Okay, let’s get back to the data. It’s about time. Okay, it’s way past time. Anyway, whatever. Here’s some data. Since it’s been a while, let’s start with a few high-level stats from around the Puget Sound…

Category: Counties

County-wide statistics.

NWMLS: New listings dry up as home prices plateau

The NWMLS published their August stats yesterday, so let’s take a look at how the month shook out for the housing market.

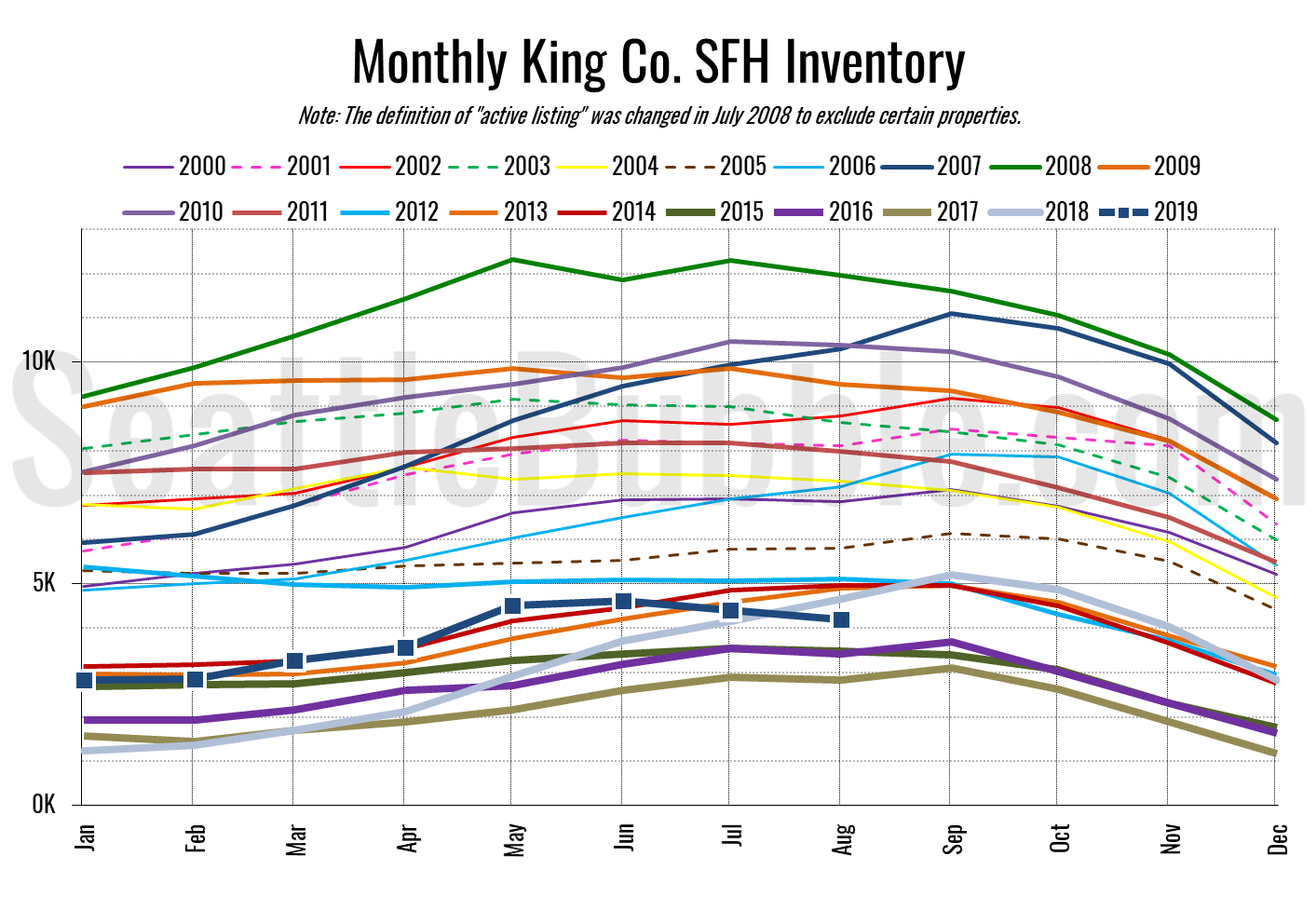

As we mentioned in yesterday’s preview post, the biggest story is a sudden, renewed shortage of inventory.

Before we get into our detailed monthly stats, here’s a quick look at their press release…

August Stats Preview: Where did the listings go?

NWMLS stats for August are due any day now, probably later today, but let’s have a look at our “early” view on the August housing market stats for the Seattle area.

The biggest news: Active listings appear to be down considerably from a year ago. This is a big flip from earlier this year, when listings were way up, and definitely not great news for buyers.

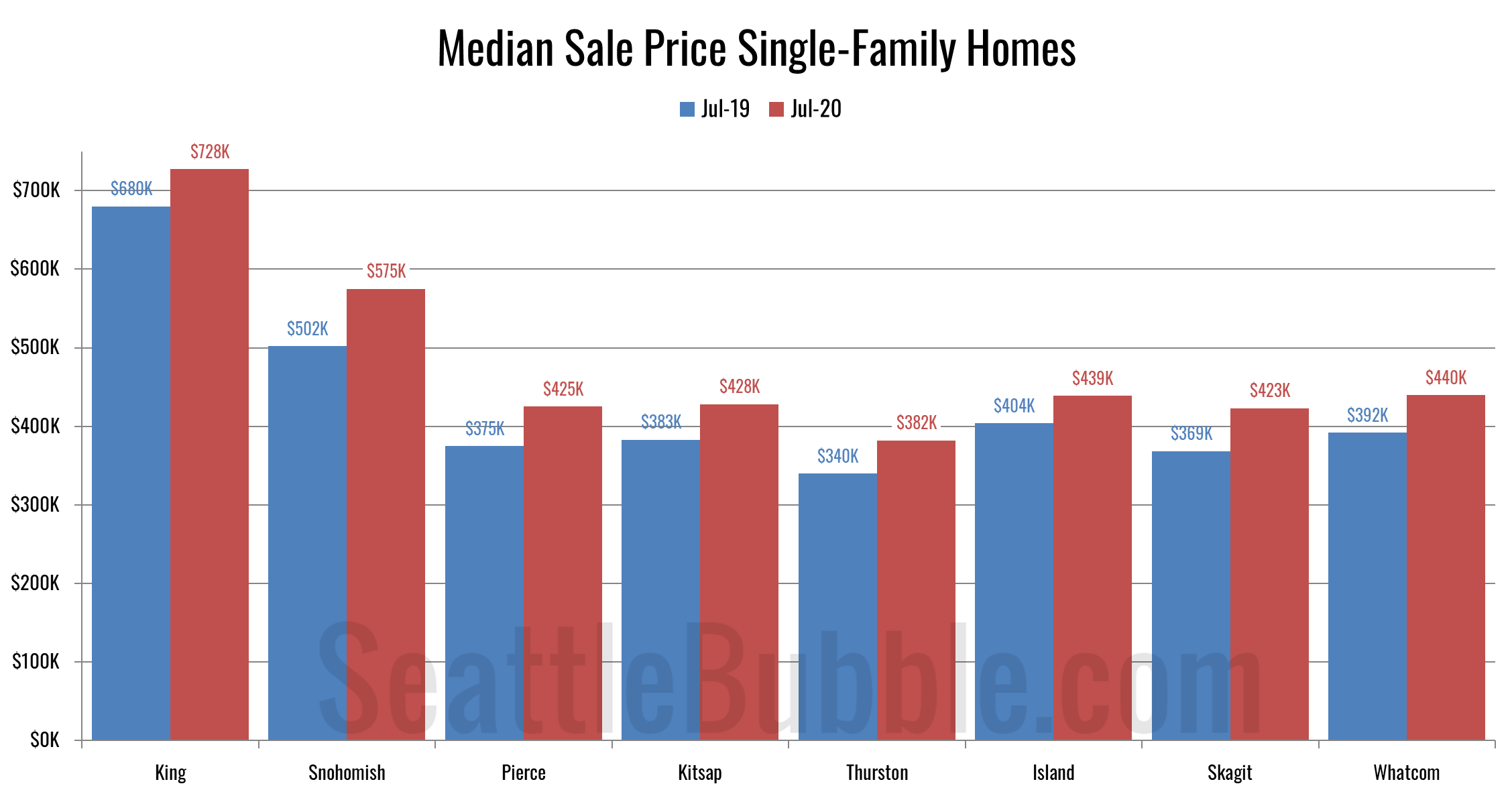

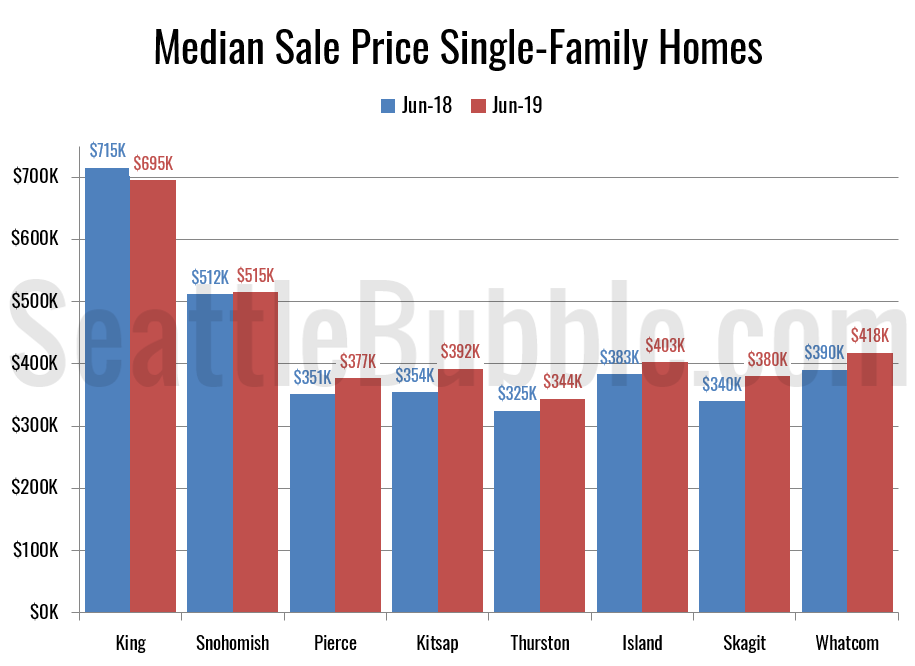

Around the Sound: King County alone in price drops and big inventory gains

I promised an updated look at June data for the outlying counties, so let’s have a look at that. Here’s the latest update to our “Around the Sound” statistics for King, Snohomish, Pierce, Kitsap, Thurston, Island, Skagit, and Whatcom counties.

King County is the only place where prices are declining, and it also has the largest increase in active listings compared to a year ago. On the flip side, pending sales were up the most in King County, and it had one of the smallest declines in closed sales (sales rose in Skagit though). In most of the other Puget Sound counties, sales are declining, and listings are either falling or not increasing by much, and prices are rising.

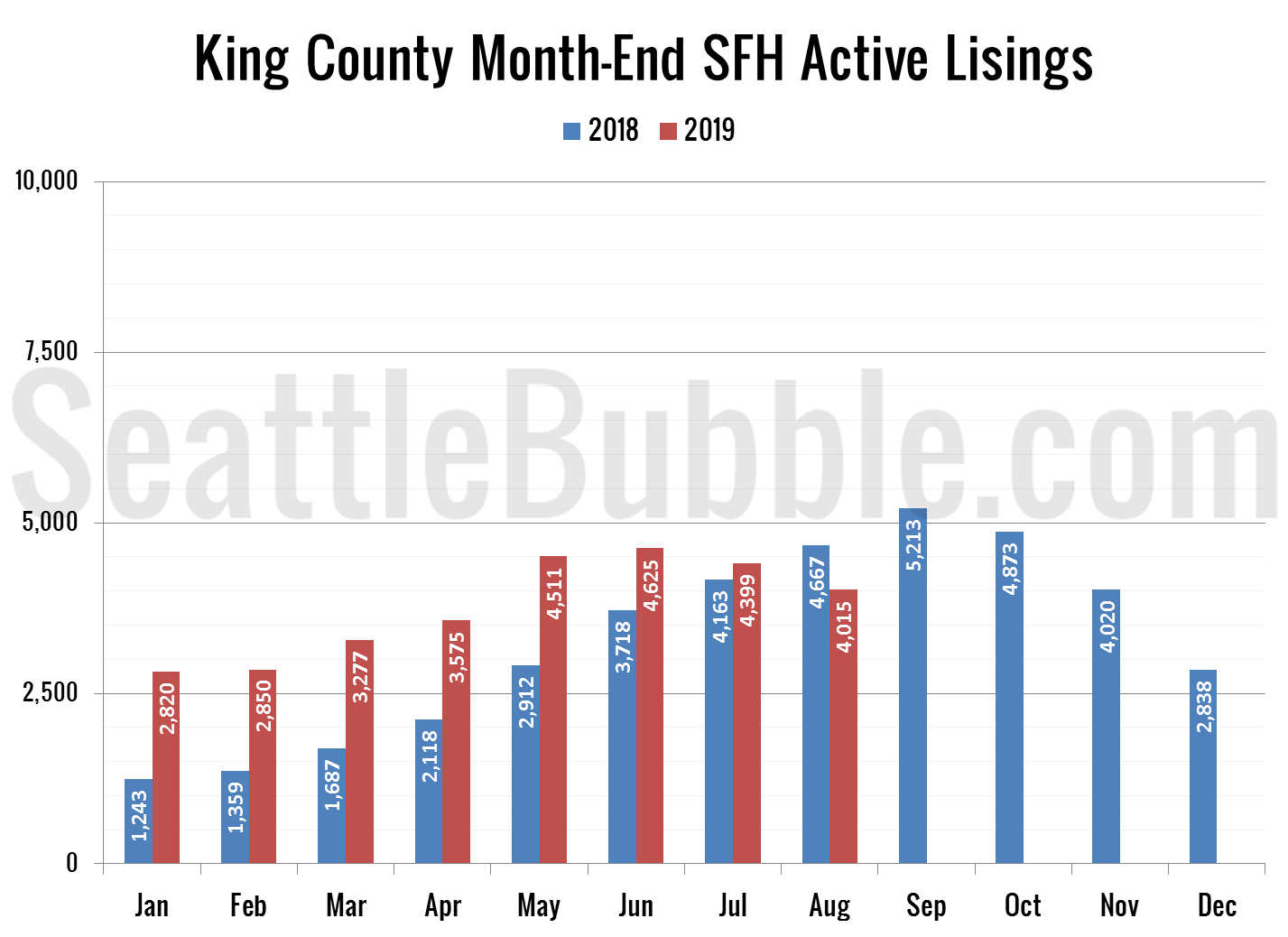

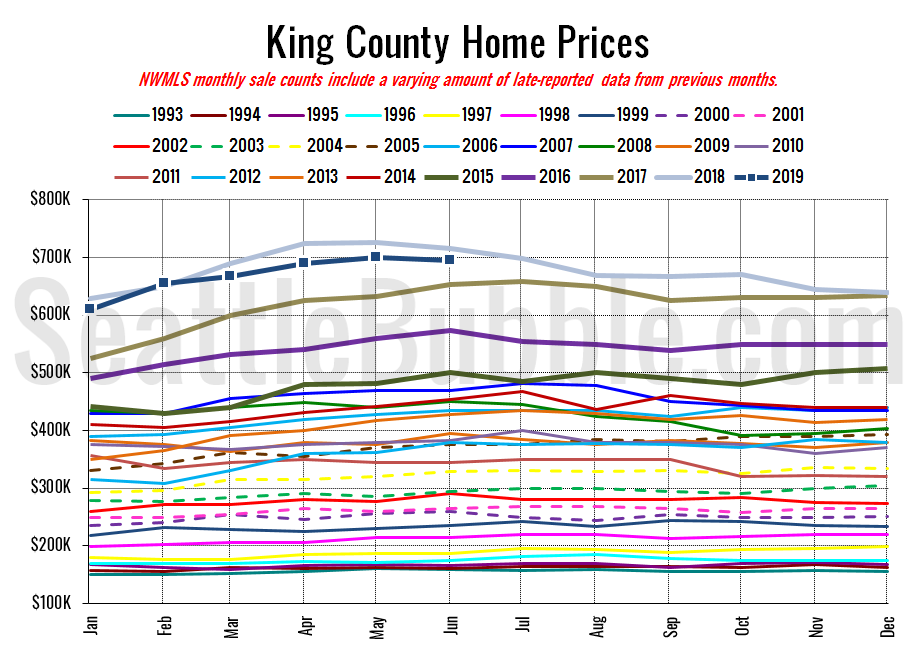

NWMLS: Home prices and sales stagnated in June

The NWMLS just published their June stats, so let’s take a look at how the month shook out for the housing market. The King County median price of single-family homes was down year-over-year again in June, the fourth month in a row of declines. Inventory was up from a year ago again, but the as we mentioned in the preview post earlier this morning, the rate of increase is rapidly declining from the all-time high set in December. Closed sales were down a bit from a year earlier, while pending sales were up slightly.