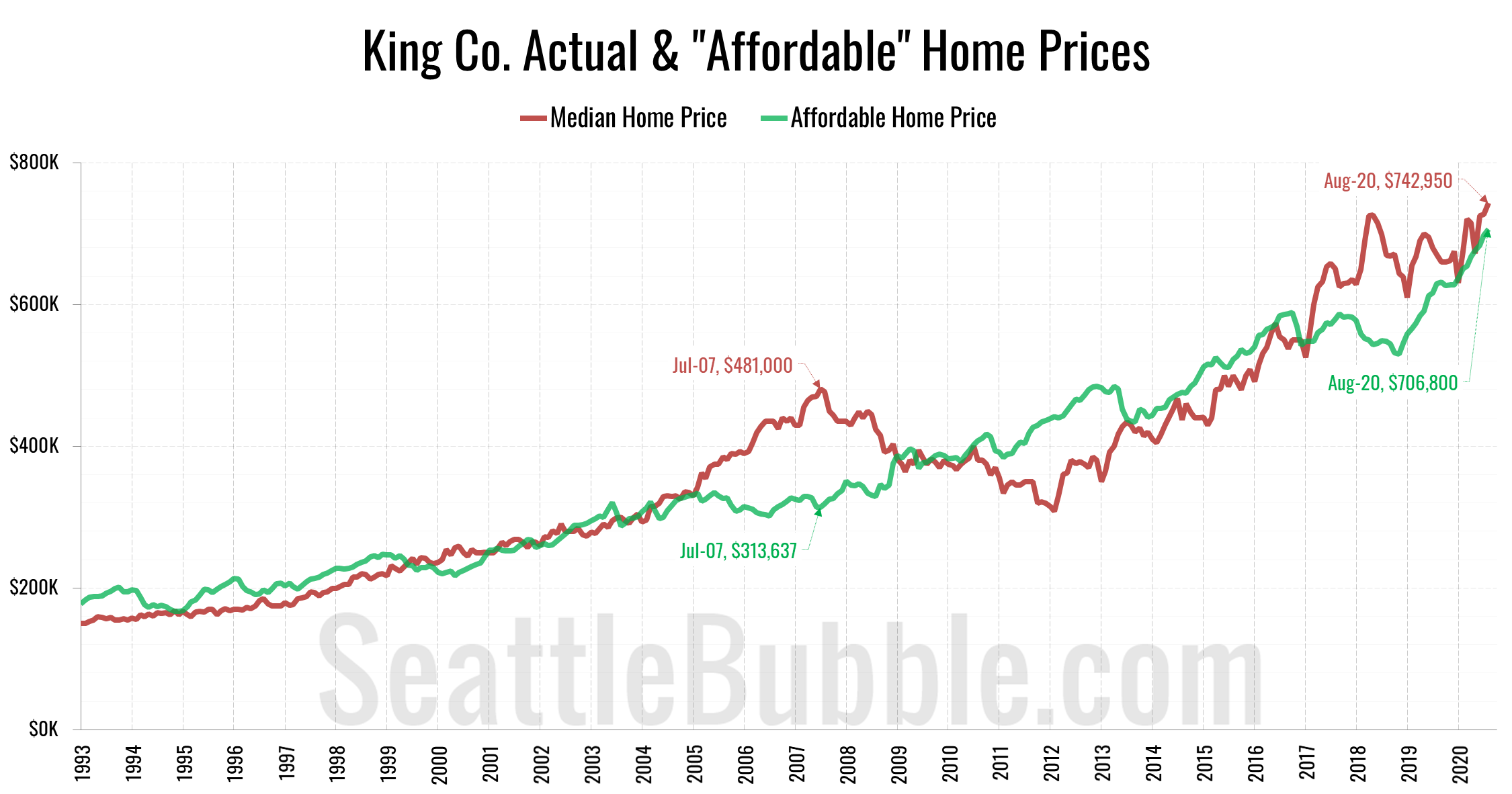

“Affordable” home price shot up 33% in less than two years

The “affordable” home price has shot up from $530,359 in November 2018 to an all-time high of $706,800 as of August. The current “affordable” home price in King County would have a monthly payment of $2,365…

Plunging mortgage rates held off a Seattle home price crash

It’s been quite a while since we’ve had a look at our affordability index charts for the counties around Puget Sound, so let’s have a look at those charts…