It’s time once again for an update on the Case-Shiller Home Price Index. According to August data, home prices in and around Seattle continue to decline at a steady pace.

Down 0.7% July to August.

Down 8.8% YOY.

Last year prices fell 0.10% from July to August (their first month-to-month drop), and year-over-year prices were up 5.7%.

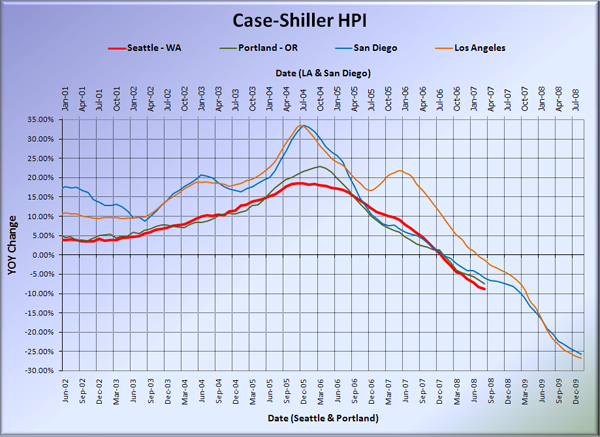

Here’s the usual graph, with L.A. & San Diego offset from Seattle & Portland by 17 months. Portland extends its streak of outperforming Seattle to nine months, falling 7.6% YOY in August.

Note: This graph is not intended to be predictive. It is for entertainment purposes only.

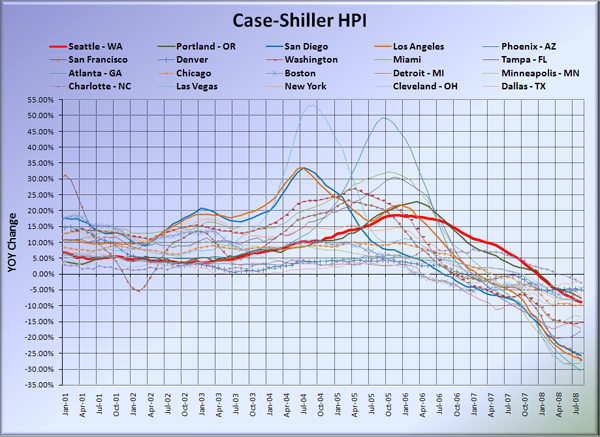

Here’s the graph of all twenty Case-Shiller-tracked cities:

In August, eight of the twenty Case-Shiller-tracked cities experienced smaller year-over-year drops than Seattle (vs. seven in July and six in June). Dallas at -2.7%, Charlotte at -2.8%, Boston at -4.7%, Denver at -5.1%, New York at -6.5%, Cleveland at -6.6, Portland at -7.6%, and Atlanta at -8.5%. Phoenix just barely edged out Las Vegas for the largest year-over-year drop, with prices in both those cities falling over 30% in a single year. There does appear to be something of a “bottom” in price decline intensity reached in Miami, with year-to-year drops having flattened at -28% for four months in a row now.

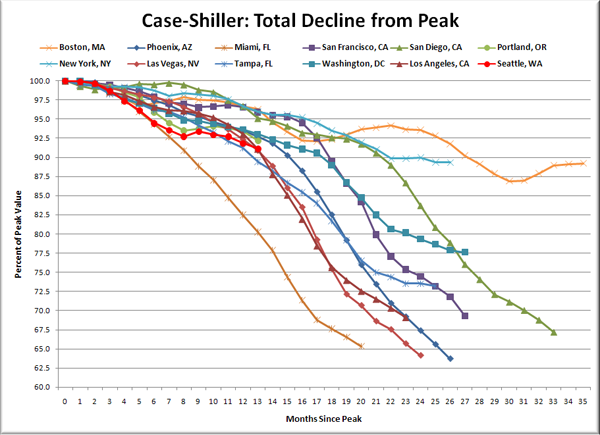

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve cities whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the thirteen months since the price peak in Seattle prices have declined approximately 9%. The two cities with the most similar degree of price drops thirteen months after their respective peaks were Los Angeles and Las Vegas.

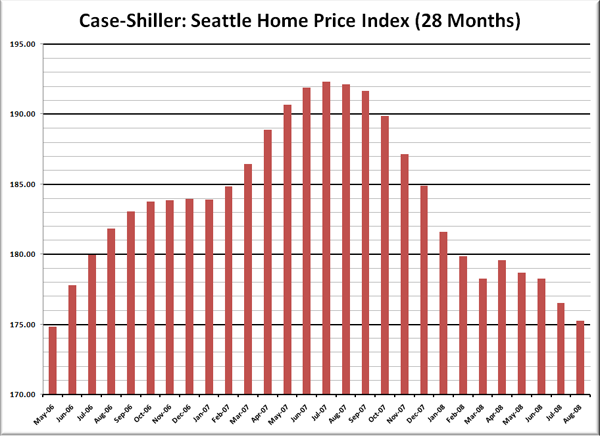

Here’s the “rewind” chart. The horizontal range is selected to go back just far enough to find the last time that Seattle’s HPI was as low as it is now. This gives us a clean visual of just how far back prices have retreated in terms of months.

Seattle’s Case-Shiller value for August 2008 was fairly close to its May 2006 values. So now prices have “rewound” twenty-seven months. For comparison, the latest Case-Shiller data for San Diego shows a rewind of over five years. Ouch.

Check back tomorrow for a post on the Case-Shiller data for Seattle’s price tiers.

(Home Price Indices, Standard & Poor’s, 10.28.2008)