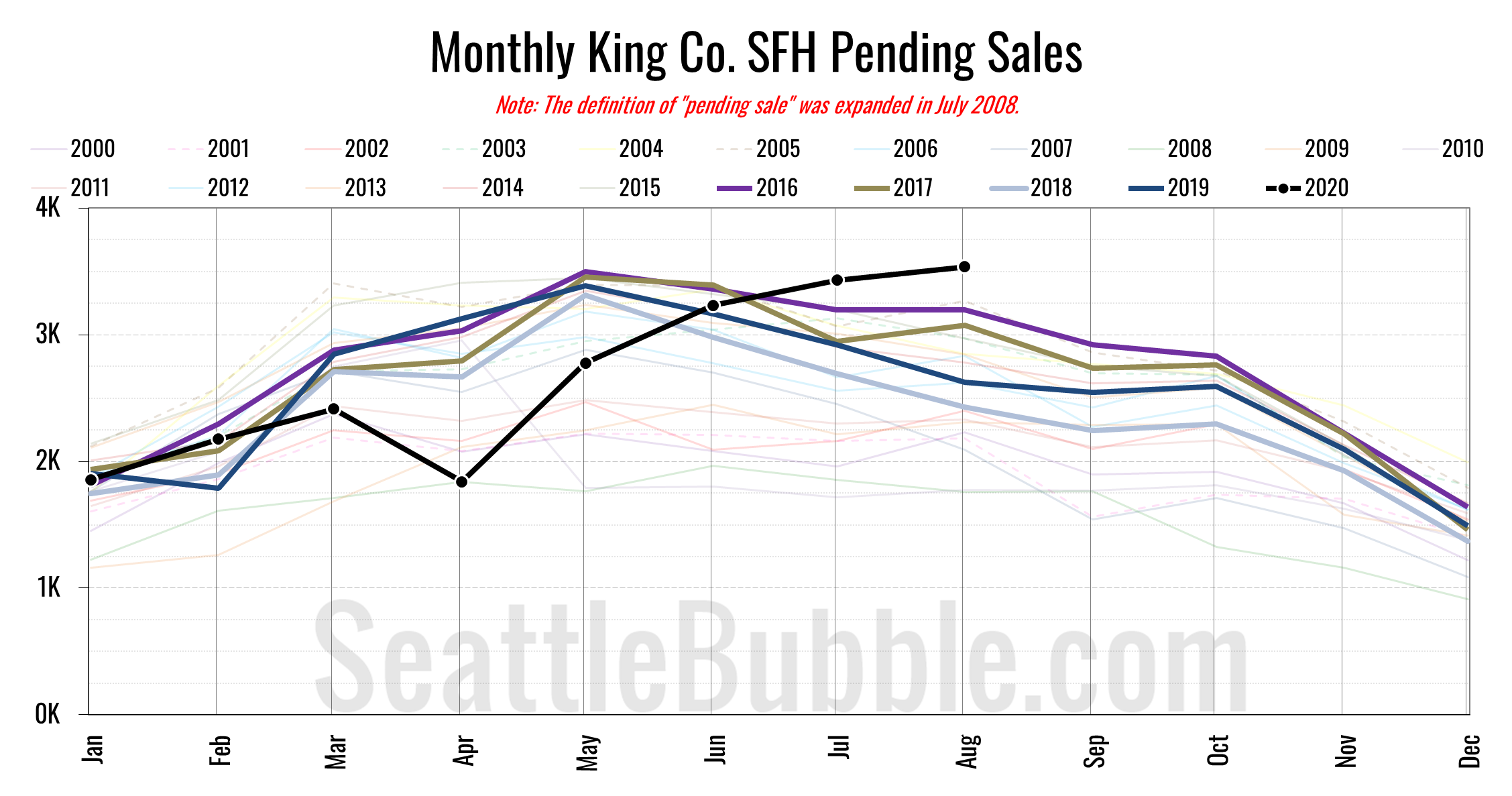

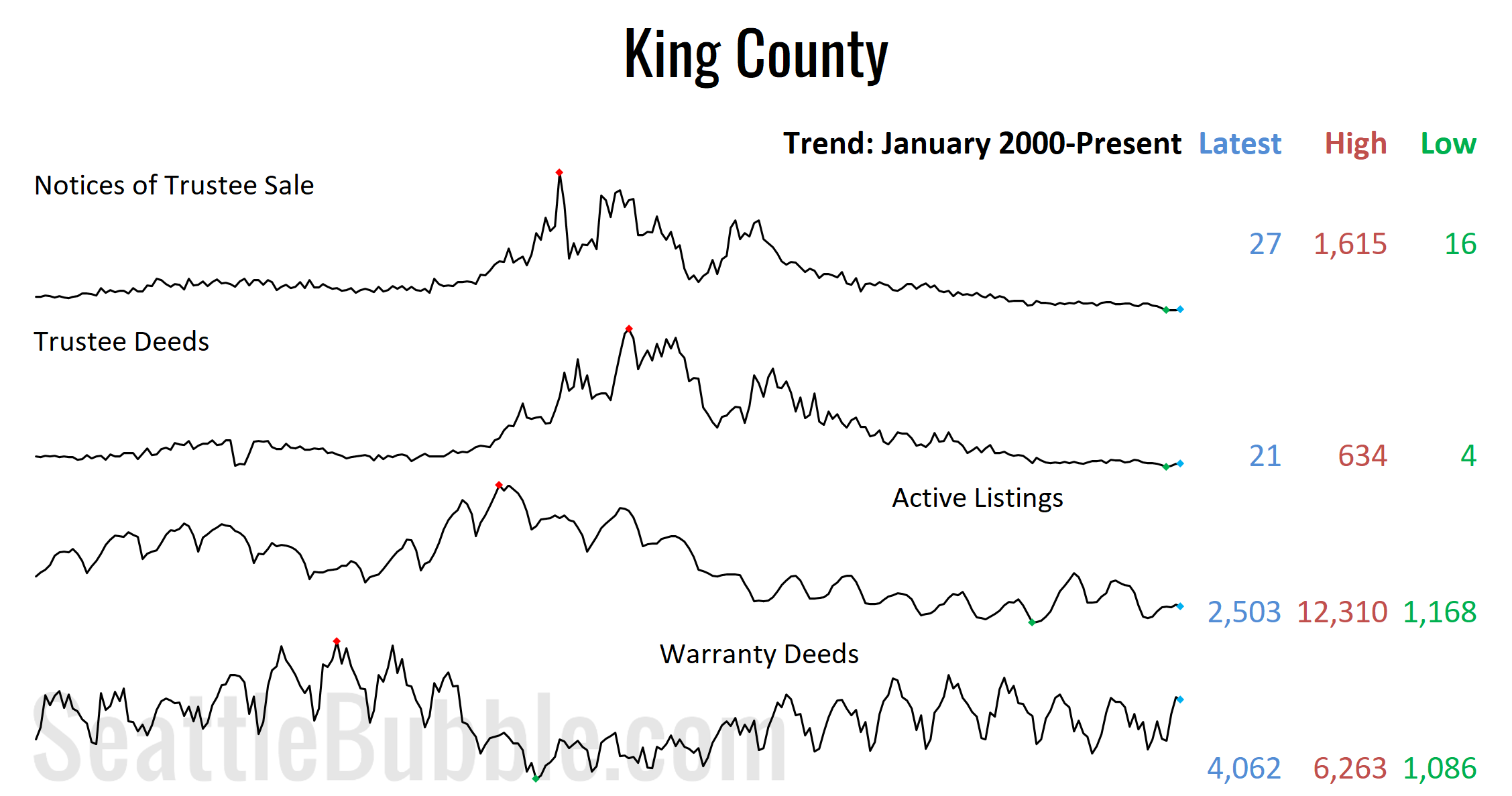

August market stats were published by the NWMLS on Friday before the holiday weekend. The King County median price of single-family homes rose over 10 percent year-over-year for the first time since May of 2018. Inventory is way down from a year ago, and pending sales climbed to an all-time record high…

August stats preview: Plenty of demand, still so little supply

As we’re getting back into the swing of things, let’s check out the housing stats for the recently-completed month of August…

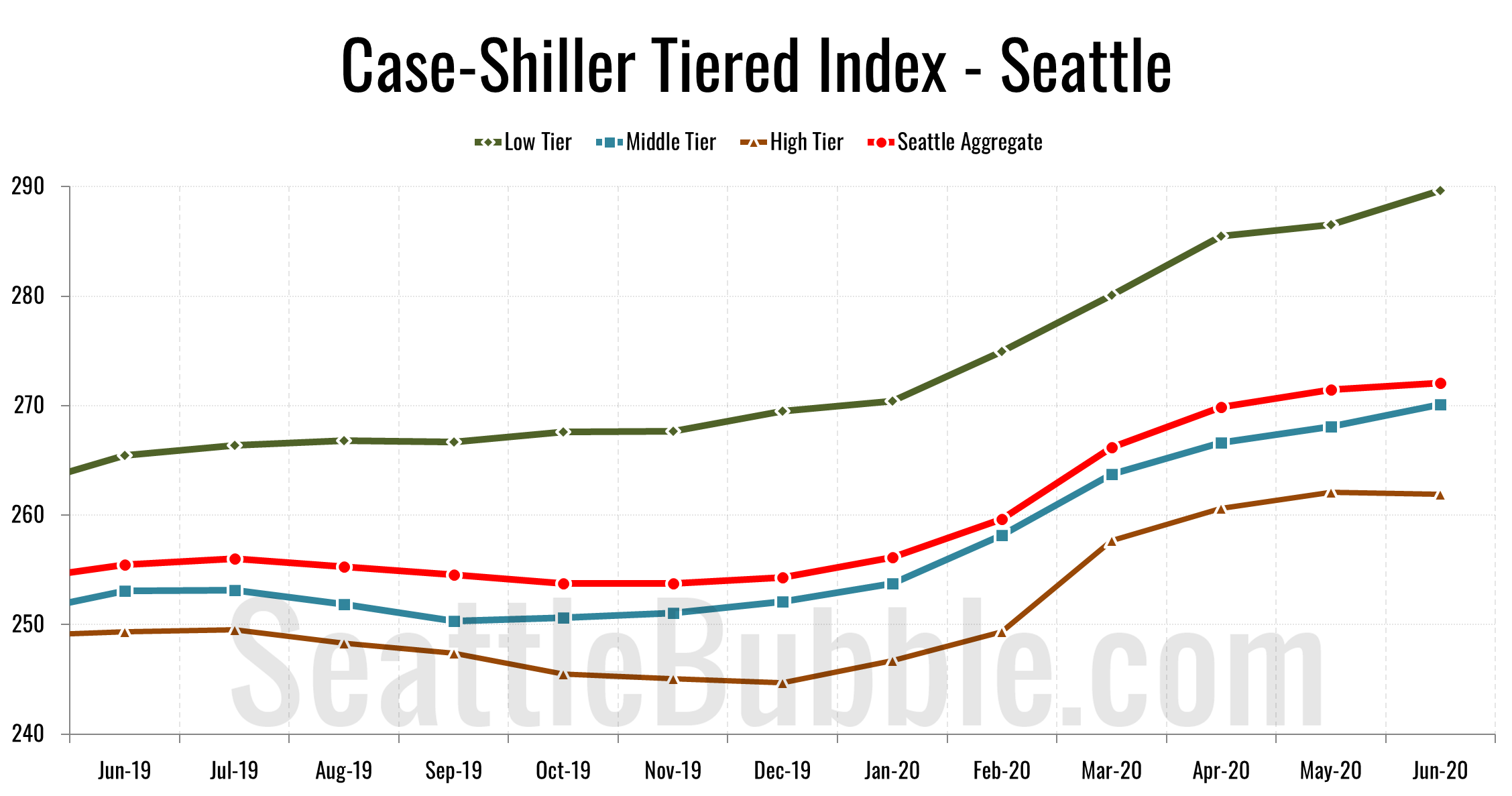

Case-Shiller Tiers: Low Tier Home Prices are Soaring

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

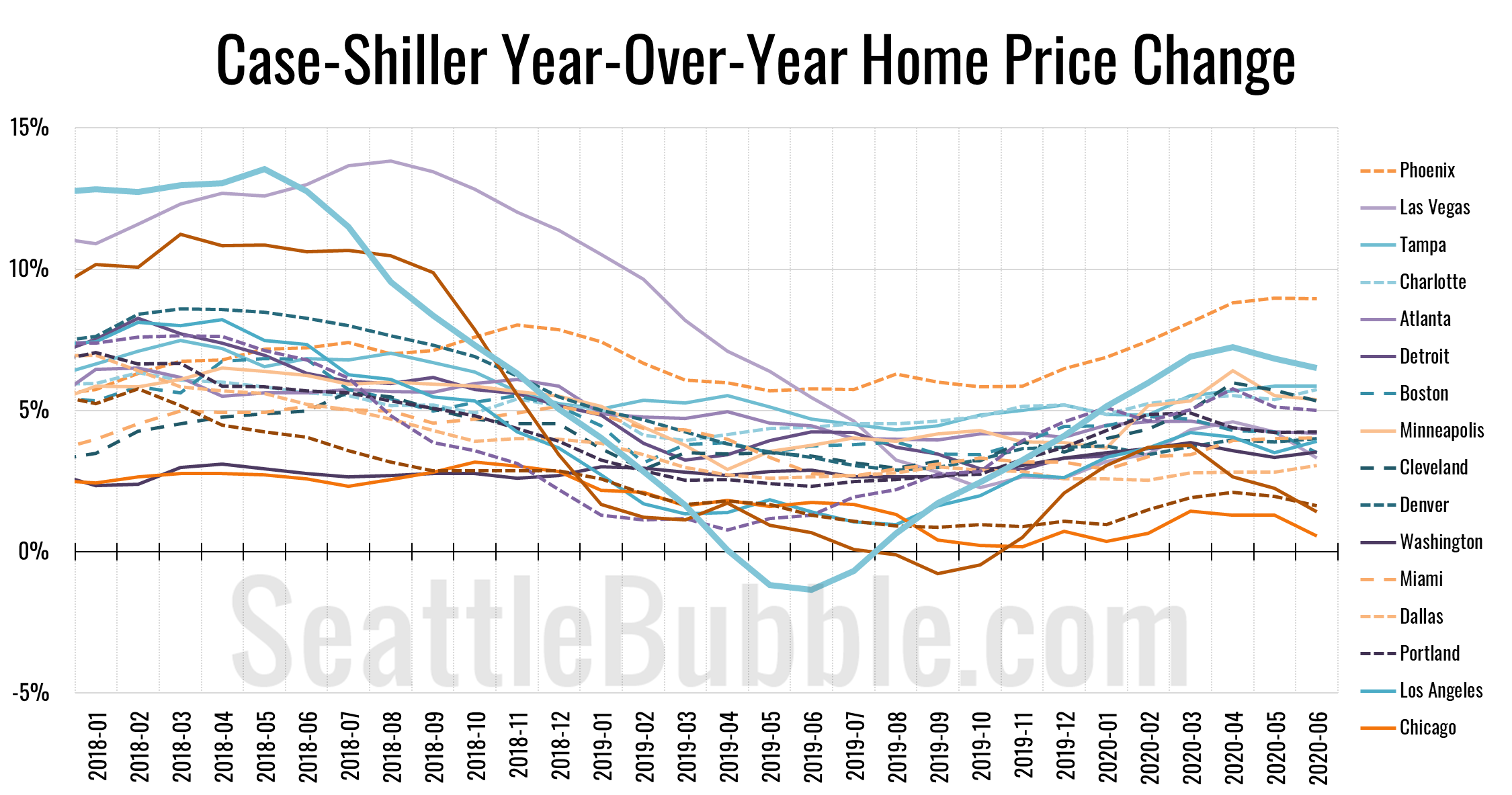

Case-Shiller: Seattle Home Prices Up 6.5% from 2019 in July

Let’s catch up a bit on our Case-Shiller data. According to June data that was released this week, Seattle-area home prices were up 0.2 percent May to June and up 6.5 percent YOY…

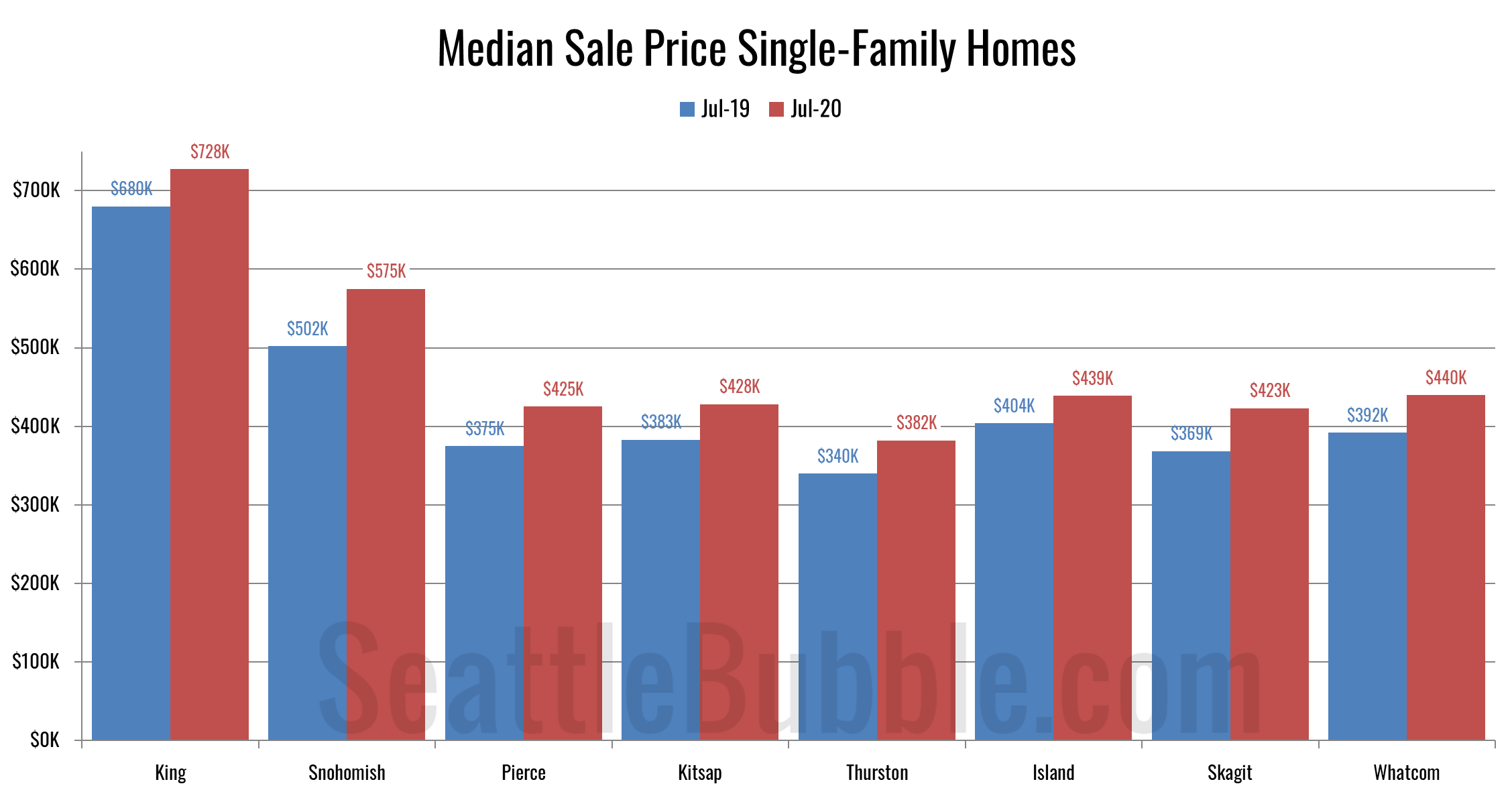

The pandemic has sparked a massive seller’s market and big price spikes around Seattle

Okay, let’s get back to the data. It’s about time. Okay, it’s way past time. Anyway, whatever. Here’s some data. Since it’s been a while, let’s start with a few high-level stats from around the Puget Sound…