Get access to the full spreadsheets used to make the charts in this and other posts, as well as a variety of additional insider benefits by becoming a member of Seattle Bubble.

The NWMLS published their March stats today, so let’s take a look at how the month shook out for the housing market. The King County median price of single-family homes was down year-over-year in March, falling more than it has since March of 2012. Inventory was up from a year ago again, but the increase was the smallest in the last five months. Pending sales recovered from the February snow storm dip, but were only up five percent.

The NWMLS press release hasn’t been published yet, so let’s get right to the numbers.

NWMLS monthly reports include an undisclosed and varying number of

sales from previous months in their pending and closed sales statistics.

Here’s your King County SFH summary, with the arrows to show whether the year-over-year direction of each indicator is favorable or unfavorable news for buyers and sellers (green = favorable, red = unfavorable):

| March 2019 | Number | MOM | YOY | Buyers | Sellers |

|---|---|---|---|---|---|

| Active Listings | 3,277 | +15.0% | +94.3% |  |

|

| Closed Sales | 1,784 | +25.9% | -5.3% |  |

|

| SAAS (?) | 1.67 | +56.0% | +12.0% |  |

|

| Pending Sales | 2,847 | +59.1% | +5.1% |  |

|

| Months of Supply | 1.84 | -8.7% | +105.0% |  |

|

| Median Price* | $667,725 | +1.9% | -3.2% |  |

|

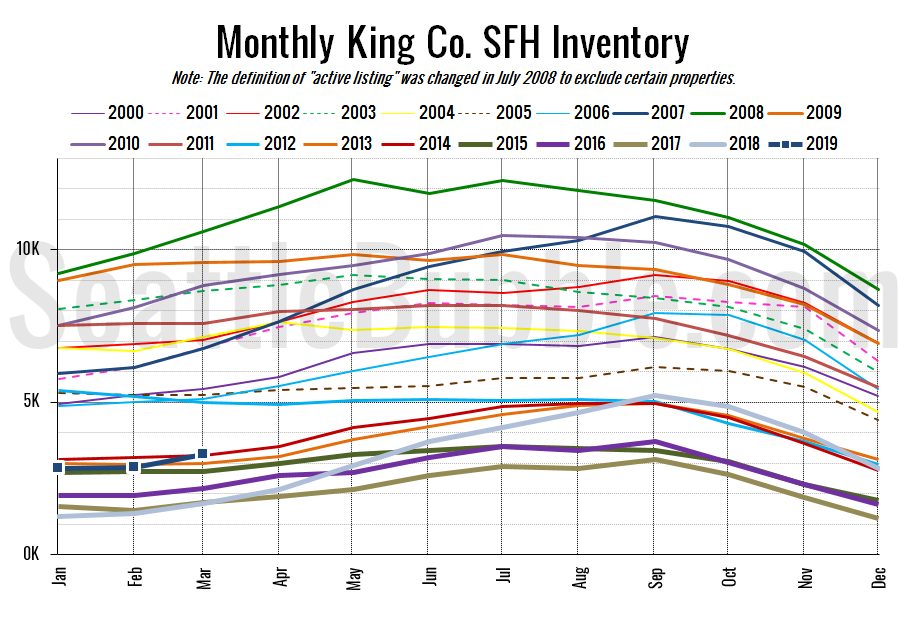

Here’s the graph of inventory with each year overlaid on the same chart.

Inventory was up 15 percent from February to March, quite a bit smaller than the 24 percent month-over-month gain over the same period a year earlier.

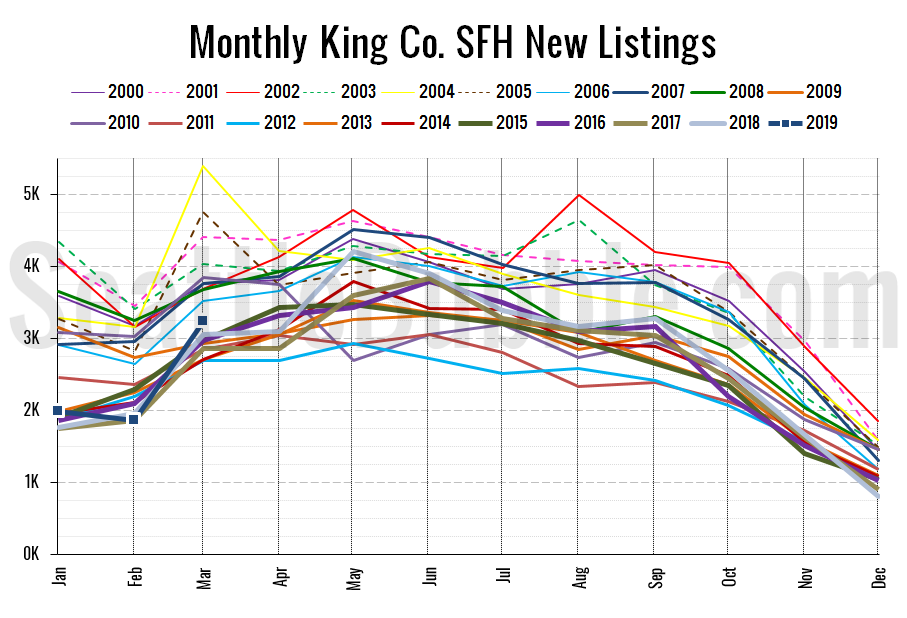

Here’s the chart of new listings:

New listings surged from February to March, and were up six percent from a year ago. Seeing a year-over-year increase in new listings is definitely encouraging for buyers.

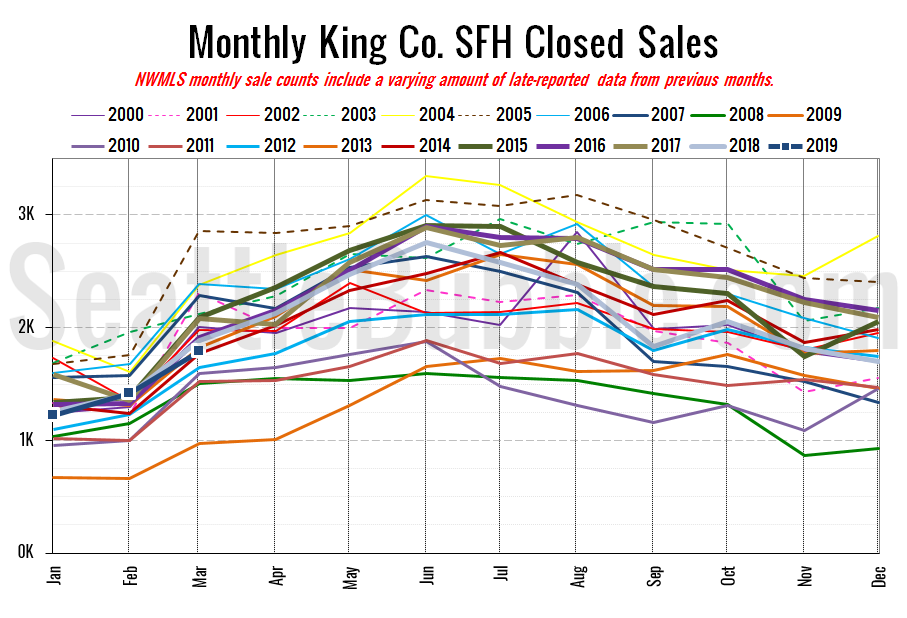

Here’s your closed sales yearly comparison chart:

Closed sales rose 26 percent between February and March, but were down five percent from last year. This is probably due to the pending sales dip last month thanks to the snow storm.

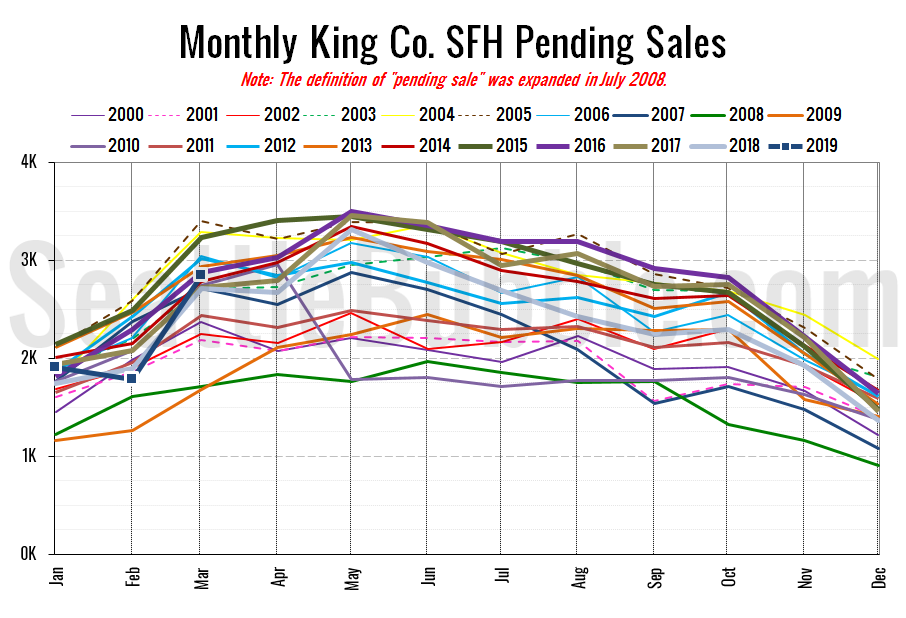

Pending sales shot up 59 month-over-month and five percent year-over-year. At the same time last year, pending sales were up 43 percent month-over-month and flat year-over-year.

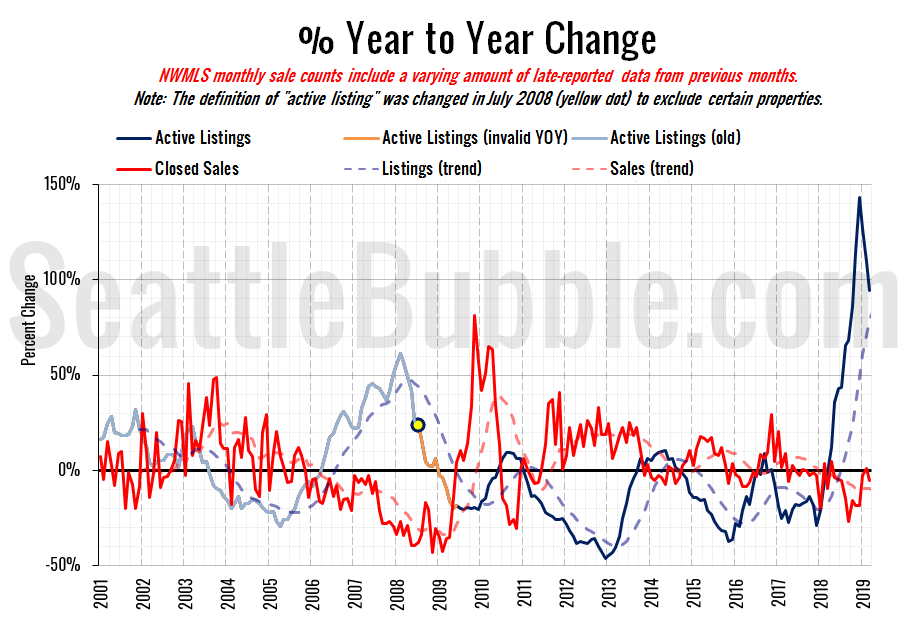

Here’s the supply/demand YOY graph. “Demand” in this chart is represented by closed sales, which have had a consistent definition throughout the decade (unlike pending sales from NWMLS).

That rate of growth is falling off almost as quickly as it shot up, but we’re still basically in record high territory.

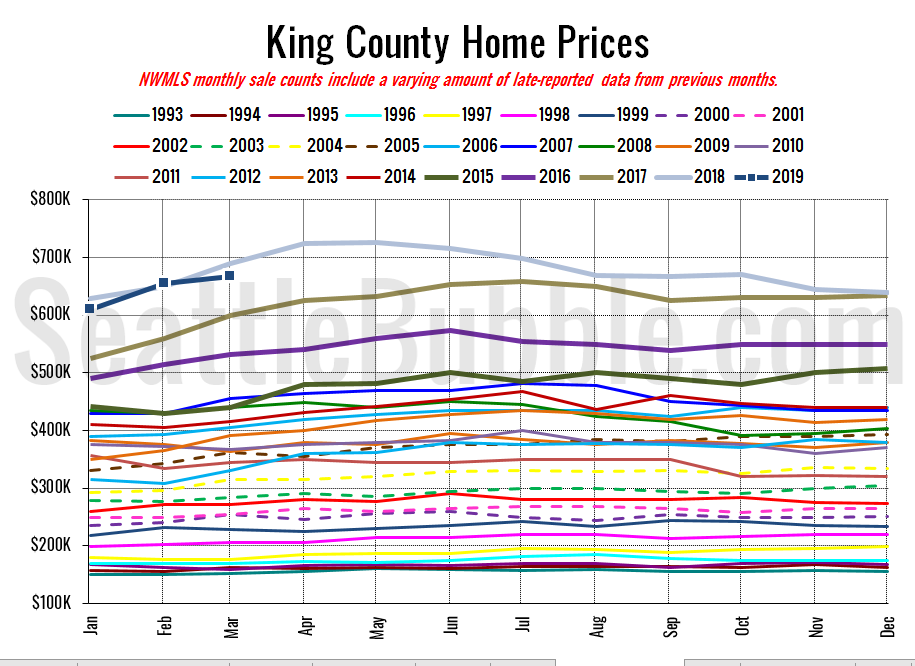

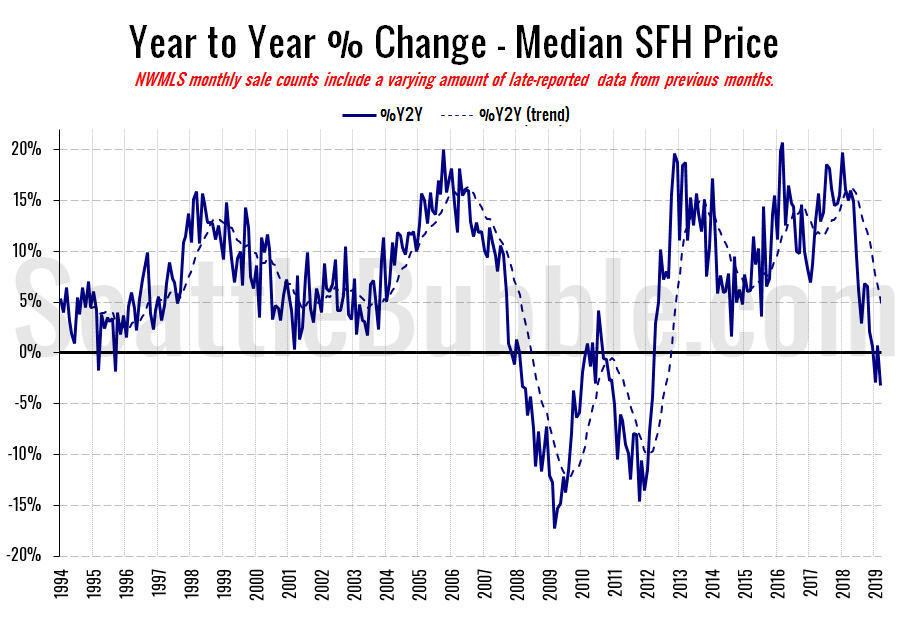

Here’s the median home price YOY change graph:

The last time median home prices were down this much year-over-year was in March of 2012—basically the bottom for home prices.

And lastly, here is the chart comparing King County SFH prices each month for every year back to 1994 (not adjusted for inflation).

March 2019: $667,725

March 2018: $689,950

July 2007: $481,000 (previous cycle high)

Here’s the article about these numbers from the Seattle Times: Relief for Seattle-area condo buyers as prices drop amid flood of new units