Happy New Year everyone!

Yes, it’s late (vacation), but I wanted to post these charts anyway. I’ll post again later today with the monthly stats preview for December data.

Let’s have a look at the latest data from the Case-Shiller Home Price Index. According to July data that was released this morning, Seattle-area home prices were:

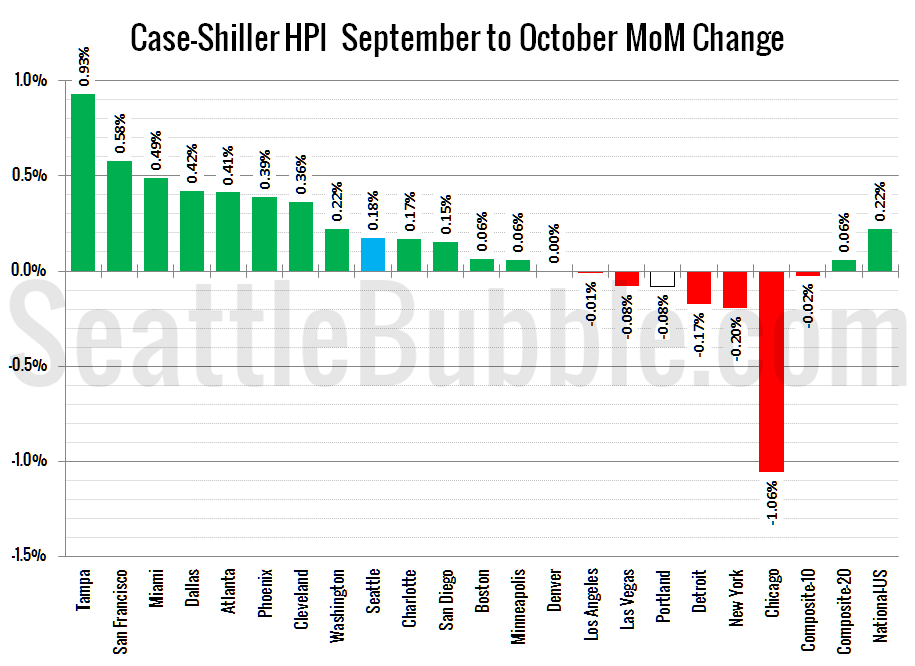

Up 0.2 percent September to October

Up 10.7 percent YOY.

Up 6.6 percent from the July 2007 peak

Over the same period last year prices were up 0.5 percent month-over-month and year-over-year prices were up 8.8 percent.

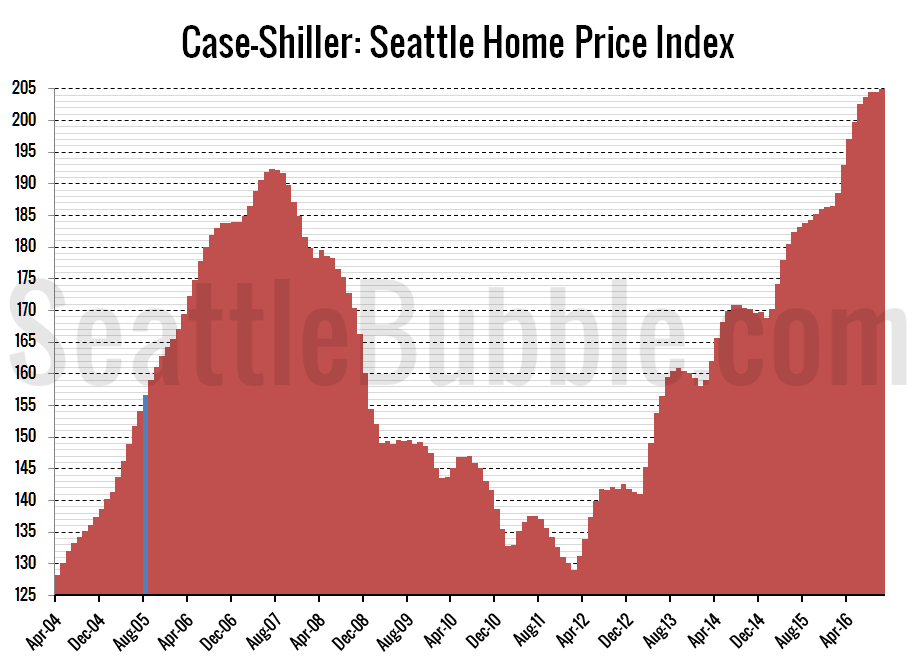

Seattle home prices as measured by Case-Shiller inched up to another new all-time high in October.

Here’s a Tableau Public interactive graph of the year-over-year change for all twenty Case-Shiller-tracked cities. Check and un-check the boxes on the right to modify which cities are showing:

After dropping to #17 in September, Seattle’s rank for month-over-month changes moved up to #9 of 20 in October.

Hit the jump for the rest of our monthly Case-Shiller charts, including the interactive chart of raw index data for all 20 metro areas.

Despite underperforming in October compared about half the other cities and the same period a year prior, Seattle’s year-over-year price growth was once again the largest in the nation. In October, none of the twenty Case-Shiller-tracked metro areas gained more year-over-year than Seattle. From February through August Portland had been in the #1 slot above Seattle.

Still more proof that the Northwest will never stop being literally the envy of other states.

Six cities hit new all-time highs again in October: Boston, Seattle, Charlotte, Denver, San Francisco, and Dallas.

Here’s the interactive chart of the raw HPI for all twenty metro areas through October.

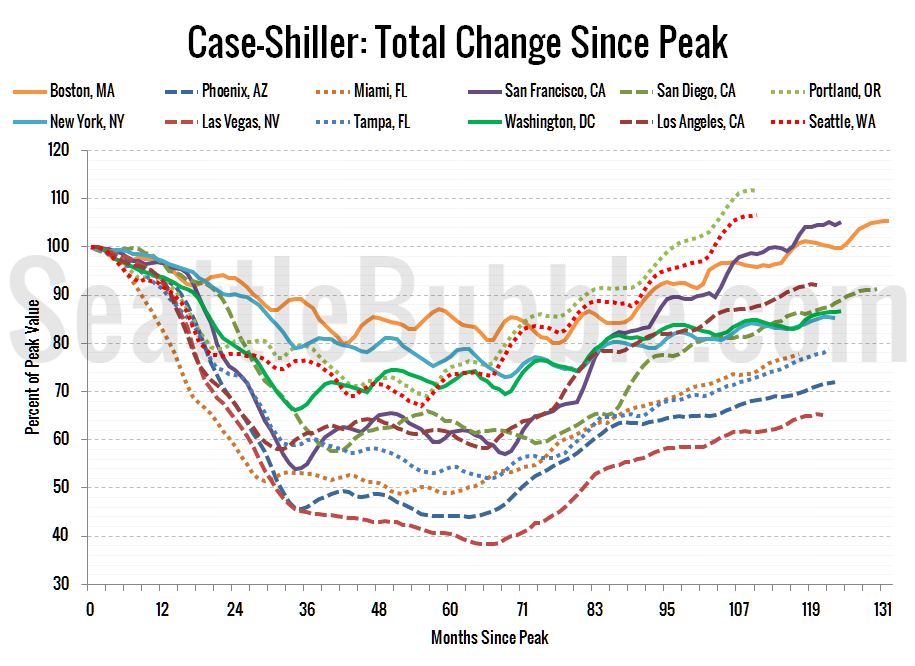

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve metro areas whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the 111 months since the price peak in Seattle prices are up 6.6 percent.

Lastly, let’s see how Seattle’s current prices compare to the previous bubble inflation and subsequent burst. Note that this chart does not adjust for inflation.

(Home Price Indices, Standard & Poor’s, 2016-12-27)