Those of you that have been following King County inventory may have noticed something a little odd about June’s official end-of-month inventory count from the NWMLS. While the number of listings appearing on local home search sites seemed to indicate that June’s inventory would be a few hundred higher than May, the NWMLS statistics for the month showed a drop of nearly 500.

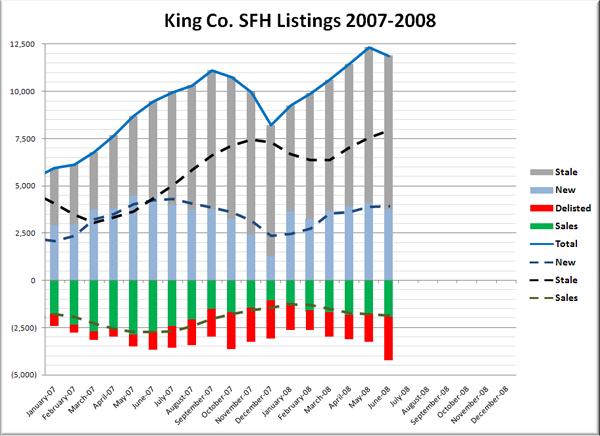

In order to satisfy my curiosity on this, I went back to the listings chart we have used in a couple previous posts, and there was definitely something unusual about June:

The number of new listings (light blue) declined slightly from May to June, just as it did last year. The number of sales (green) increased slightly, which was opposite the move from last year. But the interesting thing is the number of homes that were simply pulled off the market with no sale (red): 2,262 in June vs. 1,459 in May—a 55% increase.

I’m not alleging that this implies any sort of funny business. I just find it interesting that so many people would suddenly give up all at once like that. With 2,262 homes delisted and only 1,965 sales, last month marks the first time on record (back to 2000) that there have been more delistings than sales in a spring or summer month.

Does this signal a shift in the mentality of home sellers in King County? Are the “voluntary sellers” pulling their homes off the market, leaving only those that “must” sell? I think these are interesting questions to consider. We should keep an eye on the inventory and sales statistics in the coming months to shed more light on this matter.