Six months after home prices in the Seattle area began declining from their July 2007 peak, the annual report from the NWMLS led to a series of amusingly rosy stories in the local press in early 2008. Here’s a typical example from the Seattle Times:

’07 home prices not so bad after all

With all the dismal national news about home sales, wasn’t 2007 supposed to be the year the local real-estate market died?

Well, surprise. Although home sales indeed were down 14.5 percent in King County and the number of for-sale homes was up almost 9 percent, prices more than held their own.

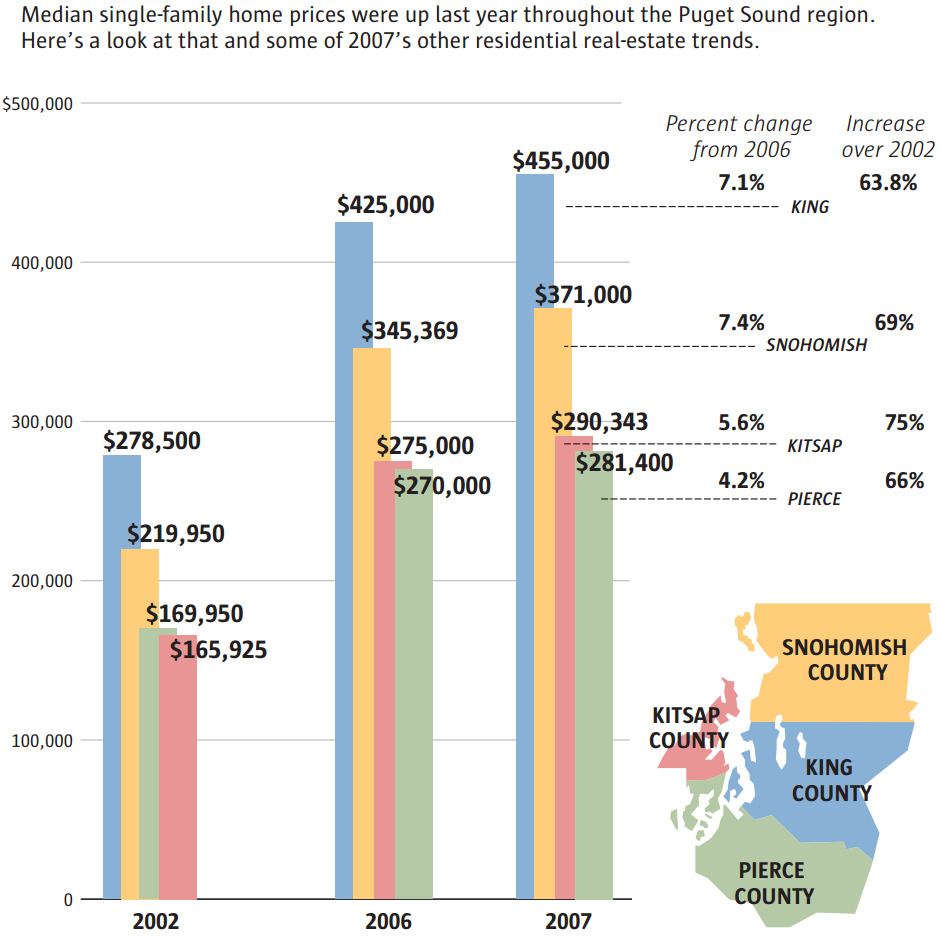

Compared with 2006, the county’s single-family home prices climbed 7.1 percent last year, according to the Northwest Multiple Listing Service’s annual report released Tuesday.

Surprise. Prices continued to fall unabated for the next four years.

Except it wasn’t a surprise if you actually bothered to look at the 2007 data with a critical eye, as I pointed out in my post at the time:

Anyone who has actually been paying attention to the market knows that something is fishy about that 7.1% figure. To figure out what’s behind that number, take a look at page 19 of the report. Basically, they arrive at that figure by comparing the median price for all sales in 2007 with the same figure for 2006. In a market that is consistently and steadily headed in a single direction, that kind of comparison would make sense. However, in today’s volatile market, such a statistic is totally meaningless.

Thankfully today’s real estate reporting Seattle Times is a thousand times better than the cheerleading, PR-rehashing junk that they published during the bubble, but it’s a good reminder to take everything you read (including posts here on Seattle Bubble) with a grain of salt. Look at the data yourself and draw your own conclusions.