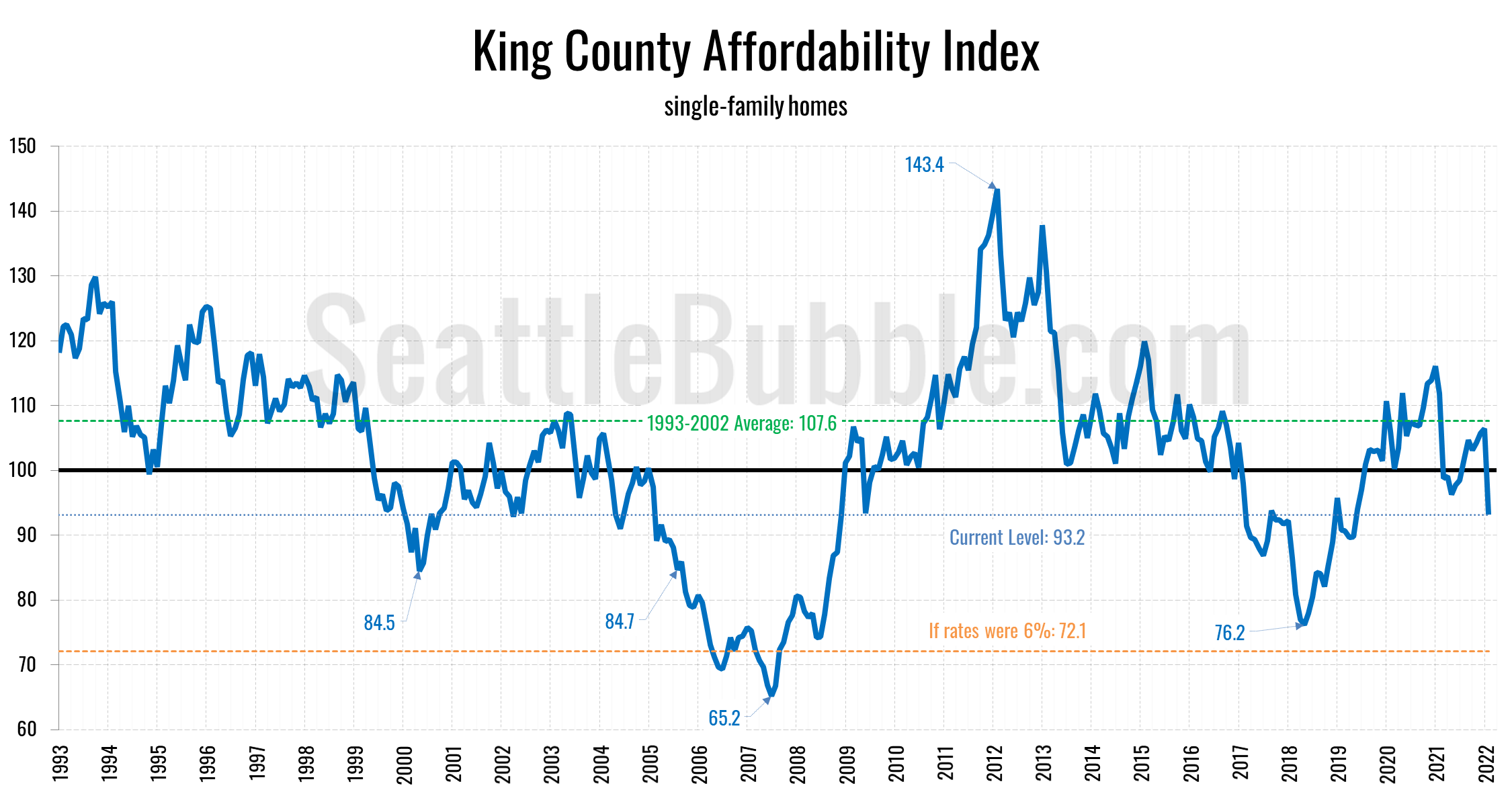

As of February, the monthly payment for the median-price single-family home sold in King County at current mortgage rates was $3,945. The good news: This is down from an eye-watering $4,758 in October. The bad news: It’s up dramatically from just a year prior, and 59% higher than what we saw at the peak of the previous housing bubble…

Tag: NWMLS

Home prices are finally falling around Seattle—more than most places in the nation

Let’s check up on what’s happening with the Seattle-area housing market in early 2023, shall we?

So… what the heck is going on with the Seattle housing market?

Since we’ve been gone for so long, I thought I’d start back up with somewhat of an overview post. Let’s just take a look at what’s going on in the Seattle-area (King County) housing market recently.

One of the biggest topics on everybody’s mind lately is home prices, so let’s start there…

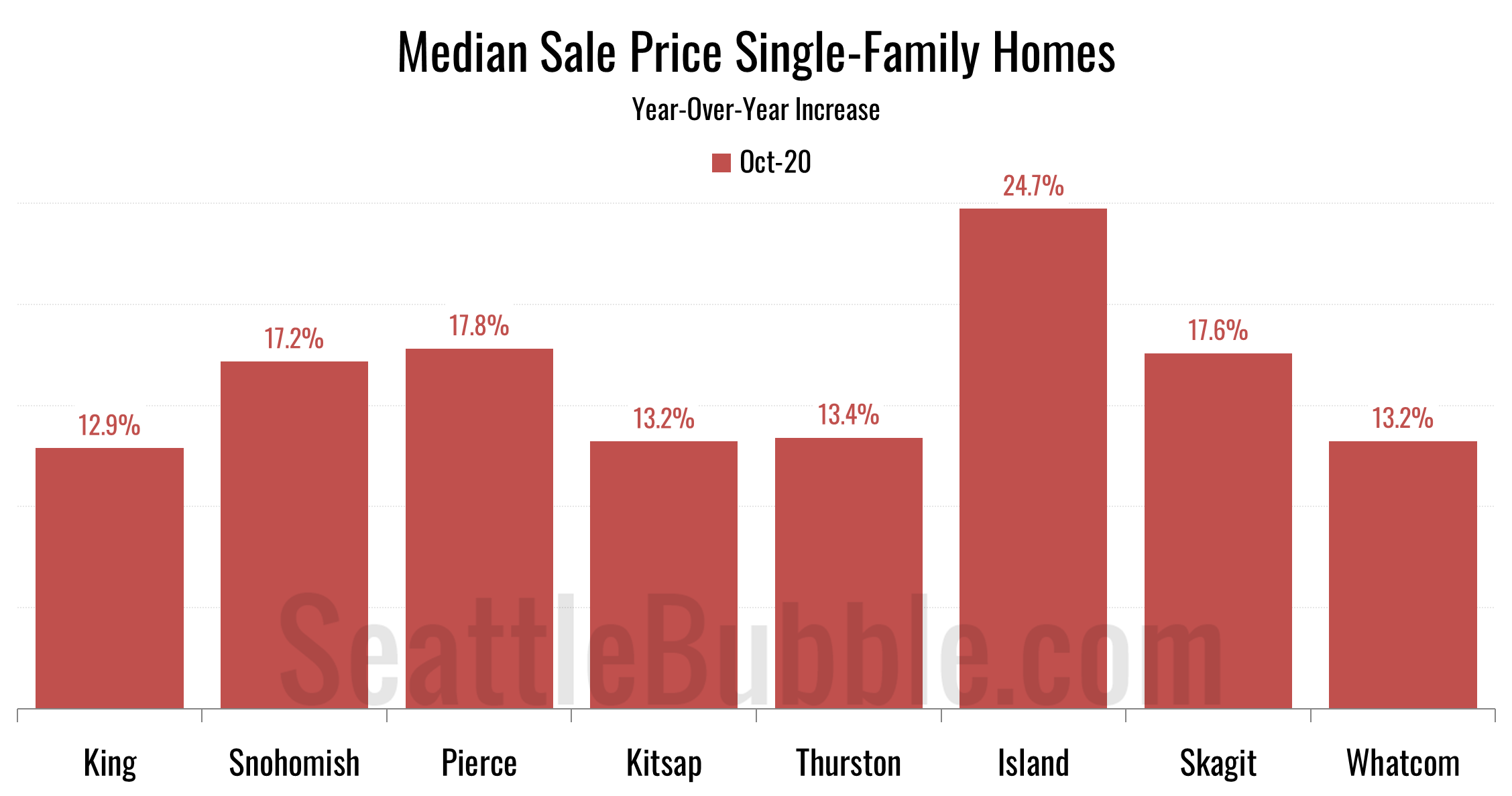

Around the Sound: Still a dismal market for buyers everywhere

Let’s take a look at our stats for the local regions outside of the King/Snohomish core. Here’s your October update to our “Around the Sound” statistics for Pierce, Kitsap, Thurston, Island, Skagit, and Whatcom counties…

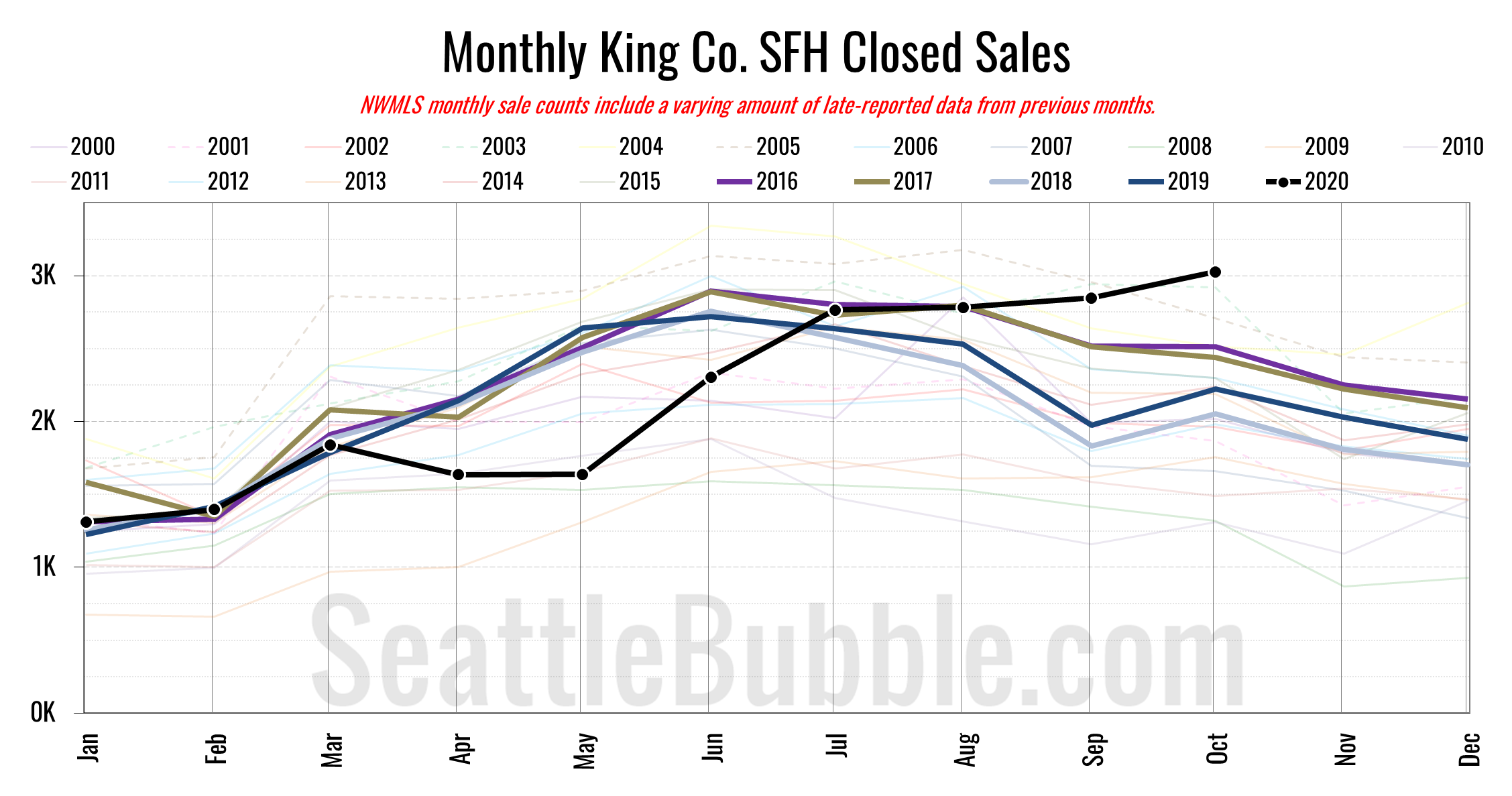

NWMLS: Strongest October ever for closed sales

October market data from the NWMLS is available. Here’s what happened last month in the Seattle-area housing market: Home prices and pending sales fell slightly, but closed sales rose to the highest level ever seen during an October—over 3,000 sales.