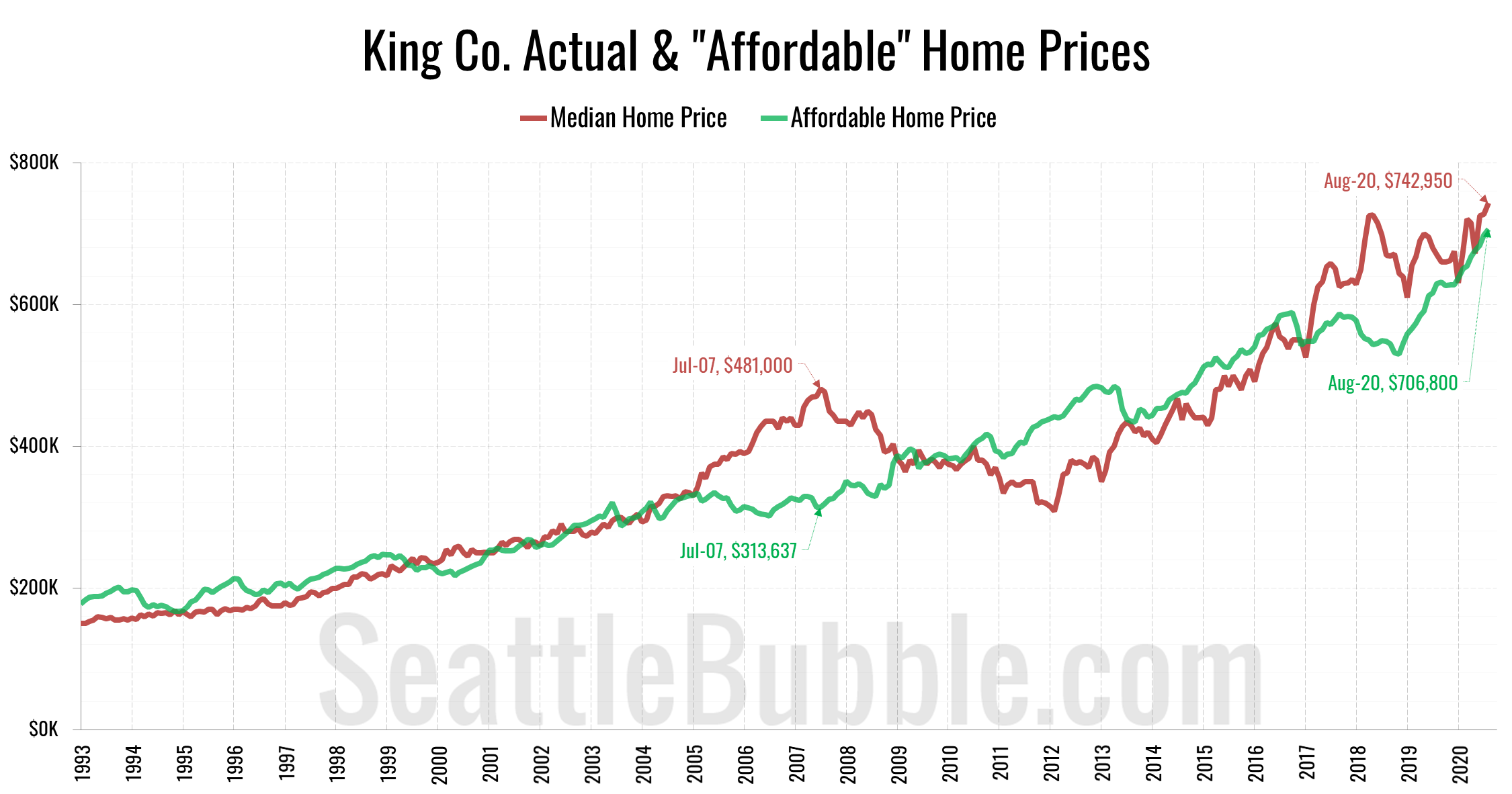

The “affordable” home price has shot up from $530,359 in November 2018 to an all-time high of $706,800 as of August. The current “affordable” home price in King County would have a monthly payment of $2,365…

Category: Counties

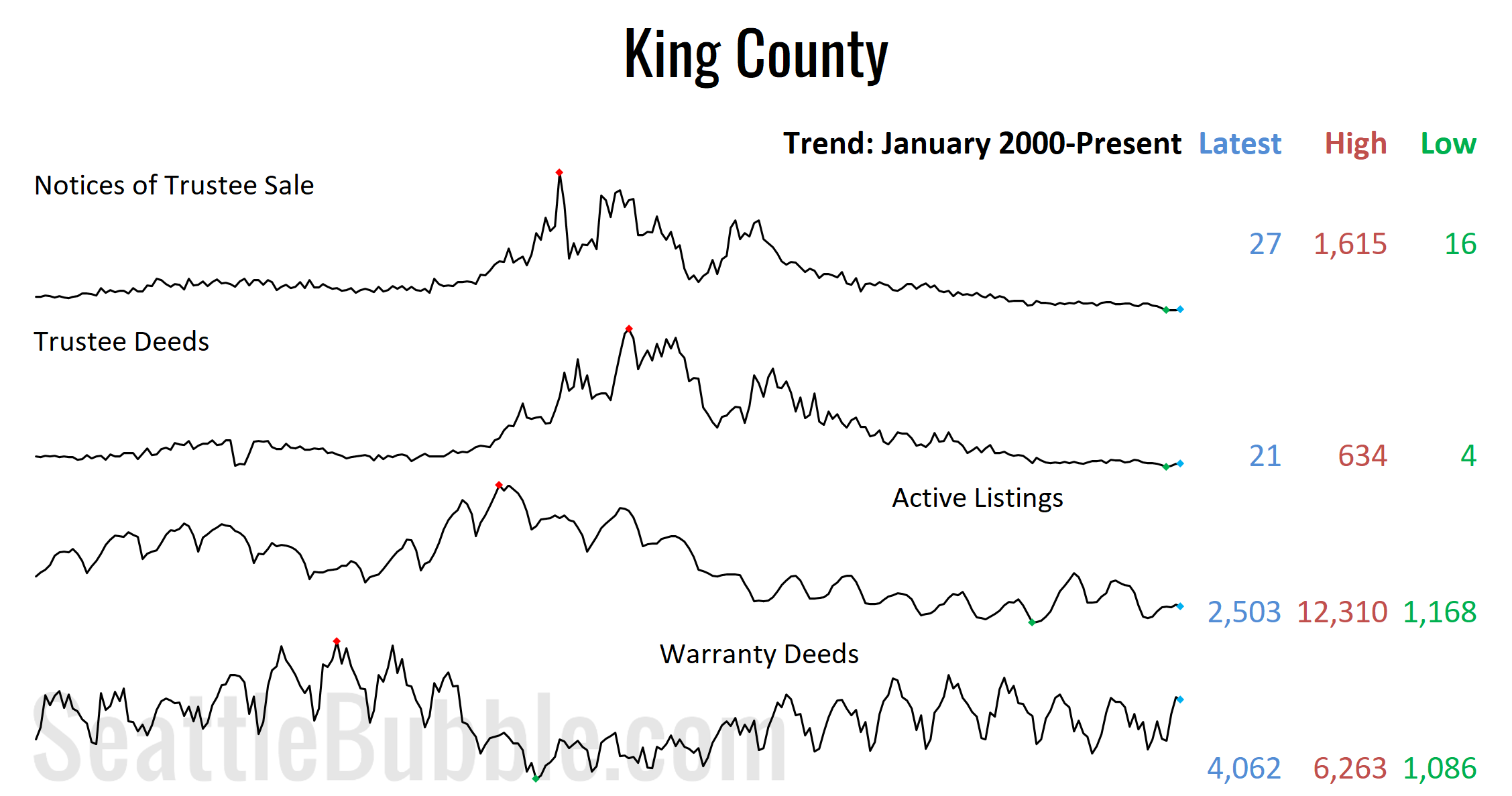

County-wide statistics.

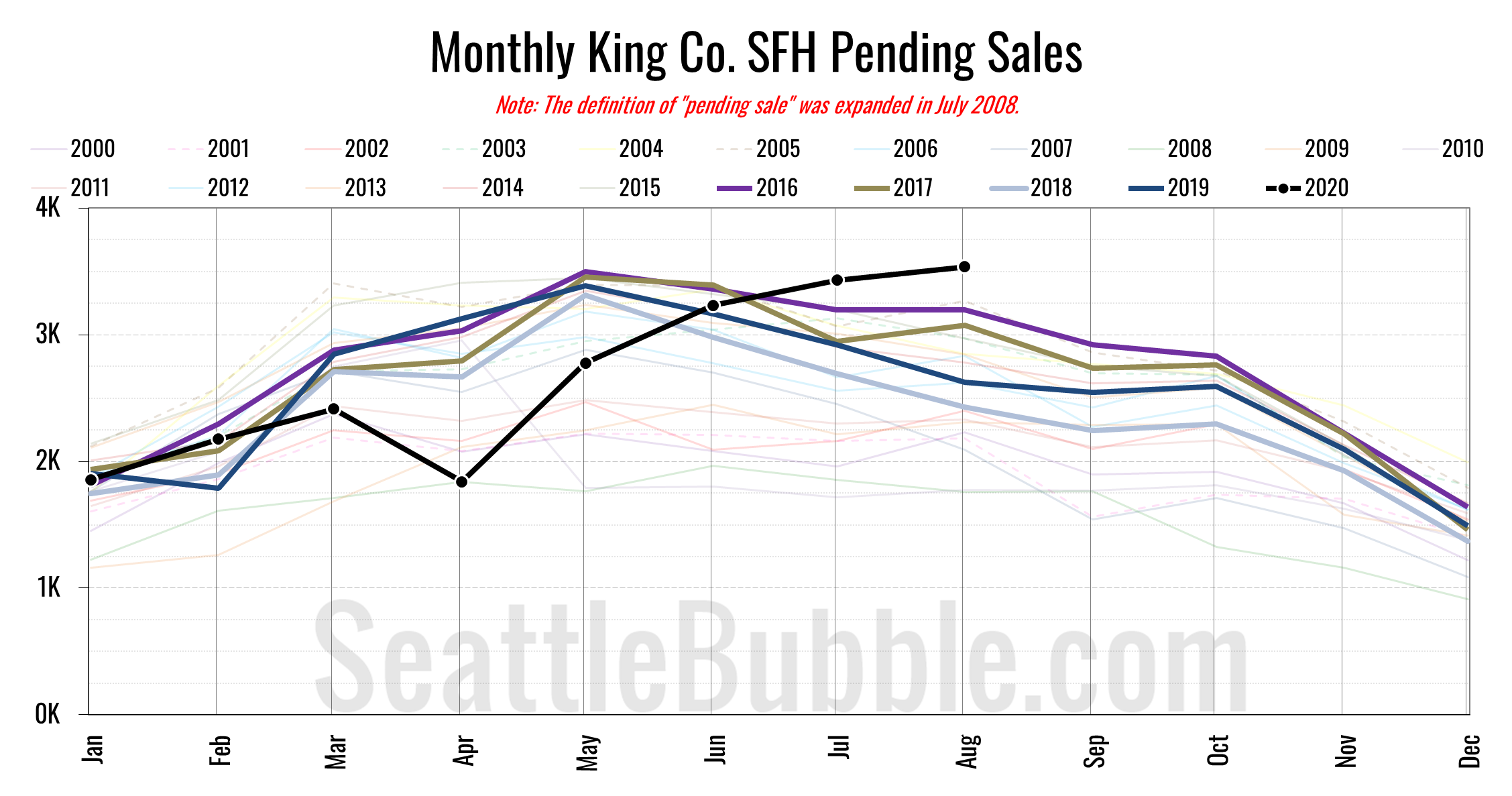

NWMLS: Pending sales hit an all-time high in August

August market stats were published by the NWMLS on Friday before the holiday weekend. The King County median price of single-family homes rose over 10 percent year-over-year for the first time since May of 2018. Inventory is way down from a year ago, and pending sales climbed to an all-time record high…

August stats preview: Plenty of demand, still so little supply

As we’re getting back into the swing of things, let’s check out the housing stats for the recently-completed month of August…

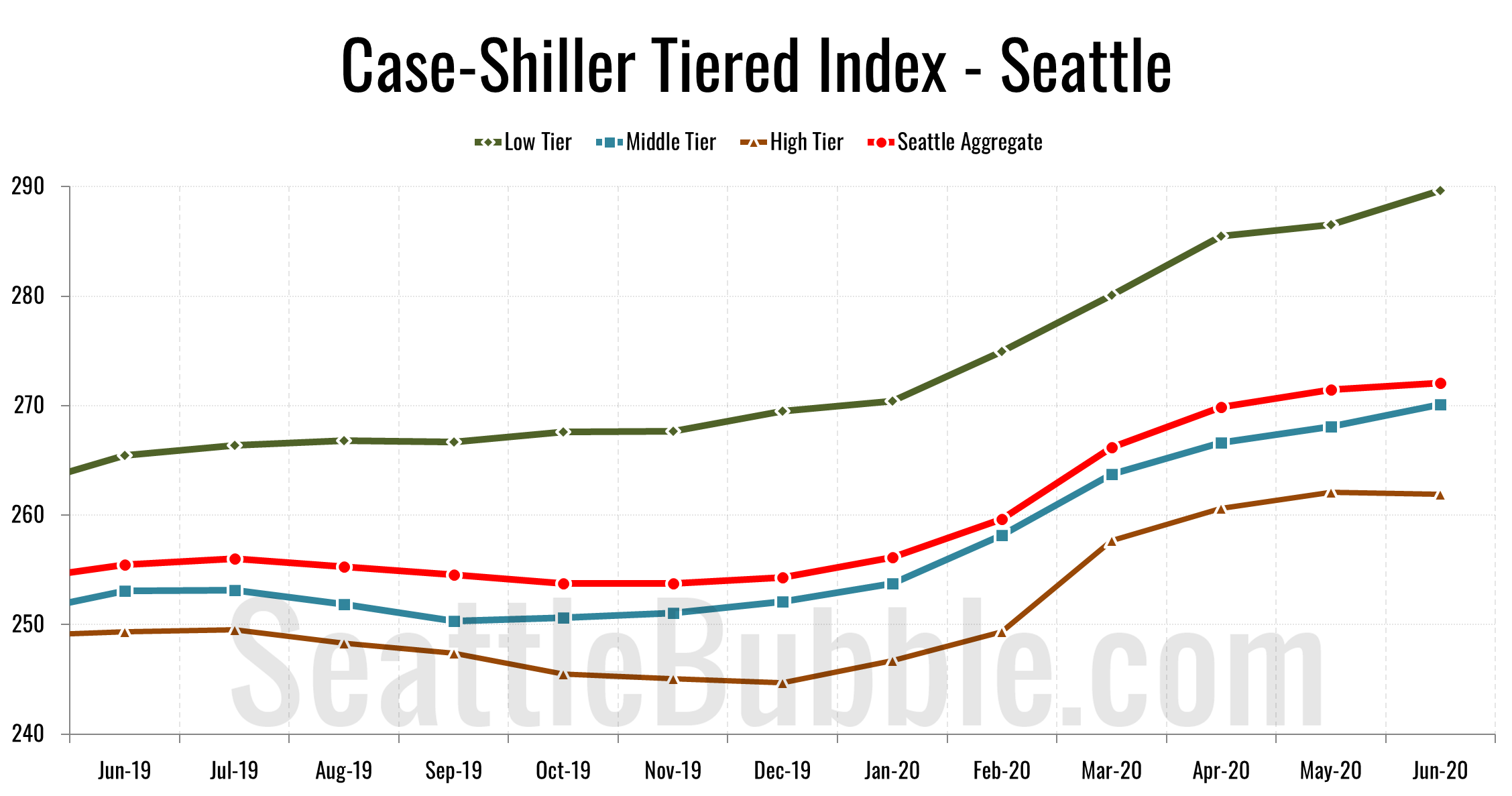

Case-Shiller Tiers: Low Tier Home Prices are Soaring

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

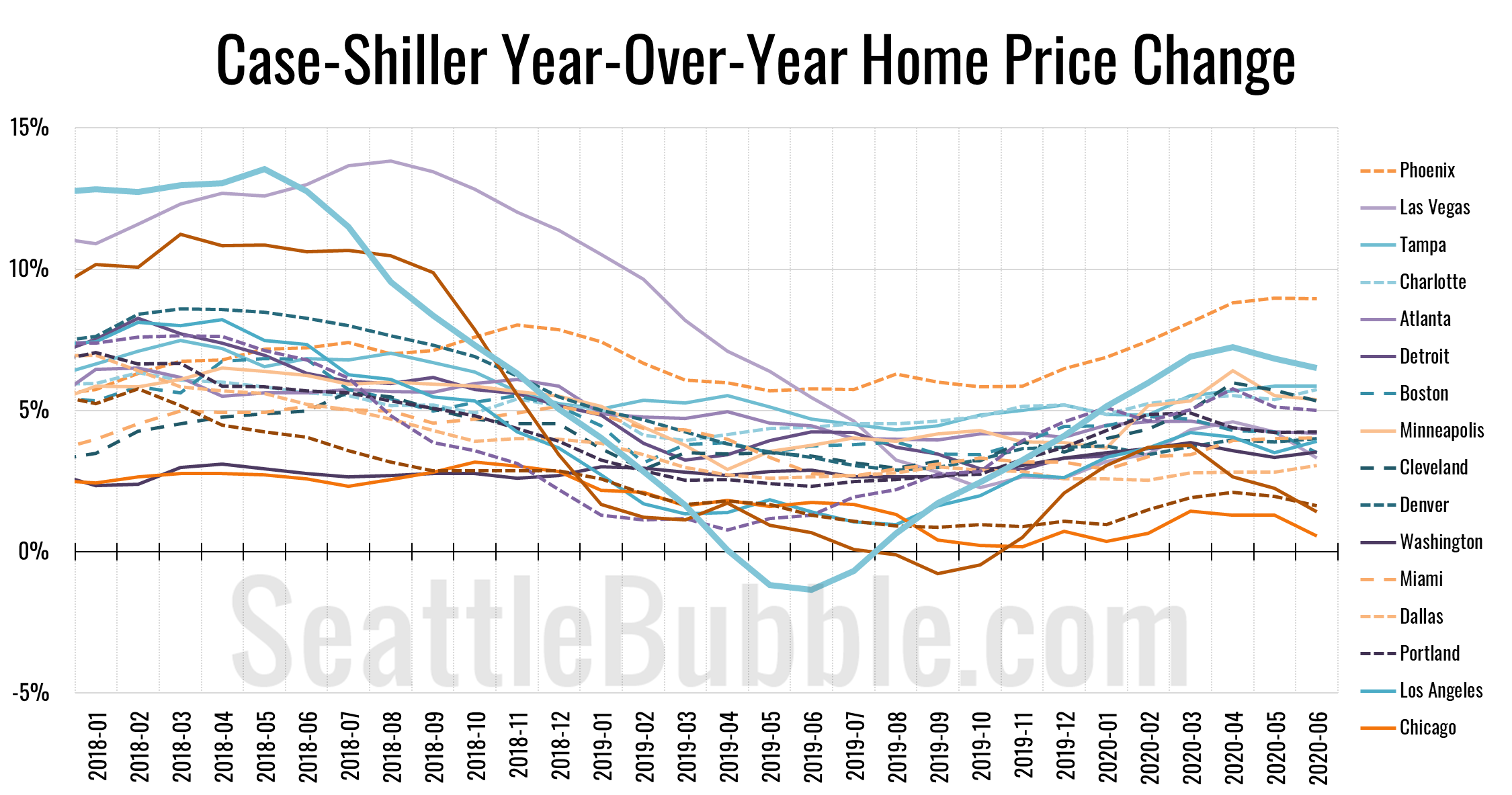

Case-Shiller: Seattle Home Prices Up 6.5% from 2019 in July

Let’s catch up a bit on our Case-Shiller data. According to June data that was released this week, Seattle-area home prices were up 0.2 percent May to June and up 6.5 percent YOY…