A reader emailed me recently to remind me of this amusing document published by the National Association of Realtors in 2006: Home Price Analysis for Seattle-Tacoma-Bellevue (pdf).

Quoting:

With home prices rising strongly in most parts of the country, there has been widespread media coverage on the possibility of a housing market bust. A thorough analysis of the Seattle-Tacoma-Bellevue metro market, as detailed below, reveals that there is little danger of this. In fact, the local housing market is in excellent shape with a potential for significant housing equity gains, particularly for homebuyers who plan to remain in their house for the long run.

The amusing part about this is that by the time this was published in July 2006, home prices had peaked across much of the country, and were by no means “rising strongly” any more. But the NAR was never one to let facts get in the way of good propoganda.

Housing equity will most likely continue to accumulate to local homeowners. The equity gains under three price growth scenarios are presented below. One scenario assumes a historical conservative price appreciation of 1.5% above consumer price index inflation. With most credible inflation forecasts pegged at 2.5%, home prices can expect to rise by 4% per year under normal circumstances. The two other scenarios assume slightly below (1.5%) and slightly above (6.5%) the normal rate of appreciation.

Heh, I love how the doomsday scenario in their “analysis” is a 1.5% rate of price appreciation. Oops.

I also especially enjoyed the obligitory Seattle is Special addition near the end:

Many non-quantifiable factors could be important for this metro market in determining home prices. Access to cultural life, the quality of museums, nearby local and national parks, water views, exclusive neighborhoods, weather, the international airport, city vibrancy, restaurants, and a host of other non-quantifiable factors could have an important influence on the overall pricing.

“Non-quantifiable factors.” Classic! Here’s what I had to say about their malarkey at the time:

All in all, what we have here is another disappointing showing from the NAR. If they’re going to have any chance of convincing a thinking person of a strong, resilient Seattle housing market, they’re going to have to come up with something more than this steaming pile of tired catchphrases and misleading statistics.

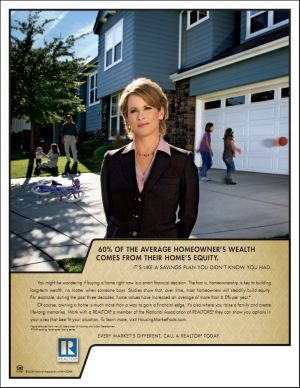

As it became obvious to everyone that home prices were falling like a rock, the NAR did try to come up with more, lobbing up a Hail Mary pass in 2008 with a “Building Wealth” campaign that desperately tried to convince people that “every market’s different,” and somehow your market would be special and immune.

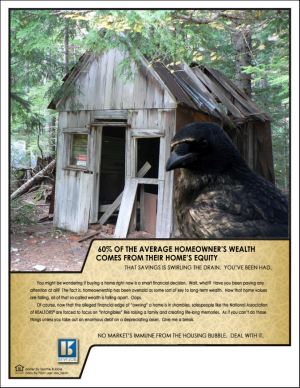

This of course prompted me to produce my own parody version.

So how’s that “savings plan” working out for all the people who bought this BS from the NAR in 2006 and 2008?