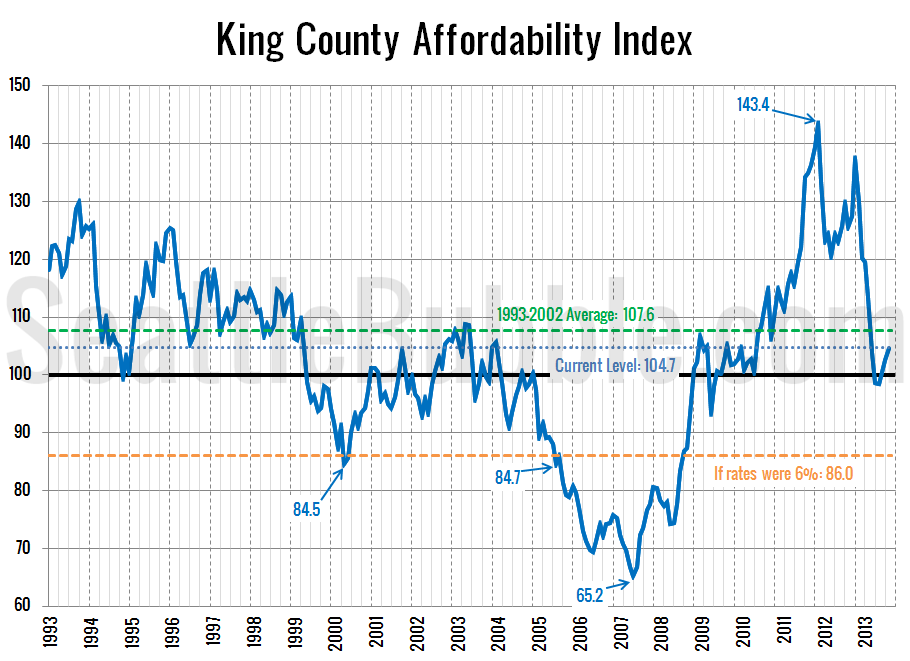

Let’s take a look at how affordability is doing in the Seattle area after the last couple months of changes in home prices and interest rates. So how does affordability look as of November? Slightly improved from July, August, and September. The index inched back up to 104.7 (i.e. the monthly payment on a median-priced…

Tag: Interest Rates

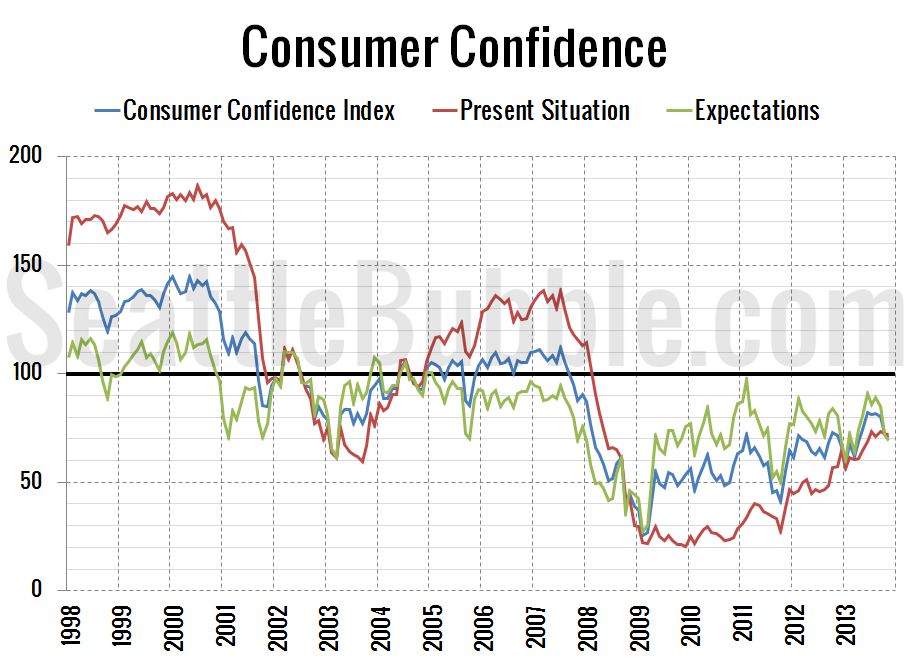

Consumer Confidence Expectations Dip as Rates Rise

Let’s check in on how Consumer Confidence and mortgage interest rates fared during November. First up, here’s the Consumer Confidence data as of November: At 72.0, the Present Situation Index decreased 0.8% between October and November, but is up 25.4% from a year earlier. The Present Situation Index is currently up 256% from its December…

“Affordable” & Median Price Line Up in September

As promised in last night’s affordability post, here’s an updated look at the “affordable home” price chart. In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could afford to buy at today’s…

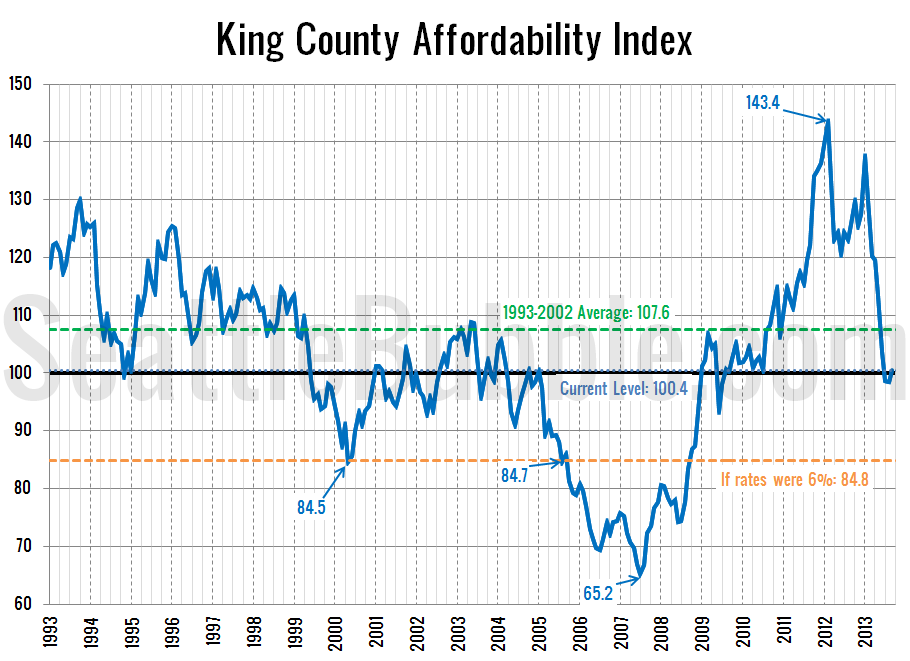

Affordability Rose Slightly in September

Let’s take a look at how affordability is doing in the Seattle area after the last couple months of changes in home prices and interest rates. So how does affordability look as of September? Slightly better. The index inched back above 100 (i.e. the median-priced home is affordable to a median-income household) thanks to the…

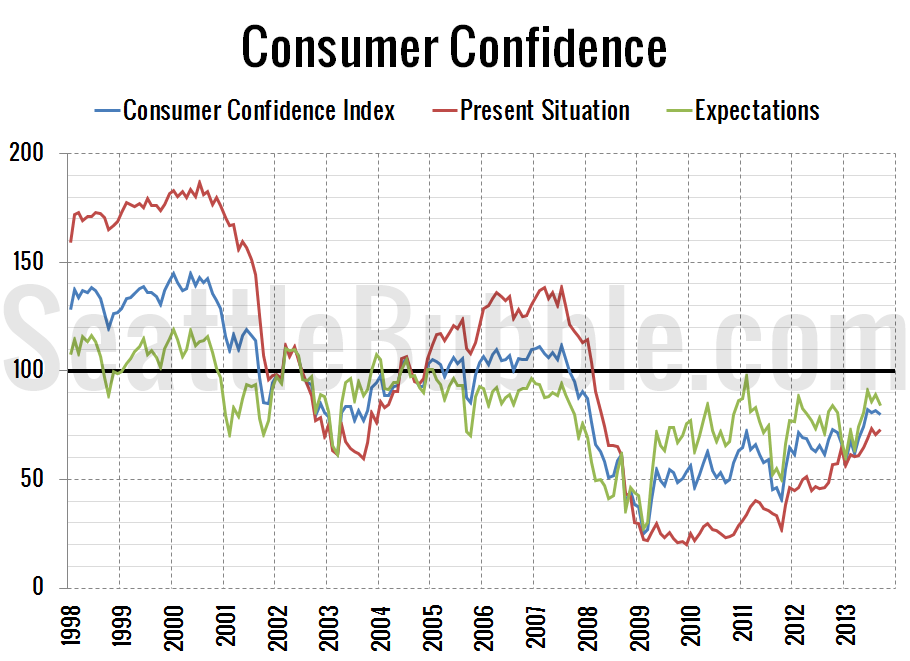

Consumer Confidence Sputters, Interest Rates Retreat

Let’s check in on how Consumer Confidence and mortgage interest rates fared during September. First up, here’s the Consumer Confidence data as of September: At 73.2, the Present Situation Index increased 3.2% between August and September, and is currently up 262% from its December 2009 low point. The Expectations Index fell slightly in August, losing…