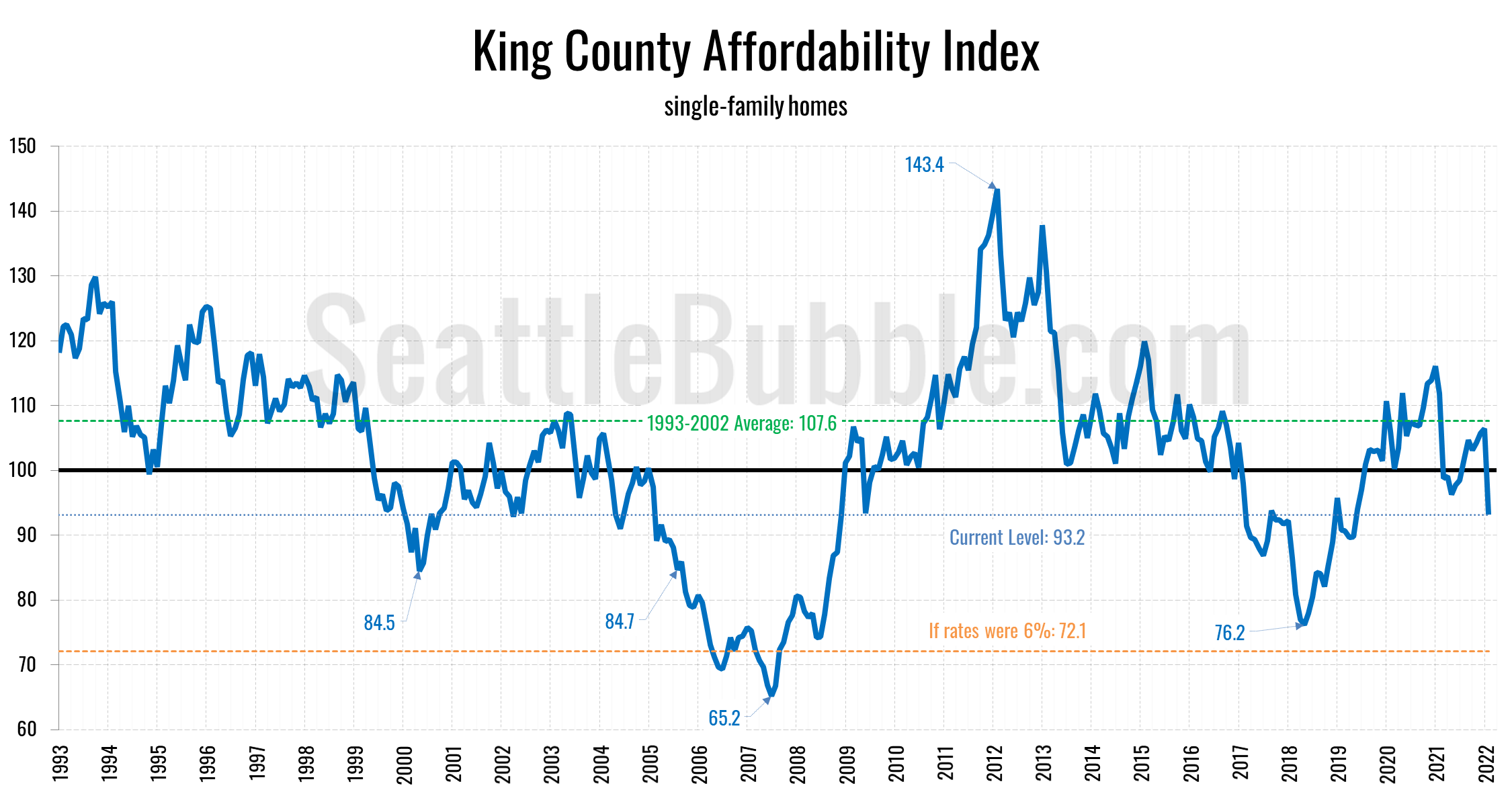

As of February, the monthly payment for the median-price single-family home sold in King County at current mortgage rates was $3,945. The good news: This is down from an eye-watering $4,758 in October. The bad news: It’s up dramatically from just a year prior, and 59% higher than what we saw at the peak of the previous housing bubble…

Home prices are finally falling around Seattle—more than most places in the nation

Let’s check up on what’s happening with the Seattle-area housing market in early 2023, shall we?

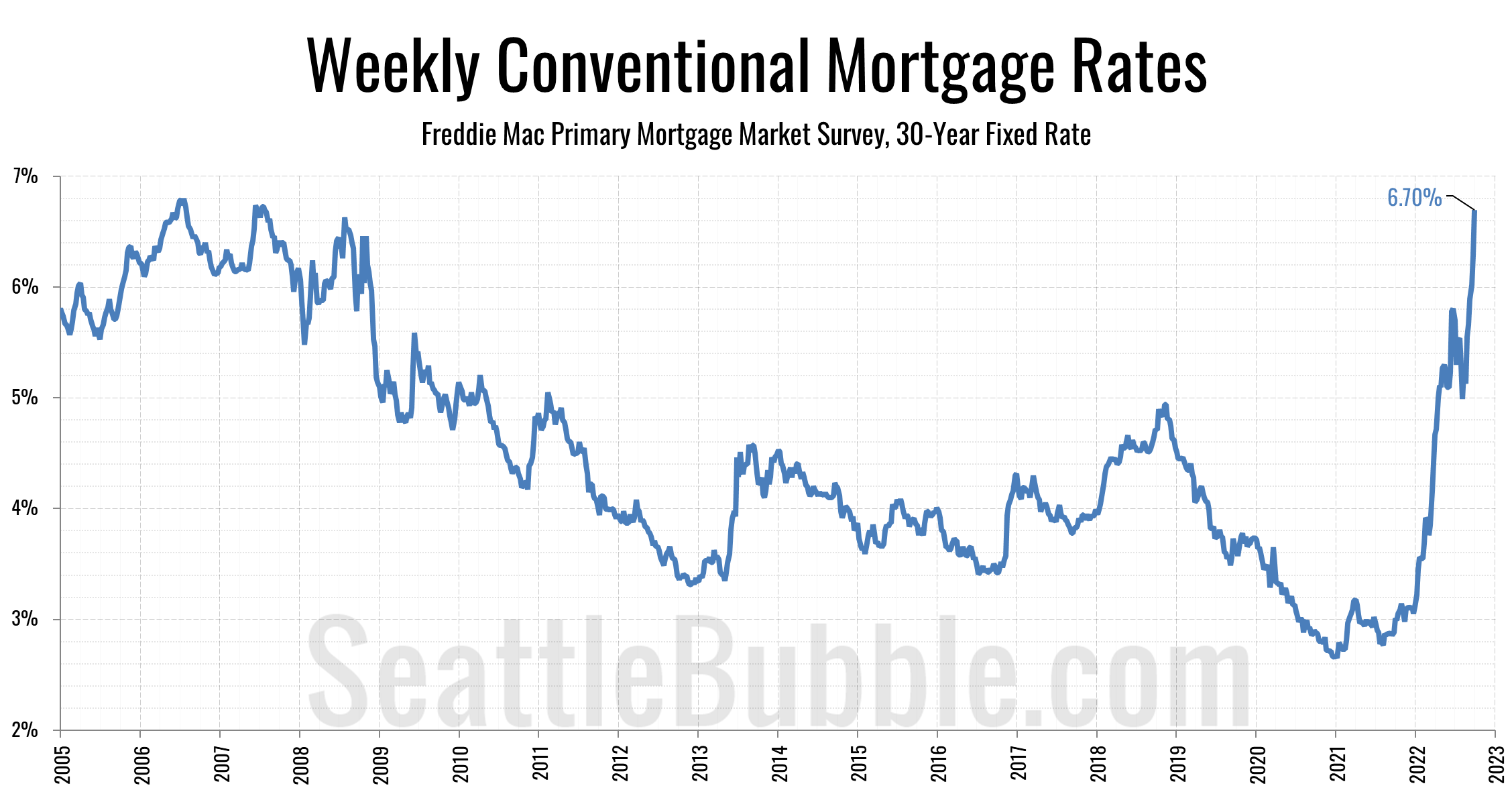

Time for the housing market to detox from low mortgage rates

After more than a decade of rates under 5%, we’re finally going to see how a more “normal” mortgage rate will impact the housing market.

So… what the heck is going on with the Seattle housing market?

Since we’ve been gone for so long, I thought I’d start back up with somewhat of an overview post. Let’s just take a look at what’s going on in the Seattle-area (King County) housing market recently.

One of the biggest topics on everybody’s mind lately is home prices, so let’s start there…

Eliminating single-family zoning is a good idea, and Christopher Kirk’s Seattle Times editorial is a steaming pile of garbage

An editorial by Christopher Kirk in the Seattle Times yesterday was so stupid I had no choice but to finally come back here and respond.

Here’s the link: Statewide rezoning of single-family neighborhoods is a terrible idea

Now, before we start it’s worth noting that this piece is described as a “Special to The Times” and the author is not a journalist. He’s not an economist, either. He’s also not an urban planner, and as you’ll see he’s obviously not a historian. He’s an architect whose primary accomplishments listed on his bio attached to the piece are having “served on public historic preservation and design review boards.”

So with that context, let’s get into it…