Remember, you can always get access to the Seattle Bubble spreadsheets by supporting my ongoing work as a member of Seattle Bubble.

Now that October is behind us, let’s have a look at all of our early indicators for the month.

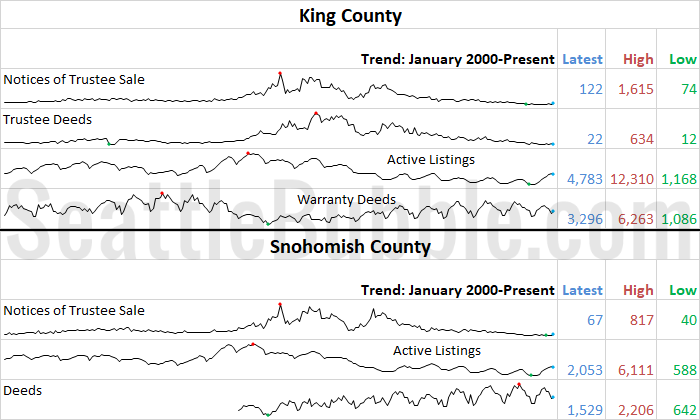

Home sales volume was down considerably from a year ago in both King and Snohomish County last month, dipping over 16 percent in both counties. Meanwhile, the number of homes on the market began the usual seasonal declines, but were still up 83 percent in King County and 63 percent in Snohomish. Foreclosures are still very rare, although the number of notices did tick up a bit month-over-month.

Here’s the snapshot of all the data as far back as my historical information goes, with the latest, high, and low values highlighted for each series:

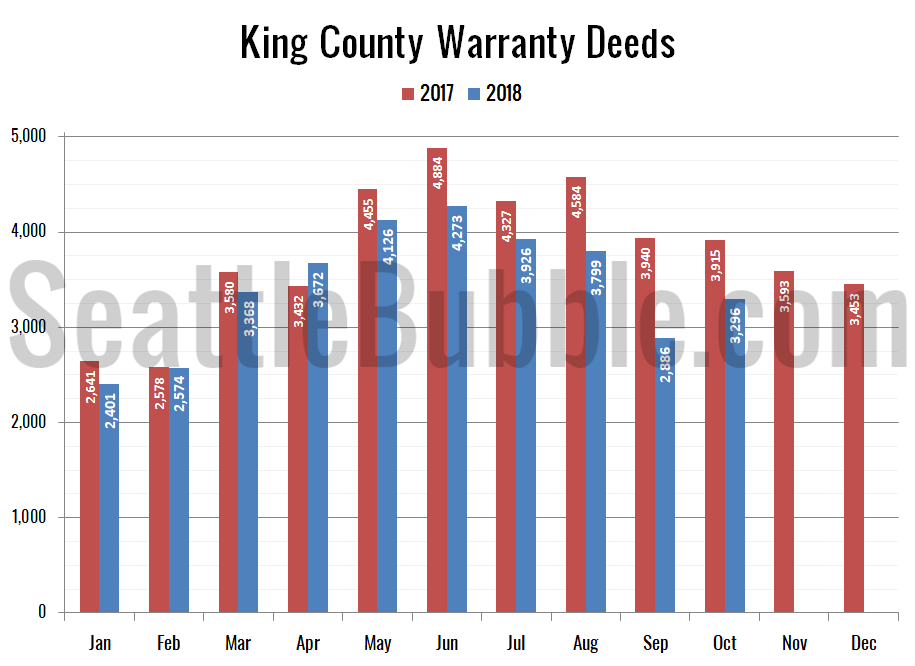

Rapidly increasing inventory coupled with continued year-over-year drops in sales is still the biggest news in this month’s data. First up, let’s look at total home sales as measured by the number of “Warranty Deeds” filed with King County:

Sales in King County rose 14 percent between September and October (a year ago they were basically flat over the same period), but were still down 16 percent year-over-year.

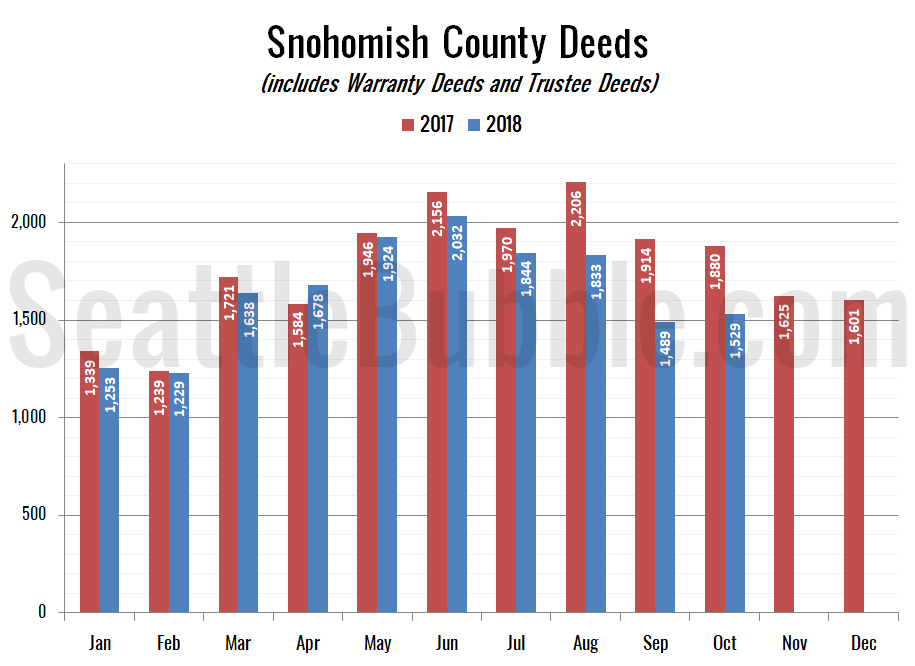

Here’s a look at Snohomish County Deeds, but keep in mind that Snohomish County files Warranty Deeds (regular sales) and Trustee Deeds (bank foreclosure repossessions) together under the category of “Deeds (except QCDS),” so this chart is not as good a measure of plain vanilla sales as the Warranty Deed only data we have in King County.

Deeds in Snohomish inched up three percent month-over-month (versus a 2 percent decline in the same period last year) but were still down 19 percent from a year earlier.

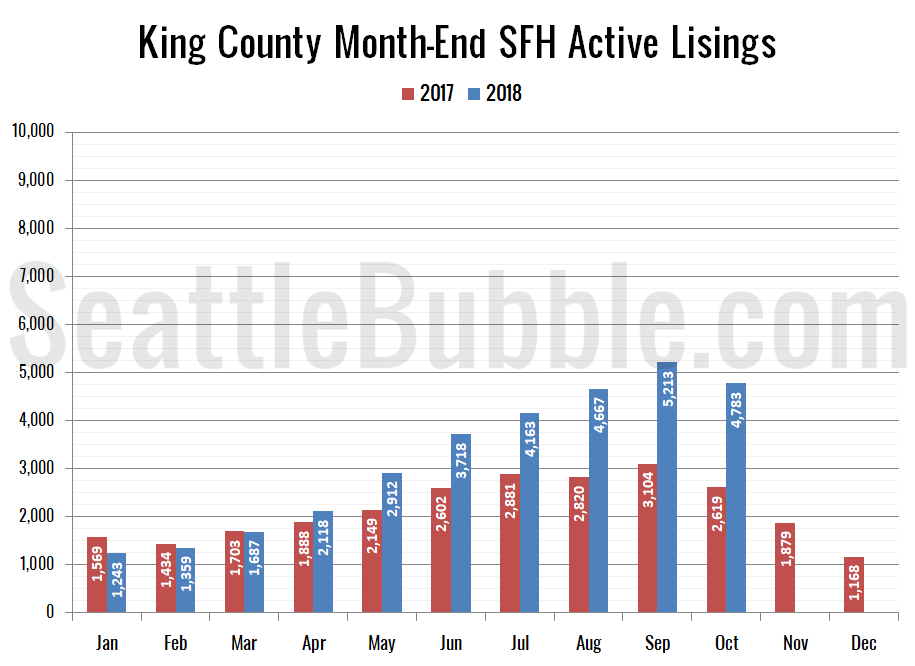

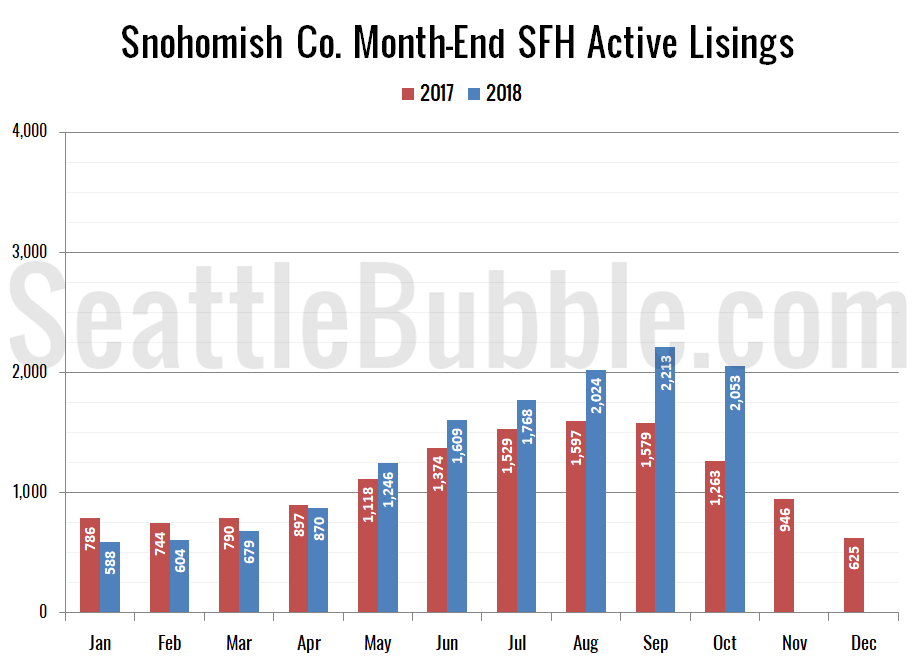

Next, let’s look at our inventory charts, updated with previous month’s inventory data from the NWMLS.

The number of homes on the market in King County fell eight percent from September to October. Year-over-year listings were up a whopping 83 percent from October 2017, which is easily a new all-time high year-over-year gain, crushing the record of 68 percent that was set just one month prior in September.

In Snohomish County inventory fell month-over-month seven percent, but the year-over-year growth also hit a new all-time record at 63 percent.

Hit the jump for the foreclosure charts.

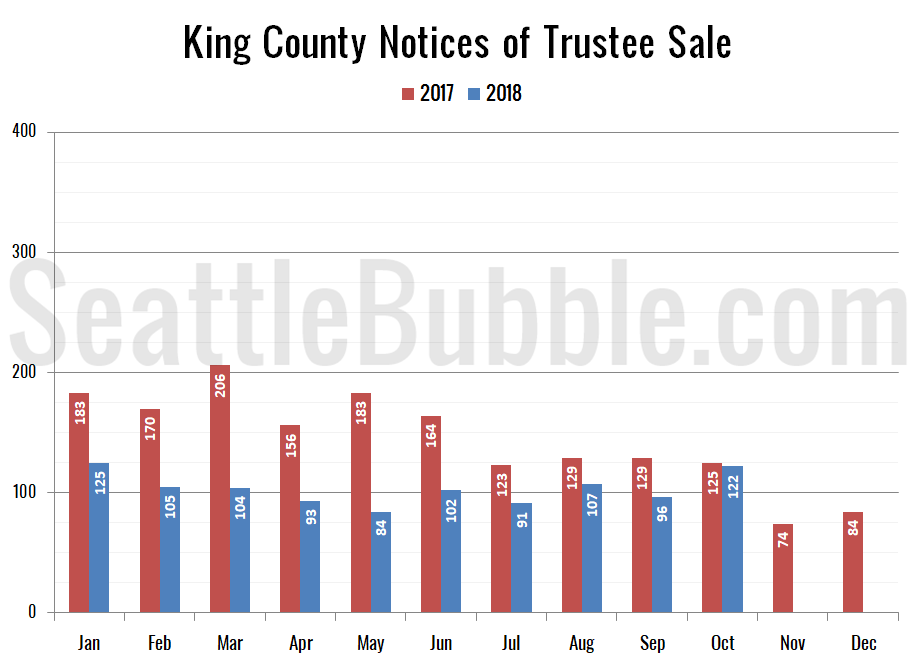

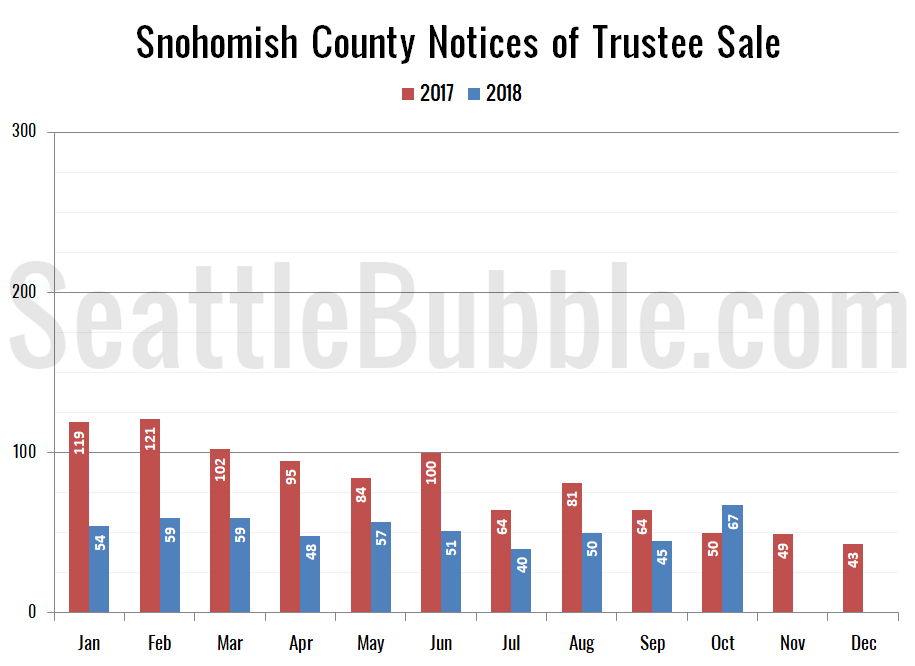

Next, here’s Notices of Trustee Sale, which are an indication of the number of homes currently in the foreclosure process:

Foreclosure notices in King County were down 2 percent from a year ago but Snohomish County foreclosure notices were up 34 percent from last year. I wouldn’t read much into that increase though, since we’re talking about a jump from 50 notices last year to 67 this year.

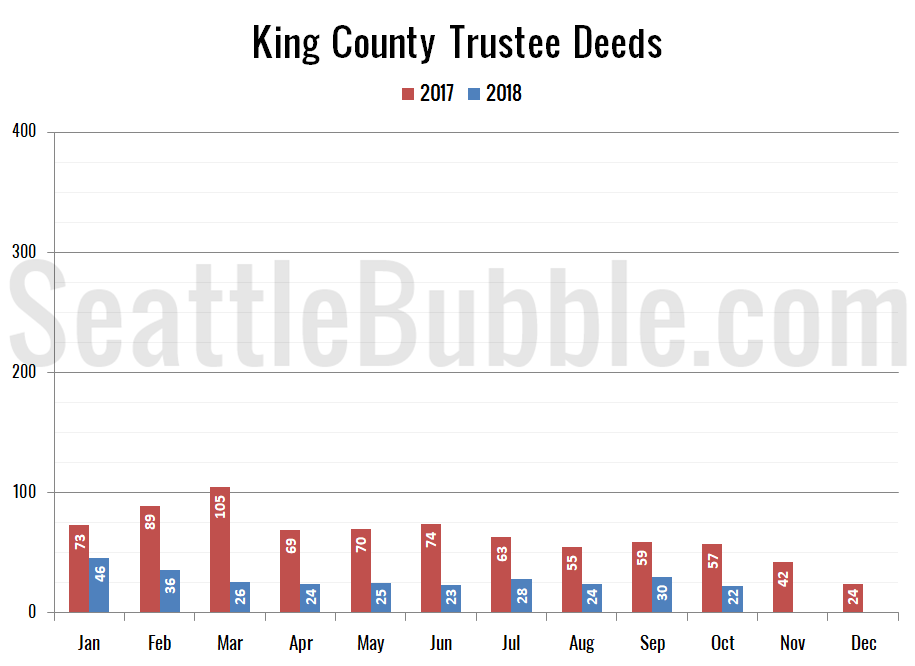

Here’s another measure of foreclosures for King County, looking at Trustee Deeds, which is the type of document filed with the county when the bank actually repossesses a house through the trustee auction process. Note that there are other ways for the bank to repossess a house that result in different documents being filed, such as when a borrower “turns in the keys” and files a “Deed in Lieu of Foreclosure.”

Trustee Deeds were down 61 percent from a year ago, to the lowest level since October 2003.

Note that most of the charts above are based on broad county-wide data that is available through a simple search of King County and Snohomish County public records. If you have additional stats you’d like to see in the preview, drop a line in the comments and I’ll see what I can do.

Stay tuned later this month a for more detailed look at each of these metrics as the “official” data is released from various sources.