The Center for Economic and Policy Research has released another report on the prospects for building home equity over the next four years, and much like their April report, their conclusions are not good for current home buyers hoping to build short-term equity.

Despite the collapsing housing bubble and consequent fall in house prices in bubble markets, the prospects for accumulating equity still look grim for homeowners as prices are still far from reaching their historical norm. The relative merits of owning and renting will be affected by the extent to which homeowners can accumulate equity. Even with the general increase in house prices at the same rate as the overall rate of inflation, homebuyers are at risk of facing plunging home values in bubble inflated markets.

Based on calculations that compare the cost of buying a home at 75 percent of the median house price, they predict that current home buyers in the Seattle area will have between -$117,471 and -$123,373 equity by 2012.

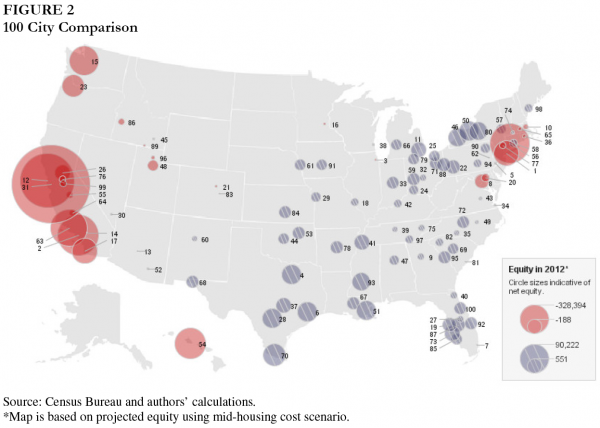

Here’s how Seattle’s situation compares to other areas around the country, according to CEPR’s calculations.

Figure 2 shows the updated projections of equity in the 100 largest metropolitan areas after four years for a household buying a home at 75 percent of the median price. Blue circles indicate positive equity, while red circles imply negative equity. The calculations deduct 6 percent of the projected sale price for realtor fees and other selling costs.

The only metropolitan areas outside California predicted to have a larger amount of negative equity than Seattle are Honolulu Hawaii and Bridgeport Connecticut.

To calculate the projected negative equity, CEPR assumed that the (75 percent of median) house price will adjust over the next four years to a value of 15 times the annual rent (adjusted upward by 33% to adjust for the difference between apartments and houses and then again by 12.6% to account for rent increases). For full details on CEPR’s methodology, download the pdf (which has been added to the Library for future reference).